For this last Grid Transformation Forum of 2018, we spoke with Ben Cohen, director of global strategy with Autogrid. Cohen shares his insights on the energy market in Japan and other markets around the world where smart grid initiatives are transforming how electricity is produced and managed.

EET&D – Ben, thanks so much for joining us for this discussion. There’s a lot of ground to cover. Let’s start with Japan where the energy market is going through a major transformation. What are you seeing there and what lessons does that have for the rest of the world?

BC – Thanks so much for having me. Yes, Japan is a fascinating place to start with because, in many ways, its energy market is very different from the rest of the world. And yet, there are important takeaways for everyone working on smart grid initiatives; regardless of whether you are in Philadelphia or Finland.

Japan is unique because it’s one of the few places where changes in its energy market are not being driven entirely by deregulation. The typical scenario that has played out around the world is that deregulation occurs after a legislative or other governmental action to foster more competition. Then, the newly deregulated market is hit by a number of economic forces as companies compete fiercely and innovate fiercely, causing a re-shaping of how energy is produced and delivered.

But Japan is different and more nuanced. The catalyst for change in Japan isn’t just regulatory in nature. It’s incorporating a desire to really be at the cutting edge of technology and the development of a business case for energy generation and management at the household level. PV panels and residential battery storage for solar-generated electricity collectively have such a significant return on investment that they have proliferated in Japan. Yes, they have a deregulated market, and yes, they have had government incentives for residential solar, but those ingredients exist elsewhere. The true driver for the hundreds of thousands of households in Japan that have residential solar is that it makes financial sense.

EET&D – That would be news to people who still have the mindset that PV solar systems aren’t cost-effective.

BC – Exactly. There wasn’t a giant parade and 90-point-font headlines in newspapers when the solar industry turned that corner, but we are there, and Japan is Exhibit A in many ways. The cost of residential solar and in-home battery systems have dropped to a point where the economics are no longer a question. Now, it’s a matter of how you implement it at scale, hooking into the right value streams, and nailing down the customer value proposition as to packaging for the end consumer: who owns the assets, energy as a service, and all sorts of other flavors.

The latest research I saw from Bloomberg’s New Energy team predicts 128 GW of small-scale PV generation in Japan over the next three decades. That is a staggering volume, and that’s just one country. The financials don’t lie. Solar systems linked to a residential battery can do very heavy lifting for a country’s energy needs.

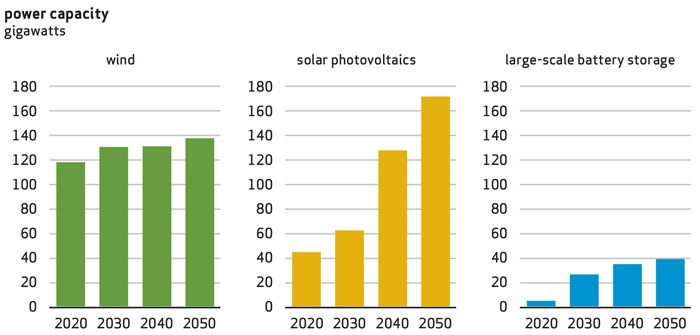

U.S. Large-Scale Wind, Solar, and Battery Storage Capacity Projections (2010–2050)

Source: U.S. Energy Information Administration, Annual Energy Outlook 2018

EET&D – We read that you will be working with an IT services firm on smart grid implementations to tie together these residential solar systems in Japan. What are the main challenges there and what can other utilities learn from your work there?

BC – Yes. The IT services firm at the forefront of this new energy market in Japan. They work with all of the major utilities in Japan, and we are providing the software and integration services that will enable these households to be linked together effectively.

The critical part is not simply linking these households together with behind-the-meter technology that allows them to be both consumers and producers of energy. The key is to create a functioning marketplace, where energy is produced, bought, sold, traded in a way that is fluid and responsive to the market’s needs over the course of an hour, a day, a month and a year. Our team is working on how to do that so that these networks work in the moment…and work during high-demand scenarios… and work in ways that show that distributed energy generation can begin replacing base loads. Coordinating all of that is what we specialize in, and our projects in Japan are exciting because we are making all of that happen at such a large scale. To me, the key lesson from what’s happening in Japan is that the energy companies that are thinking about how to do all of that at scale and create a true distributed energy marketplace are the ones that will be best positioned to succeed.

EET&D – Let’s hop across the Pacific Ocean to California. That state generated a lot of headlines recently with their goal of sourcing 100 percent of their energy from clean sources. Do you think that will be a “critical mass” moment for renewable energy that will spur growth of a distributed solar energy generation similar to what you just talked about in Japan?

BC – That’s a great question. Actually, I might be a bit contrarian on this topic. Don’t get me wrong. I think the state’s decision to do this is a milestone… but I don’t think it’s going to be a catalyst because I think the catalysts were already in place for states like California to move to a 100 percent clean energy model.

That doesn’t lessen the significance of California’s announcement. I just take a different view of the causality. That announcement by California is a recognition of the direction that we are already heading because the combination of low-cost PC, affordable residential battery storage and a deregulated market make this model a realistic goal at scale. We were already there. But California’s announcement puts a spotlight on that reality in a way that is important because it marks a key moment in the evolution of the energy industry.

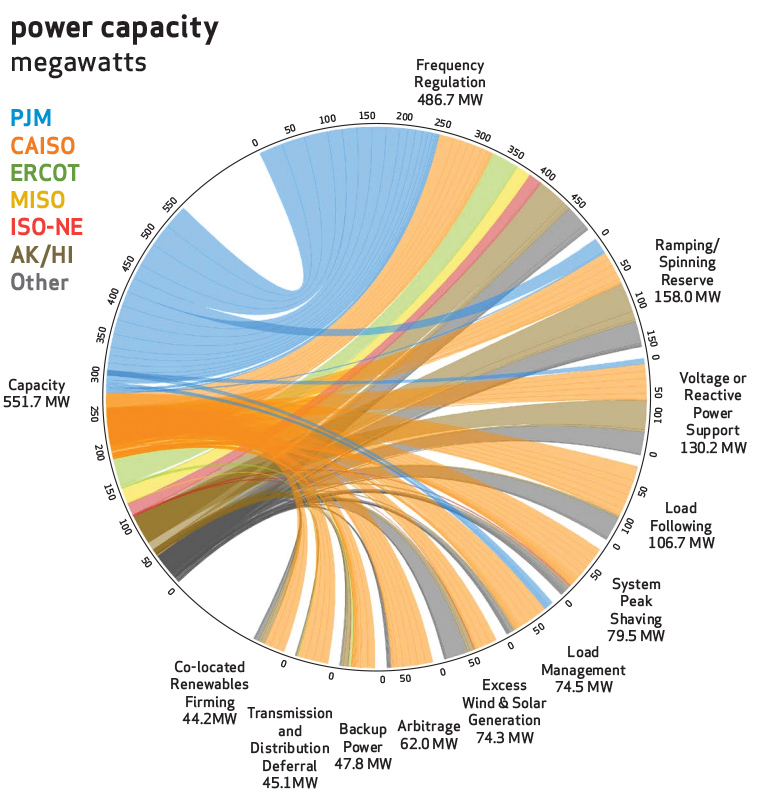

U.S. Large-Scale Battery Storage Capacity and Applications Served (2016)

Note: The figure does not include a 10 MW/7.5 MWh battery storage unit located in Maui, HawaII, which did not report any applications in 2016.

Source: U.S. Energy Information Administration, Form EIA-860, Annual Electric Generator Report

(click to enlarge)

EET&D – California already has a diversified power generation model that relies on a significant volume of renewable sources. Do you think there’s a significant role for distributed residential solar to play as it has in Japan?

BC – Definitely, and the exciting thing is that it’s already happening. We are working with a leading energy storage provider on a distributed solar initiative that assembles thousands of households in Southern California into a virtual power plant, which allows the state to respond to high-demand situations. It’s just in its infancy, and it’s already capable of harnessing nearly 40 MW of power. That will be much larger in the very near future. The model works, and it’s simply a matter of having the right combination of consumer education, utility rollout strategy and supporting incentives to go bigger.

I love that you started with Japan and California, because on the surface these are two dramatically different energy markets in terms of the structure and underlying dynamics, and yet both tell the same story: that distributed energy is already working at scale in both places, and both markets will make a major leap forward in the scale of that with the right technology to tie all of it together.

EET&D – Those are both examples of forward progress, but let’s talk about what’s standing in the way of a faster evolution of other energy markets. Not every market is as progressive on these issues as Japan and California. What are some obstacles that still need to be addressed?

BC – So many of the past obstacles have been cleared out of the way. PV is at a price point where the economics of residential solar are undeniable. And residential batteries are being produced on a scale that solves the previous bottleneck, plus there are proven financial models for how to make them affordable to consumers so that it’s built into the model for how they are paid for the energy they produce. And you’re seeing governments and regulatory agencies embracing this trend as a way to achieve sustainability goals and energy independence directives. Those hurdles are already cleared or in the process of being cleared, which is remarkable compared to where we were a decade ago.

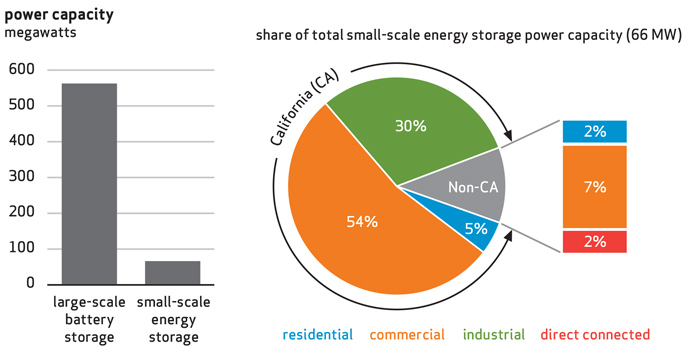

U.S. Small-Scale Energy Storage Capacity by Sector (2016)

Note: Data collected on small-scale storage may include forms of energy storage other than batteries. Direct-connected storage is not located at an ultimate customer’s site but are in front of the meter and/ or connected directly to a distribution system.

Source: U.S. Energy InformationAdministration, Form EIA-861, Annual Electric Power Industry Report

But there are some remaining obstacles, and I don’t want to minimize them. These have to do with the mindset of utilities and consumers, for whom this is a major change in the model for how energy is produced and consumed.

Let’s start with consumers because in many ways this is the easier of the two obstacles to overcome. Households see themselves as consumers of energy. They use a certain number of kilowatt hours of electricity and a certain volume of natural gas, and they pay those bills, and then they repeat that process the following month. It’s a major shift for them to get their heads around being an energy producer, but to be honest, I’m not worried about that obstacle. Consumers are practical, and when their utility makes it clear they can make money every month with a PV-plus-battery implementation rather than writing a check to the utility every month, they won’t be confused for long. Yes, it’s a major shift in how they think about energy, but money talks.

The harder mindset transition will be with some utilities, I think.

EET&D – How so?

BC – I don’t want to paint with too broad a brush, because there are so many utilities that are forward-thinking and doing really innovative work that is a win-win for consumers and for their organization. But some utilities are playing catch-up, and you can hear it in the language they use. When you still refer to customers as “ratepayers,” that’s a clear sign that you are thinking about the energy marketplace in the old way rather than with a mindset that sees households as partners in an integrated network of power generation and power consumption.

I know that’s a semantic issue, but it reflects a larger mindset. And my experience is that the companies that speak with that language are the ones who are moving slowest to understand the new energy model and position themselves to be competitive against other energy providers who are several steps ahead.

EET&D – That’s a major shift for organizations that have been in an industry that changed very little for decades before the wave of deregulation.

BC – I agree, but the bottom line is that companies that keep thinking that way are going to have a hard time catching up as the market continues to evolve. When I talk to utilities, I avoid making this an all-or-nothing proposition. They don’t need to design these as massive projects to begin reaping major benefits. One thing I always make a point of saying is that you don’t need a million customers right out of the chute in order to move forward. For reasons I completely understand, utilities are conditioned to think of their user base either in total or as large segments. But projects like the one we are doing with the energy storage provider in California is a great example of how you can solve specific problems as a utility with a highly-defined new energy project.

One of the thorniest problems for utilities to solve is demand-response events where there are spikes that cannot be met by the core power generation infrastructure in place. Very smart people have wrestled with that challenge for decades using the toolkit they had in place, but distributed energy like residential solar gives them a new tool. And it’s a powerful one. For even the most conservatively-inclined utilities who still use the “ratepayer” language, this is often the best way to get started with the distributed energy model. You don’t need a million customers involved. A few thousand can give you more than enough energy to take the edge off of demand-response events. And there are proven models for how to roll this out, how to make it work financially for consumers, and how to manage all of that with software that creates this bi-directional marketplace.

EET&D – You’re talking about demand-response situations, but what about replacing base power generation with this kind of distributed model. How far off are we from that?

BC – It will happen. When the marginal cost of a kilowatt hour of power from a PV system is zero, there’s no reason why residential solar can’t begin replacing base power generation needs at some point soon. It’s not a technology issue. It’s not an integration issue. And it’s not a financial model issue. It’s just a matter of time.

The key for many utilities is not to replace 100 percent of their base power generation, though. In the same way that bridges are designed to handle 200 percent or 300 percent of capacity, utilities would want to have well more than 100 percent of base power generation before they would feel comfortable shifting their base power load away from coal-powered plants and natural-gas-powered plants to distributed energy. That’s on the horizon, but in the meantime, these smart grid implementations provide an effective solution for one of the pain points that utilities have struggled with forever. To me, that’s where these initiatives prove their initial worth for a lot of organizations, and then it can grow in scope from there

EET&D – Before we wrap up, what are you and your team seeing in other parts of the world? And do you see a willingness to embrace these models there?

BC – One of the best parts of my job is working with people in parts of the globe that you don’t traditionally associate with the cutting edge of technology, but that’s exactly what I’m seeing in places like Africa and South America and underdeveloped areas of Asia.

It’s a bit ironic, I guess, but the countries with the most advanced traditional power grids have often been the most risk-averse when it comes to these models. They have systems that work, and they are conservative about trying new things that may represent a risk in their mind. But there are lots of places on the globe where power delivery infrastructure has traditionally been unreliable, and to them, these distributed energy models managed by smart grids aren’t a risk. It’s a chance to make a major leap forward in reliable, flexible energy infrastructure.

India is a great example of this. The country has traditionally had a weak grid system, so the energy industry there (in collaboration with governmental agencies) have taken much more of a “blank page” approach that re-thinks energy production and distribution. These distributed models – where households are not just consumers of energy but collaborative producers of energy – are more cost-effective to implement than traditional infrastructure. And faster. And easier to manage, with the right systems and software in place. The same is true in areas of South America, Central America, Africa and Asia where power infrastructure has been less-than-reliable for decades.

This isn’t just exciting stuff from a technical point of view. It’s life-changing for the people who live there and who run businesses there. For us, in the most developed nations, all of this energy stuff is primarily a business story about which companies are winning and how many rooftops have PV panels. But for so many parts of the world, this is so much more than that. This is a chance for companies to create more jobs in impoverished areas, for parents to make enough money to send their kids to school, and for kids to do their homework under working lights at night. I’m so proud to be a part of helping that happen. Everyone in our industry should feel the same way because what we are doing is proliferating around the world in a way that is making the world a better, more equitable place.

EET&D – That’s an important perspective, Ben. Our industry is a truly global one, and it’s about much more than just electricity. Thanks for sharing your insights with us, and safe travels as you criss-cross the globe working on these exciting projects.

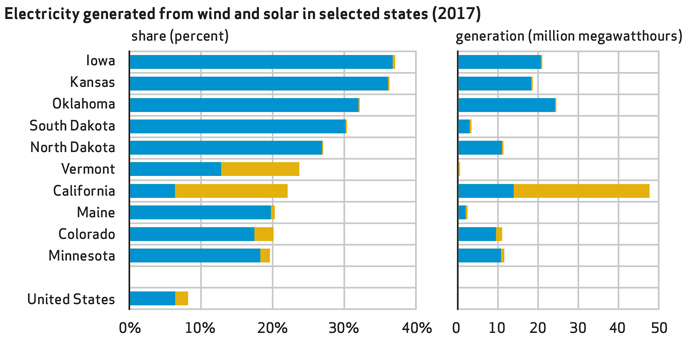

Combined wind and solar made up at least 20% of electric generation in 10 states in 2017

Source: U.S. Energy Information Administration, Electric Power Monthly

Ben Cohen is the director of global strategy at AutoGrid, which provides flexibility management software used globally by utilities, electricity retailers, renewable energy project developers and energy service providers to deliver clean, affordable and reliable energy by managing networked distributed energy resources (DERs) in real time and at scale. Cohen earned his undergraduate degree at Stanford and his MBA at Harvard.

Ben Cohen is the director of global strategy at AutoGrid, which provides flexibility management software used globally by utilities, electricity retailers, renewable energy project developers and energy service providers to deliver clean, affordable and reliable energy by managing networked distributed energy resources (DERs) in real time and at scale. Cohen earned his undergraduate degree at Stanford and his MBA at Harvard.