As customers become more willing to receive alerts from utility companies and pay their bills through their cell phones, utilities need to follow the lead of electric companies such as Pulaski in integrating innovative ways of applying the Internet and mobile phones in order to provide customers with more convenient, flexible and timely information.

Billing for utilities is still mainly carried out on paper. A huge 63 percent for electricity providers, 64 percent for gas and 73 percent for water (according to a recent PayItGreen Survey) are all significantly lagging behind their counterparts across the cell phone, financial services and Internet provision markets, which are already benefiting from engaging with their customers through new channels such as text and Internet.

But the predicted growth of mobile payments is set to reach 377 percent over the next three years (AITE Group), and utilities for the first time in 2010 recorded on average more than 10 percent of customers receiving and paying their bills electronically, according to a recent report from industry research firm, Chartwell. So the move towards electronic bill presentment and payment (EBPP) has clearly started, and 2011 will see a sharp increase in adoption, extensively driven by the deployment of smart meters and by new payment methods, including SMS messaging.

Other industries using electronic payments have already shown that through the use of these new technologies, Days Sales Outstanding (DSOs) have been significantly reduced. Whereas the average DSO for a customer receiving a paper bill is approximately 45 days, eBilling and payment solutions can reduce this timeframe by up to 70 percent. And recent NACHA (now the Electronic Payments Association) research found that the cost of issuing such paper bills can currently amount to as much as $.66, a figure that could be reduced or shifted to the customer by introducing more direct channels such as paying via SMS/text.

Most importantly, eBilling – and in particular using SMS/text – can dramatically improve overall customer satisfaction by providing customers with timely information about changes in their services and offering them more flexible payment options.

Mobile payments a key driver

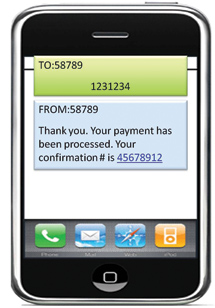

Integrating text into customer communications is going to prove a key driver for enabling utilities to embrace this rapidly emerging payment channel. SMS/text can be used in a variety of ways, such as for sending timely payment reminders to encourage customers to pay on time; sending immediate confirmations to let customers know that their payments have been received; to get instant traction with delinquent customers by sending shut-off avoidance messages to inform customers when their payments are critically overdue; and to receive payment authorization messages in order to process a bill payment.

One way SMS can be used is for sending

immediate payment confirmations.

The use of SMS/text also transfers these benefits directly on to the customer, allowing them to pay bills faster, more conveniently, and at a time that best suits them.

Potential for utilities

Despite the fact that many utilities haven’t fully optimized paperless billing into their collection processes, NACHA predicts a 35 percent year-on-year growth rate in eBilling. 2011 will be a huge year for utility companies looking to improve their collection rates – with the benefits of using mobile payments being a substantial portion of those improvements.

One company already reaping these benefits is Tennessee-based Pulaski Electric System (PES), which has integrated the BillingTree mobile payments suite into its existing collections processes. The energy company services 15,000 electric customers in Giles County in the State of Tennessee, and has always been at the forefront of energy supply. It launched its state-of-the-art 100 percent fiber-optic network in early 2007, and continues to offer its “triple-play” of video, voice and data services to a growing number of residents and businesses across the county.

“Initially, I expected the 20-30 age group to sign up for the mobile program, but we had customers well into their 50s and 60s signing up as well. It has been very well received by our customers. We publicized it through the radio and of our walk-ins the day of the launch, 30 percent of customers signed up. At Pulaski, we provide every avenue possible for the customer to take care of business, with 15 percent of customers accepting bill notifications via the web and 10 percent of them paying online. We anticipate similar results through the text program.” – Daryl Williamson, Vice President of Customer Support at Pulaski Electric Systems.

By integrating SMS/text technology into existing infrastructure, utilities can reap multiple benefits across other communication channels. The use of SMS/text helps to alleviate pressure on inbound call queues and consequently reduces waiting times for customers, which in turn, enhances the customer’s experience and maximizes efficiency.

Added benefits of SMS/Text

Utilities can go one step further in using SMS/text to gain full advantage. By using it to communicate with customers about any upcoming issues that they need to be aware of, customers can receive helpful information on planned brownouts or possible power outages due to maintenance work, easily and conveniently. Such information would be happily received by most customers, who will appreciate being able to plan their activities and energy usage accordingly.

The European experience

The use of SMS/text has already been extremely effective in utility companies across Europe, with many already using SMS/text to their advantage. Companies including E.ON – the world’s largest investor-owned power and gas company – have already leveraged the benefits of automated SMS/text notifications in order to effectively communicate meaningful information to their end user customers. Judging by the levels of success in Europe, this new channel has huge potential to be similarly successful in the U.S.

Smart Meters driving change

Add to this the fact that over the next ten years, half of all American households will have a Smart Meter installed in their homes (according to statistics from the Edison Foundation), and it is clear that utilities need to start preparing themselves to be able to deal with these new technologies in ways that enable them to quickly and cost effectively distribute data and information. Through the deployment of Smart Meters, consumers are able to see precise detail around the time(s) of day, week(s) and year(s) when they use the most energy.

This increased detail in information is putting more and more pressure on utilities to be able to deal with higher volumes of consumer information and is, in turn, driving the requirement for a new approach to engaging with their customer base. Utilities are realizing that by implementing new payment channels such as SMS/text, customers have more flexibility in managing their personal payment processes and feel more in control of their usage payments.

Allowing customers to pay by text allows more

flexibility in managing their personal payment processes.

Going Green for the Gen Ys

Eliminating the paper cycle through the introduction of eBilling and epayments and exploiting mobile and SMS/ text applications also matches the expectations of the tech-savvy ‘Generation Y’ group of home-owners, who are already used to eBilling and ePayments for Internet and cell phone use. And most Gen Y customers are happy to pay for power and water in the same way. By using these new payment channels for the ‘Gen Ys’, utility companies can increase the likelihood of timely payment by offering more convenient payment options.

This development in mobile payments is a huge breakthrough for utilities, as Pulaski is finding. The other major driver in 2011 will be the rise in the use of pre-funded accounts, which offer another option for making payments easier, and reduce the element of risk for utilities.

In the past year, electronic payment facilities that utilities can offer customers have dramatically expanded, not just with optimized web-payment forms for use on smart phones but with new services such as pre-funded accounts.

Pre-payment for services has gained significant acceptance in the US led by the cell phone industry, where a report from IDC indicated 65 per cent of new customers in Q4 of 2009 opted for pre-pay service plans. The same economic factors driving the shift in cell phone plans have impacted pre-payment demand for other services that traditionally rely on short-term credit or deposits. Utilities can consequently reduce the risk of an unpaid bill by introducing pre-funded accounts for particular customers who they have identified as being unlikely to be able to pay on the spot.

Customers can draw down funds allocated for a specific service, thereby minimizing risk for the utility company, while also eliminating the need for upfront deposits, which are largely unpopular with new account holders or the un-creditworthy in particular.

Utilities can even introduce a points-based loyalty reward program, by providing those consumers who complete a payment promptly with well-earned points. Customers can gain rewards for maintaining positive balances, opting for paperless billing, or setting up recurring bill payments online, etc. This can help make controlling finances easier for the customer themselves, while providing a risk resistant alternative to those providing the services.

The technology is here for utilities to implement new and innovative ways to enable customers to manage corporate and household budgets, and to provide rewards for customers in good standing.

The future of EBPP

Last year, the utilities market was identified as one not fully recognizing the latest advancements in electronic bill payments processing (also called electronic bill payment and presentment), but one that would become increasingly under consumer pressure to offer customers ePayment facilities. Supporting mobile SMS/text payments provides a convenient option for utilities to quickly start supporting consumers on-the-go. Billers can leverage this technology to reduce costs associated with consumer contact, including time sensitive notices as well as the expense of traditional paper bills.

The rapid mainstream adoption of SMS/text messaging and demand for increased mobile commerce alternatives is shifting EBPP from what previously was almost exclusively on the desktop to the hand-held device and in particular for use on smart phones. The technology is here now for utilities to implement new and innovative ways to communicate with their customers about their services, and to provide them with interactive and mobile payment services in order to maximize the likelihood of payment - and payment on time.

About the Authors

Daryl Williamson joined Pulaski Electric System five years ago, prior to serving as a sales associate for Verizon Wireless where he became very familiar with SMS/text capabilities to reach customers. Daryl has more than 15 years of customer service experience and was instrumental in Pulaski Electric System’s fiber-to-the-home deployment. He has a proven ability to carefully find and enhance customer service offerings. Daryl completed his BBA at Athens State University, followed by an MBA at Middle Tennessee State University and is currently working toward an accounting degree.

Randy Phelps served as the Vice President of Operations for one of BillingTree’s clients prior to joining BillingTree’s executive team as Chief Operating Officer. Randy was an early adopter of integrated payment solutions and has more than 15 years of experience in strategic planning, business unit development, project and product management, and turnaround strategic planning. His experience spans several industries and disciplines including Financial Services, Collections, Telecom, Healthcare, Utilities, Security, and Business Services.