Industry 4.0 has long been a buzzword in the manufacturing and industrial sectors. Representing the fourth industrial revolution, Industry 4.0 highlights the transition from steam and electric power to modern advances in automation, data and analytics, networking and cloud computing.

Energy 4.0 applies the same concept to the electrical power utility industry. New technologies designed and built specifically for utilities have the potential to transform how generation, transmission and distribution infrastructure is managed, maintained and modernized. With access to real-time data, utilities can improve flexibility, resiliency and safety while lowering the cost of operations and maintenance compared to using traditional in-house resources and infrastructure.

Unfortunately, concerns over cybersecurity, IT infrastructure and reliability have caused utilities to hesitate when it comes to making investments that would modernize and enhance the electric power grid.

But with rising challenges and the transition toward renewable energy and distributed grids, the time to invest is now. Those who take a strategic approach and implement the right solutions that provide real-time situational awareness and automated monitoring for high-value and critical assets will be the ones who emerge best positioned for long-term success and profitability.

Energy 4.0 technologies

Energy 4.0 is a general term for the collection of hardware, software and technologies that leverage connectivity, data and computing power to modernize the grid.

The Industrial Internet of Things

The Industrial Internet of Things (IIoT) is a network of physical devices or sensors that collect, exchange and transmit contextual data. Soaring adoption and improving technology mean the global utility IIoT market is expected to grow to more than US$129 billion by 2032.1

Cloud computing

Cloud computing is the on-demand delivery of computing services over the Internet, including servers, storage, databases, networking, software, analytics, or other IT services.2 A recent survey showed that nearly all utility leaders have implemented cloud solutions, compared to less than 50% of lower-performing utilities.3

Data and analytics

Data and analytics allow utilities to collect, store and use data from multiple sensors to improve decision-making, business processes and performance.4 A recent study found that 52% of electric utilities had already or were currently implementing big data analytics.5

Artificial intelligence and machine learning

Artificial Intelligence (AI) allows computers to analyze and contextualize data to provide information or automatically trigger actions without human intervention.6 Machine learning (ML), on the other hand, is a subset of AI that uses algorithms to automatically learn and recognize patterns to make increasingly better decisions.7

The barriers to energy 4.0

Despite a wide range of potential benefits and the adoption of similar technologies in other industries, the utility sector has tended to lag behind for two primary reasons.

Security considerations

As critical infrastructure, utilities are highly concerned about cybersecurity. Regulated standards enforce the cybersecurity defences that utilities must implement to keep their networks protected, but internal security policies may go even further in limiting the use of network access or services due to perceived security risks.

This fear is not totally unfounded. The combined energy sector experienced 10.7% of all cyberattacks, ranking it fourth among industries.8 However, when evaluating cybersecurity risks, utilities should consider the type of data being transmitted and whether it can be used to disrupt the flow of electricity.

Internal policies and strategies

Utilities have traditionally focused on capital expenses (CAPEX), spending on equipment and assets needed to upgrade and build infrastructure. However, the move toward Energy 4.0 requires that utilities shift how they measure financial performance and allocate some budget toward ongoing operational expenses (OPEX) to pay for services such as network access, storage and computing.

The trends driving the need for new technology

The utility industry is changing, with emerging trends combining to place significant pressure on infrastructure that was not designed to meet current requirements.

Aging infrastructure

A recent report found that more than 70% of U.S. transmission lines were more than halfway through their 50-year life, while the average age of large transformers exceeded 40 years.9 The situation is similar in Canada, where the majority of the electric system was built more than 50 years ago.10

Labour and skills shortages

In addition to the technology itself, utilities must also invest in the skills, capabilities and expertise needed to achieve the full benefits of a new solution.

But utilities are increasingly competing for these scarce resources against other industries, especially high-tech firms. At the same time, a recent report found that more than 50% of experienced utility workers are expected to retire within the next decade.11 Technology can reduce the burden on scarce technical resources and free up personnel to focus on other, more strategic initiatives.

Extreme weather

Climate resiliency is now a key requirement as more frequent and severe weather impacts grid reliability and performance. A recent survey found that more than 50% of utilities said extreme weather impacted the delivery of electricity more than usual in the past year.12

Renewable energy

Utilities are heavily investing in decarbonization in response to regulatory, social and investor pressure. Investments in sustainable energy sources are projected to total more than US$3.4 trillion over the next decade.13

Decentralization

Power has traditionally flowed in one direction from a generating station to users often located vast distances away. But that is likely to change. A 2022 study, for example, found that 86% of consumers were interested in generating their own electricity.14 With locally generated power flowing in two directions, transmission and distribution systems need to be upgraded.

Putting Energy 4.0 technologies to use - Remote asset monitoring

Remote Asset Monitoring uses smart, contactless, infrared temperature sensors to provide utilities with automated remote thermal inspections on a near real-time basis.

The smart sensors take advantage of Energy 4.0 technologies to continuously monitor the health and performance of high-value utility assets while providing greater visibility and control of critical infrastructure. Infrared sensors automatically detect faults and alert technicians, allowing them to diagnose the issue and prioritize a repair based on the severity and estimated time to failure.

With increased access to data, utilities can monitor trends over time, improve reliability and transition toward a condition-based maintenance strategy that significantly reduces operations & maintenance costs.

How thermal and visual sensors work

Utilities are already familiar with handheld thermal sensors that have long been used to detect overheating assets such as transformers and their subsystems.

Remote Asset Monitoring uses similar technology to provide continuous, 24/7 coverage to detect faults at any time and during any load or temperature condition. Infrared sensors detect if there are I2R problems with any type of current-carrying asset. In a default configuration, thermal readings are taken every fifteen minutes while visual snapshots are provided twice a day, resulting in very low bandwidth consumption typically around 1MB per day.

AI/ML-powered software automatically alerts operators to a temperature anomaly that falls outside a set range. Since temperature can vary significantly due to changing load and weather conditions, alarms are based on temperature differential and are only generated if the component temperatures differ from each other by more than a few degrees. A consistent variance in absolute temperature will not sound the alarm.

Generally, the greater the temperature differential, the more severe the problem is and the sooner it needs to be repaired. Corrective maintenance can therefore be prioritized.

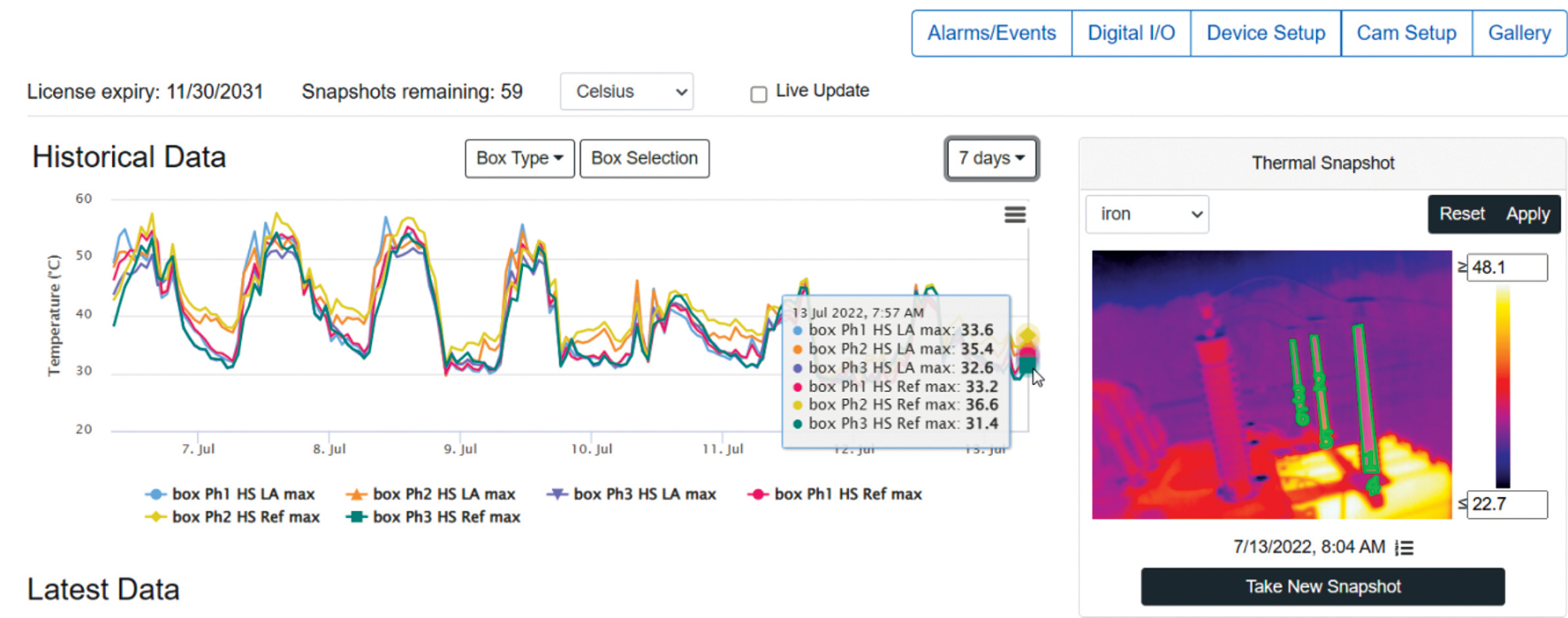

The IIoT dashboard displays the thermal image with the areas of interest identified by the green polygons. It shows the current and historical temperature readings graphed over time. The dashboard is also used to configure the sensors and view/set the alarms.

By leveraging third-party cloud services and network providers, utilities can minimize the cost of building, maintaining and upgrading IT infrastructure. Utilities can then scale these resources up or down based on actual usage, increasing flexibility and responsiveness as requirements change. Fewer in-house technologies also help to reduce the burden on internal IT departments.

Main components of the contactless sensor

- Infrared Module

- Visual Sensor

- Wi-Fi or Cellular Communications

- GPS

- Bluetooth

- Digital Inputs and Outputs

- Information and Configuration Dashboard

Implementing sensors for remote asset monitoring

Before installing the sensors, utilities should develop a comprehensive project plan that ensures everyone is working toward the same objectives. Start by identifying the initial scope, the business reasons for the project and the key metrics before determining the equipment and technologies required. This will also make it easier to set realistic budgets and installation timelines.

Utilities can then determine where the sensors will be deployed. For example, if the goal is to reduce the frequency of faults, a utility could select an older substation that requires more frequent maintenance. If, on the other hand, the goal is to reduce total travel time, sensors could be deployed at a distant facility that is difficult to access. With the site selected, utilities can identify the specific types of faults and the points on the equipment to be monitored.

Finally, installation and deployment can take place. Depending on the specific deployment, this can often be completed without an outage, drastically reducing installation costs compared to wired alternatives. Technicians can then complete the configuration and conduct testing, adjusting the parameters as needed to ensure complete and accurate data.

With the sensors installed, utilities can begin to transition toward a condition-based maintenance strategy, using AI/ML for predictive maintenance in place of periodic, scheduled inspections.

Optimizing operations and maintenance with Energy 4.0 technologies

By leveraging Energy 4.0 technologies and implementing a contactless system, utilities can optimize operations and maintenance and free up scarce technical resources for more strategic initiatives.

Communications

Carrier-grade networks provide utilities with the latest high-speed technology without the need for expensive hardware, cabling infrastructure, installation and maintenance. Using a carrier network can isolate the IoT network from the corporate network, mitigating cybersecurity risks and providing greater capacity, reliability and more frequent upgrades than an in-house network.

Storage and processing

Similarly, reputable cloud service providers provide greater levels of performance, security and scalability than on-premises infrastructure. After accounting for the hardware, software and maintenance costs, sharing computing resources over the cloud can lower costs to as little as 10% of owning and maintaining an on-premises data center over three years.15

Economies of scale

Because IIoT sensors are built with small, highly integrated parts and use standard carrier communications, the solution can easily scale up to more sites or assets over time. Utilities can start with smaller-scale pilot projects to sustainably invest while becoming familiar with both the technology and the process of procuring, installing and using the sensors.

Installation and deployment

The compact and easy-to-install sensors can be deployed faster and more cost-effectively than alternative monitoring solutions. No trenching is required for power or communications, and most sites will have a suitable mounting location without the need for further construction.

While the exact cost and schedule will vary, an IIoT sensor installation can be done in under an hour. Multiple sites can be managed simultaneously to reduce the total timeline. Utilities should plan to allocate 60% of the total cost to the purchase of the equipment and 40% to installation, with an additional 10% allocated to any contingencies.

Five examples of remote asset monitoring

Thermal and visual sensors can be deployed across a wide range of applications. Below are some examples of how utilities can implement IIoT devices for Remote Asset Monitoring.

Transformer monitoring

Transformers are high-value assets critical to the reliable flow of power. Physical inspections can detect faults, but these single-point-in-time inspections require crews to be in the right place at the right time.

Contactless thermal sensors can be aimed at transformers and their subsystems to detect temperature anomalies and automatically alert crews as soon as a fault appears. Instead of waiting for the next inspection, crews can be dispatched to address the issue before the component fails.

Wind turbine and substation inspections

Similarly, physical inspections on wind farms are time-consuming and expensive, requiring specialized expertise and certifications. Utility-grade thermal sensors reduce the need for manual inspections by providing 24/7 coverage of both the turbines and the supporting substations.

Underground vault monitoring

Underground transmission and distribution lines negatively impact the cost of maintenance and the overall life expectancy of the system. Underground vaults can also pose a threat to workers in cases of fires, explosions, or flooding.

Thermal and visual monitoring offers a way to detect potential problems and alert crews to hazards before they arrive at and enter the vault. Similarly, monitoring around joints and splices can detect cable faults or identify damage, wear and corrosion before failure.

Overhead switch verification

Verifying the position of motor-operated switches is often a highly manual and time-consuming process. Visual sensors allow technicians to remotely verify that switches are open or closed without traveling to the site, dramatically reducing the time and cost of switching operations and providing more flexibility and responsiveness to changing grid conditions.

Substation battery monitoring

Substation batteries are a vital part of the protection and control system. Failure could result in damage to equipment and put workers at risk. Substation batteries can be continuously monitored with thermal and visual sensors to ensure the health and performance of the battery before a failure occurs.

Embracing technology for long-term success

The utility industry has reached an inflection point. Accelerating trends toward renewable energy, distributed grids, labor shortages, and more frequent and severe weather events are taking a toll on aging infrastructure that was not designed to meet the challenges of the future.

Remote Asset Monitoring using contactless thermal and visual sensors provides utilities with a continuous view of high-value, critical assets while minimizing the need for physical inspections. With greater access to historical and real-time data, utilities can mitigate the risk of catastrophic failures, prioritize strategic investment decisions and reduce the burden on scarce technical resources.

And by implementing effective security policies and IIoT architecture, discussed in more detail in other papers, utilities can achieve the benefits of Energy 4.0 technologies without compromising sensitive data or critical equipment.

Energy 4.0 technologies including IIoT, cloud computing, data and analytics and AI/ML are changing the way that electric power and its critical assets are managed and maintained. By making the right investments today, electrical power utilities will be better positioned for long-term success and profitability.

Richard Harada has more than 20 years of experience in industrial networking communications and applications. Prior to joining Systems With Intelligence, Harada worked at RuggedCom and Siemens Canada, where he focused on product management and business development for industrial communications in the electric power market. Harada is an electronic engineering technologist and has a Bachelor of Science degree in computer science from York University in Toronto.

1 https://www.futuremarketinsights.com/reports/iot-in-utilities-market

2 https://azure.microsoft.com/en-ca/resources/cloud-computing-dictionary/what-is-cloud-computing

3 https://www.accenture.com/ca-en/insights/utilities/cloud-imperative-utilities-industry

4 https://www.gartner.com/en/topics/data-and-analytics

5 https://www.osti.gov/servlets/purl/1639296

6 https://ai.engineering.columbia.edu/ai-vs-machine-learning/

7 https://ai.engineering.columbia.edu/ai-vs-machine-learning/

8 https://www.ibm.com/downloads/cas/DB4GL8YM

9 https://www.reuters.com/investigates/special-report/usa-renewables-electric-grid/

13 https://www.infosysbpm.com/newsroom/analyst/documents/next-gen-it-services.pdf

14 https://www.ey.com/en_us/power-utilities/five-utility-trends-to-watch-in-2022

15 https://cloudpost.us/capex-vs-opex-on-premises-versus-the-cloud-which-saves-more-money/