Municipal electric utilities in New England face significant energy cost increases in the coming years due to the retirement of older generation plants and the impact that shifts in the sourcing of generation will have on transmission patterns. Municipal utilities can mitigate the impact of these increases by reducing the amount of energy used across their service areas during targeted high-value periods, including critical peak hours. To accomplish this goal, municipal utilities must be able to do three things:

- Predict when high value hours will occur on the grid

- Motivate and empower large energy users in their service areas to reduce energy usage and, most importantly

- Do all of this without transferring the customer relationship to a third party vendor

The following discusses these issues in greater detail and describes how one municipal utility in New England is meeting the challenge by employing a strategy that relies on Commercial and Industrial (C&I) Distributed Energy Resources (DERs) and a Distributed Energy Resource Management System (DERMS) that could save millions of dollars per year.

New England Generation Plant Retirements

EPA restrictions and marginal economics have caused a significant number of generation plants to announce retirements in New England. This, in turn, is driving cost increases in the coming years.

According to a published report1, More than 4,000 MW of primarily older, less efficient, and higher-emitting resources have already left the market, with another 3,500 MW exiting by 2018. Another 6,000 MW's of capacity is sourced from plants that will be at least 40 years old by 2020 and designated at risk. Notable exits cited by the report include:

- Brayton Point Station (1,535 MW from oil and coal)

- Mount Tom Station (143 MW from coal)

- Norwalk Harbor Station (342 MW from oil)

- Salem Harbor Station (749 MW from oil and coal)

- Vermont Yankee Station (604 MW from nuclear power)

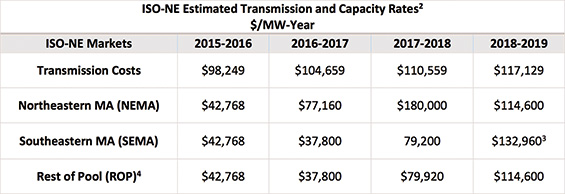

These exits will make it more expensive for municipal utilities to acquire the energy needed to service their customers. The table below shows the impact these retirements are having on key components of the region's overall energy costs.

Since most municipal customers are on a blended rate, they will not see increases in the specific cost drivers, but feel their impact in the form of overall energy cost increases.

As the table above indicates, all regions will see significant increases, but ISO-NE customers in the Northeastern Massachusetts (NEMA) region will see capacity rates increase more than four-fold to $180,000 MW-Year by 2017/2018.

Understanding the Underlying Cost Drivers

High value hours occur when prices increase and charges related to critical peaks are assessed. The price increases are self-explanatory, but the relationship between critical peaks and energy costs merits some additional explanation.

ISOs and RTOs have an obligation to reliably meet their regions' energy needs, even during the highest periods of energy use. To plan for these periods, power pools need to determine how high is high' when it comes to the need for electricity. The exact calculation varies across ISOs/RTOs but the logic is similar. When the system-wide need for electricity is at its peak, the ISO determines how much each energy provider has contributed to that peak and assesses them accordingly. In ISO-NE, capacity charges are calculated using this logic.

The ICAP Tag is assessed during the single highest hour of system-wide electricity usage during the year. Energy providers, including municipal utilities, are assessed a share of the peak load based on the energy usage in their service area during the ICAP Tag hour.

Because municipal utilities have to pay this cost, they have no choice but to pass it through to customers based on each customer's demand' contribution to the system wide peak when the charges are assessed.

Managing Demand during Grid Peaks

On the surface, reducing these demand charges seems as simple as reducing energy usage across the service area during critical peak periods. In practice this is harder than it sounds.

Managing C&I DERs

The most direct path to savings is to affect targeted reductions on the DERs of the service area's largest C&I customers. The problem is, these resources are not under the direct control of the municipal utility.

Mills, industrial water pumps, manufacturing facilities, and institutional HVAC systems are all large yet manageable loads that can significantly impact a potential peak period if curtailed at the right time. The problem is that these assets are primarily used to manufacture goods, treat waste water, and maintain comfortable conditions for workers and customers. Typically, the C&I management teams that control these assets are busy filling orders, managing inventory, and meeting payrolls.

Convincing busy C&I customers to re-task mission critical resources requires a holistic offering that pairs the information and notification capability of a robust DERMS platform with a turnkey, managed service that motivates and empowers customers without disrupting normal operations. While this type of deep dive into customer energy systems is necessary for success, it could also easily exceed the resources of many municipal utilities.

Outsourcing to a vendor is a possibility, but what does that type of arrangement look like, and more importantly, at what cost to the customer relationship?

The following provides a case study that describes how one New England municipal utility is answering these questions.

Reading Municipal Light Department

Reading Municipal Light Department (RMLD) is located about 30 minutes north of Boston, Massachusetts. Its staff of 70 plus employees serves more than 29,000 customers in a four-town service area including Reading, North Reading, Lynnfield, and Wilmington. RMLD has a long history of customer service including a Total Quality Management (TQM) process that has been in place since 1993. Over the years, RMLD has forged an extremely strong bond in the communities it serves, as evidenced by consistently high marks on customer surveys for reliability, responsiveness, and service.

Located in the NEMA region of ISO-NE, RMLD and its customers are facing some of the region's steepest energy cost increases in the coming years. Taking action to mitigate these increases for their customers became a priority project for RMLD. After a search for solutions, they partnered with Tangent Energy Solutions, Inc. (Tangent).

"Tangent provided an offering that met all of our key criteria," said Tom Ollila, Integrated Resource Engineer for RMLD and project leader for the Peak Demand Reduction (PDR) program. "They had a proven ability to accurately predict demand peaks, a track record of working with C&I customers and a process that kept RMLD front and center with the customers."

The first step for RMLD was to set a challenging but reachable goal for overall peak reduction. For the past few years, RMLD has had an annual peak demand of about 160 to 170 MW. Approximately 90 MW of that peak is sourced from about 400 C&I customers. More than twothirds of the C&I peak, or approximately 57 MW, was created by their 50 largest C&I customers. A 20 percent reduction in the peak-load for these 50 customers would translate to a peak reduction of just over 11 MW. Controlling this C&I load during critical peaks and other high value hours established the basis for RMLD cost reduction goals.

While the specific details of the program are confidential, it is estimated that the overall annual savings could exceed a million dollars. Any PDR program savings will be divided between the C&I customer, Tangent, and RMLD, which will pass through its share of savings to benefit the whole system and not just participating customers. Providing a system wide economic benefit was a key priority for RMLD.

Implementing the Program

The next steps involved implementing the technology and enrolling customers.

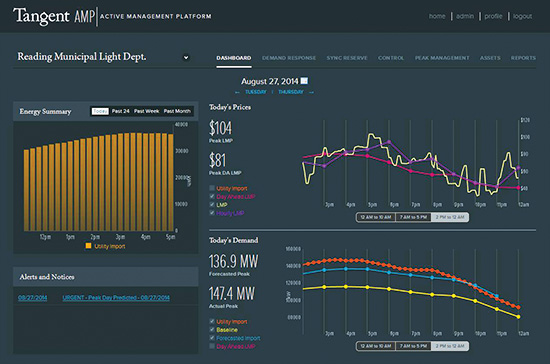

A customized DERMS platform

Tangent AMP™, a hosted DERMS was developed by the same team that pioneered the technology for Demand Response provider Enerwise. Before it was purchased by Comverge in 2007, Enerwise was the largest C&I DR provider in PJM. This combination of technical expertise and C&I customer experience was exactly what RMLD was looking for.

The host monitors signals from the grid, facility, weather, and on-site assets. Using proprietary algorithms, these signals are used to predict high value opportunities on the energy grid, including critical peaks, and premium pricing periods.

When an economic opportunity is identified, customers are notified and may elect either a manual response where they implement their own curtailment activity, or an automated response where a customerspecified energy management protocol is implemented by signaling the facility's industrial or building control equipment.

Before implementing the technology, RMLD and the host DERMS customized the standard screen options and fields to match the specific program RMLD was offering its customers.

"We chose this technology because of its track record and because they were willing to work with us to keep RMLD front and center with our customers," said Jane Parenteau, Director of Integrated Resources for RMLD. "Moreover, this system did not require significant upfront costs or special hardware to be installed, other than a data recorder. It communicated directly with C&I existing electric meters, and building/ energy control systems."

With the technology in place, RMLD and the host developed a prioritized list of customers and jointly solicited their enrollment into RMLD's PDR program.

A Turnkey Activation Strategy

The customer enrollment process consisted of analyzing energy information RMLD already had at its disposal, including meter data, and energy bills for the past 12 months. This initial assessment was followed by an on-site visit to assess C&I customers' facilities, HVAC systems, industrial control equipment, and other energy resources. An additional business assessment was conducted to understand how much and when each customer could curtail energy. Customers were provided with a savings assessment and given the opportunity to enroll in the voluntary program.

"We needed to do more than just alert customers to peak demand situations. It was important to give them the capability to take action without burdening them or disrupting normal operations," said Ollila. "Tangent helped us implement a turnkey solution, while always making it clear to our customers that this was an RMLD program."

Results to Date

The first year (2014/2015) focused on signing up a significant number of customers in preparation for the following year (2015/2016) when the capacity charge would increase more than 80 percent from $42,768 MW per year to $77,160 MW per year.

Customer enrollments jumped to a strong start. By targeting the largest customers first, RMLD was able to reach more than 54 percent of its three-year MW enrollment target in the first year. Of the 50 initial customers representing approximately 57 MW, 12 were signed representing a peak demand load of approximately 31 MW.

The DERMS platform was fully installed by mid-summer. Since then it has accurately predicted 87 percent of the high value hours targeted by RMLD and Tangent. In its second year (2015/2016), the enrollment process will continue, but the focus will increasingly shift toward working with the C&I customer base to maximize C&I customer participation during the high-value periods.

Finally, a less measurable, but critically important, result has been RMLD's ability to provide a value-added service without putting a vendor layer between itself and its customers. By customizing its technology, working through, rather than around, RMLD, and creating a savings strategy that benefits the entire service area, this program strengthens RMLD's standing with its customers.

Economics beyond Cost Management

Since implementing the program, RMLD has discovered that the technology and managed services put in place to mitigate cost increases are also proving to have value in two other programs. RMLD is in the process of upgrading to AMI meters for its largest customers. These meters will expand the pool of customers that qualify for the Demand Design program and therefore help justify the cost for the new meters.

RMLD recently implemented a pilot program using a few hundred residential hot water heaters retrofitted with load control technology that operates on a predetermined schedule. The host DERMS will communicate directly with the control system to curtail the load from these heaters and reduce energy usage during peak hours as well.

"We are very pleased with the launch of the PDR program and look forward to working with Tangent to expand its use to more of our C&I customers," said Ollila. "I recommend this type of program to other municipal utilities seeking cost control of their capacity/transmission charges, especially in New England."

About the Author

Dean Musser is an energy industry entrepreneur, business strategist and commercial and industrial energy expert with three decades of experience in delivering rapid returns on investment.

Dean Musser is an energy industry entrepreneur, business strategist and commercial and industrial energy expert with three decades of experience in delivering rapid returns on investment.

Prior to founding Tangent, Dean was COO of Comverge C&I Group, a demand response, advanced metering and grid management solutions company. He founded, and was President and CEO of Enerwise Global Technologies, which he transformed into the largest demand response provider in PJM. Dean previously served as VP of Operations & Engineering for Conectiv Solutions, where he led the spin out of Conectiv to create Enerwise. His 30 year relationship with C&I energy customers started at Multi-Test Maintenance, a premier engineering service company in the Mid-Atlantic, which he bought and then sold to Delmarva Power to create the foundation for Conectiv Solutions. Dean holds a BS in Electrical Power Engineering from Drexel University, and an AS in Electrical Engineering Technology from Pennsylvania State University. He is a licensed Professional Engineer in several states.

References

1 ISO-New England 2015 Energy Outlook

2 SOURCE Transmission: RNS Rates 2014-2018 PTF Forecast (http://www.iso-ne.com/static-assets/documents/committees/comm_wkgrps/trans_comm/tariff_comm/mtrls/2014/aug11122014/a8_rns_5_yr_forecast.ppt) plus 2015 ISO-NE SCD (Scheduling, Control and Dispatch) rate (http://www.iso-ne.com/static-assets/documents/2015/01/rns_supplemental_final_january_5_15.pdf)

Source: Capacity Estimated "Net Regional Clearing Price" for capacity from appropriate Forward Capacity Auction (FCA) and updated for Annual Reconfiguration Auctions (ARAs) that have occurred for 2015-16 and 2016-17

3 NOTE: Due to regional reconfiguration Rhode Island is included in SEMA 2018-2019, but in ROP all other years.

4 ROP markets are ISO NE regions not included in NEMA or SEMA