Energy and utility marketers are a unique breed facing the remaining vestiges of a conservative and cautious market with an influx of technology that is bringing change at an ever increasing pace. With this dynamic landscape in play, the way the energy industry markets itself is changing. It’s vital for energy CMOs to lead in new ways, to truly know their markets and to have clearly defined messages to the right target audiences. To that end, the McDonnell Group 2nd annual Energy & Utility B2B Marketing Benchmark Study is designed to look at the unique reality – challenges and opportunities – for B2B marketing in our industry.

Last year’s study highlighted the struggle marketers are facing, including not holding the strategic position that it should in order to address the CEO’s challenges and navigate the changing marketplace. It was also clear marketers were not measuring the effectiveness and success of programs to adjust course, make impact and have the ‘capital’ to demand the seat.

But, as originally intended, the study also brought forward the first existing baseline for B2B marketers in our industry to compare their programs and approach to marketing to others in the same space.

This year’s results serve to verify last year’s findings and underscore the marketing climate marketers are operating in as they work to get their companies ahead of the change that is upon the industry. While results indicate that a shift could occur in the not-so-distant future, there has not been much change in the inbound/outbound approach. Outbound being the traditional methods of marketing (print advertising, billboards, telemarketing and direct mail) that are pushed to consumers versus inbound marketing (blogging, content publishing, search engine optimization and social media) focusing on creating quality content that pulls relevant prospects and customers towards the company and product. The 2013 survey results show 9 percent of respondents focused on inbound marketing, 61 percent focused on outbound, and 30 percent focused on both equally. 2014 results are similar with:

- 10 percent focused on inbound

- 65 percent focused on outbound

- 26 percent on both equally

Inbound not only increases revenue, but also accelerates company growth and increases profitability. Marketers in this industry must start making the shift to inbound marketing in order to offer their

audiences useful information and tools to attract people to their website, while also interacting and developing relationships with these potential customers.

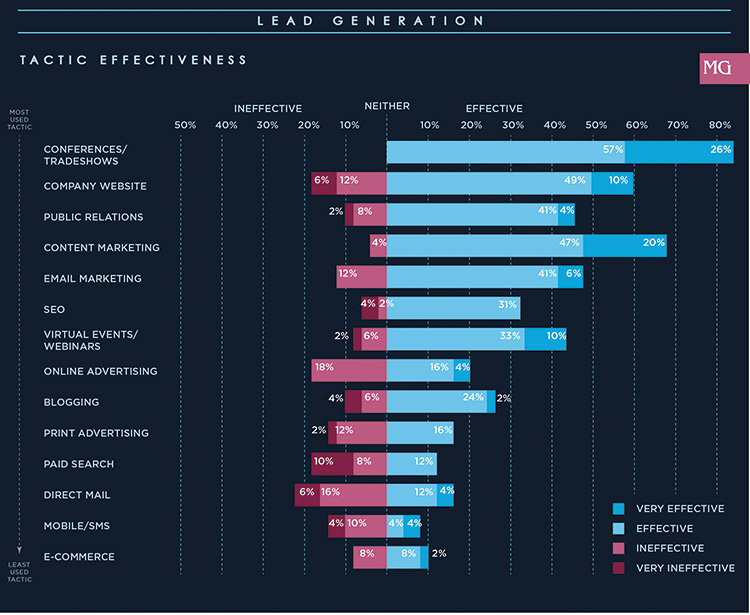

When considering lead generation, there is a slight shift in the most often used marketing programs/tactics. In 2013, the top four most used tactics were: company website (97%), conferences/tradeshows (96%), content marketing (92%), and email marketing (85%). In 2014 marketers identified the following:

- Conferences/tradeshows (100%)

- Company website (98%)

- Public relations (88%)

- Content marketing (86%).

As for the most effective programs/tactics for lead generation, in 2013 the top four most effective tactics were: conferences/ tradeshows (85%), content marketing (61%), company website (58%), email marketing (49%). In 2014 the most effective were:

- Conferences/tradeshows (83%)

- Content marketing (67%)

- Company website (59%)

- Email marketing (47%).

While some industries debate the effectiveness of face-to-face events, in the utility and energy space, events are still a main method of networking, collaborating and brainstorming. Even with decreasing travel budgets and virtual interactions on the rise, conferences and trade shows are still seen as a viable and highly effective way for generating leads and extending the reach of the brand. Forty-seven percent of marketers predict they will spend an equal amount of money on tradeshows in 2015 as they did in 2014.

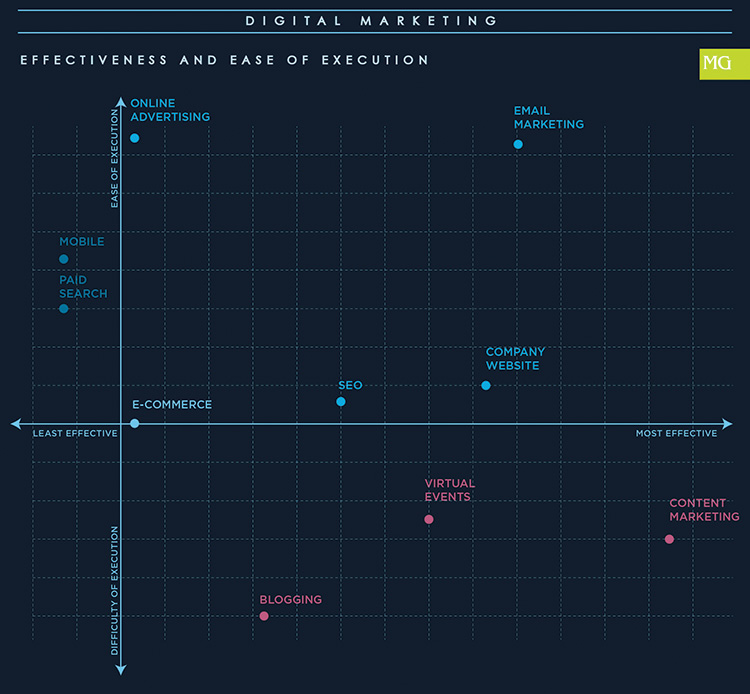

When digging more into digital marketing tactics, respondents stated that email marketing is the easiest to execute (51% very easy/easy) followed by online advertising (41%). Blogging ranked the most difficult to execute (52% difficult/very difficult) followed by virtual events/webinars (36%) and content marketing (34%).

However, even with content marketing being the 3rd most difficult tactic to execute, and lack of time considered the greatest barrier to overall marketing success, when asked what the most exciting marketing opportunity they saw for 2015, an overwhelming 69 percent identified content marketing as the next big thing.

In the Content Marketing Institute’s 2014 5th annual content marketing survey, 70 percent of marketers say they are pumping out higher volumes of content than a year ago. More than ever, B2B marketers are focused on serving up content, an inbound marketing tactic, which helps customers engage and accelerate through the buyer journey.

Are We Making Any Progress?

There is so much data in the study, but with the conclusion of this year’s study, the big question is…are we making any progress?

In regards to marketing’s inclusion in the C-suite, there seems to be little progress as both the 2013 and 2014 study results identified only 25 percent of participants had a marketing executive in the C-Suite. The 2013 data identified 35 percent of respondents with a CMO/VP title compared to 43 percent in the 2014 study. Based on last year’s findings, some questions were added to the 2014 survey, and when asked how their companies viewed the importance of marketing, only 20 percent indicated that their companies saw marketing as critical with an additional 41% indicating that marketing is seen as very important.

This is staggering when you consider that the traditional 4 P’s of marketing (product, price, placement, promotion) are the very lifeblood of any business. It is marketing that defines the distinctive features and benefits of the product or service, sets the price and communicates those features and benefits to the appropriate audience.

What’s Holding up the Progress?

Lack of measurement

In 2013, 29 percent of marketers identified they do not measure marketing effectiveness at all, compared to the 35 percent from the 2014 study. Measurement and analytics moves marketing away from distractions and toward growth. Without it, marketers struggle to determine what is truly effective and what is not in order to course adjust. Plus, it is difficult to track how marketing programs contribute to corporate goals and show how marketing programs directly impact sales.

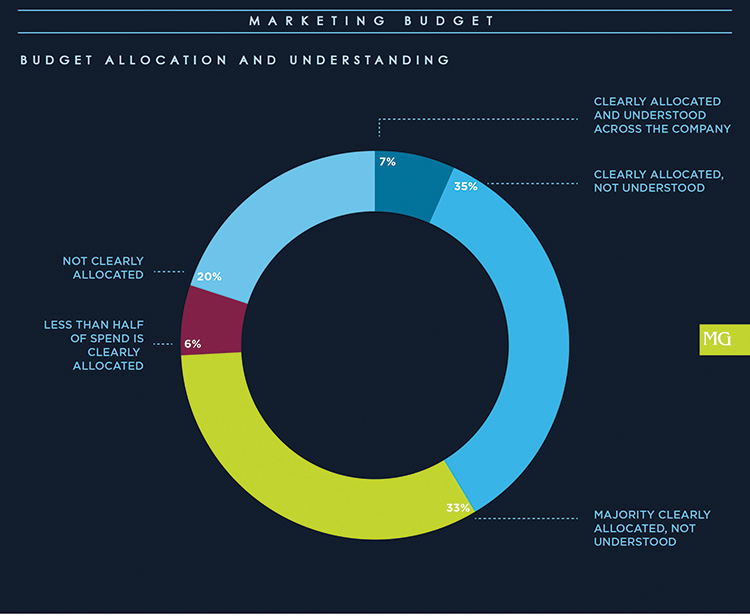

Lack of budget transparency

In 2013, 18 percent indicated marketing spending is clearly allocated and understood across the company, while 21 percent indicated it was clearly allocated, but not always understood. In 2014, only seven percent indicated marketing spending is clearly allocated and understood, while 35 percent indicated it was clearly allocated, but not always understood. Understanding this, the number with budgets clearly allocated went up from 39 percent to 42 percent.

This begged the addition of a question in the 2014 survey concerning whether or not companies have a documented marketing strategy. The answer to this question is tightly aligned with what one would expect based on other responses, with only 33 percent identifying they have a documented marketing strategy. An additional 41 percent said they have one, just not documented. However, a full 26 percent answered that they do not have a marketing strategy.

Lack of data

Marketing decisions need the support of research. While marketing strategy is numbers driven, the research shows 52 percent of respondents have five percent or less of their budget allocated for market research.

When asked to describe their company’s approach to market research, only 13 percent identified that market research is embedded in their company DNA, while 60 percent said it was either not important or recognized as important but not funded. The most common form of research performed by participating companies was Customer Satisfaction Surveys (50% had conducted CSAT, of which 27% have an ongoing program or conduct often [23%].) This was followed by Market Segmentation at 41 percent. So what was the least common? Marketing Effectiveness at only 12 percent, followed by Brand Perception/Awareness at 15 percent.

What Are the Opportunities?

Even with the increasingly fast-paced environment that is changing the dynamics of our industry, marketers have a positive outlook on 2015 with 85 percent being optimistic or very optimistic about their company’s potential growth and 70 percent saying the same about the industry’s overall potential. Yet the opportunity is great for marketers to step up to lead their companies to success.

Marketing has evolved from ‘vertical to holistic’ as it has grown from the 4 Ps to the need to delight and draw closer to the customer. This is so we can better know them, anticipate their needs and build real relationships to create a meaningful, two-way dialogue between company and customer. We can do this through the use of data. Data-driven marketing drives efficiency, enables smarter decisions and propels a competitive advantage in the marketplace.

In today’s B2B marketing world, personalization of customer data will let us build actionable strategies. With meaningful data, marketers can create winning plans that will drive better sales and give them bigger returns on investment. In addition, marketers must also track marketing involvement across every touchpoint, connecting the measurements across multiple channels to crack the metrics code, so we can know what is working and what isn’t. By tracking and analyzing marketing effectiveness and having the numbers to back it up, we then have the power to adjust and steer marketing programs while having the metrics when talking to the C-Suite.

Interactivity through social media and content publishing is transforming the nature of the brand and relationships with customers and prospects. Fifty-five percent of B2B buyers search for information on social media as part of their discovery (source: MediaBistro) means focusing more on delivering content via social media to increase awareness.

All of this points to the opportunity for marketers in this industry to better know the environment in which we are operating, know what others are doing that works and what doesn’t work, in order to set goals and give marketing the energy and the strategy to succeed.

About the Author

With over seven years of experience as a marketer in the utility industry, Carrie Owens is currently the marketing account manager for McDonnell Group, the leading integrated marketing firm for the energy and utility industry. She works with her clients in the creation and delivery of integrated marketing programs, providing strategic and tactical direction to propel them to market leadership and build value for their businesses. Prior to joining McDonnell Group, she was the public relations and marketing manager for EnerNex.

With over seven years of experience as a marketer in the utility industry, Carrie Owens is currently the marketing account manager for McDonnell Group, the leading integrated marketing firm for the energy and utility industry. She works with her clients in the creation and delivery of integrated marketing programs, providing strategic and tactical direction to propel them to market leadership and build value for their businesses. Prior to joining McDonnell Group, she was the public relations and marketing manager for EnerNex.