Battery energy storage systems (BESS) are a critical part of the modern grid. Energy storage is ideal for the integration of new resources necessary to meet rising power demands, enabling intermittent renewables to meet a utility’s power needs when there is no sun or wind while keeping the grid stable at times of high generation. The suitability of BESS for the modern grid has led utilities to make it a key part of their long-term strategy.

However, battery storage can also be a stressor for utilities. There are dozens of BESS suppliers to choose from, all using a wide range of different batteries and inverters, and utilities need to right-size their systems to ensure they are not investing in more or less storage than they need. BESS resources are complex assets that require regular monitoring and maintenance to ensure safe and reliable operation, while operators must also make sure those operations are within the bounds of manufacturer warranties. There is also a diverse set of revenue opportunities for utility BESS assets to participate in, but as this differs for each ISO/RTO, navigating it can be daunting.

All of this means battery storage has the potential to add to utility challenges, even as the technology represents a critical element in the power mix. Through this article, I will explain how having the right software can give utility operators a powerful tool that enables them to fully harness the capabilities of a BESS. An advanced battery analytics platform provides utilities with full access to and control of the wealth of data offered by a BESS, becoming a valuable tool for all stages of a BESS lifecycle – deployment, operations, augmentation and end-of-life (EoL). Analytics software also ensures that battery systems remain a safe and reliable asset while unlocking revenue-generating opportunities for utilities.

From cradle to grave, a tool for the entire life of battery storage

Battery storage includes a manufacturer-provided energy management system (EMS), and utilities may think this is enough for BESS operation. While a basic EMS generally confirms safe battery performance, the software is largely limited to identifying immediate safety concerns over long-term concerns and is susceptible to failure itself. More advanced analytics software, which operators can use in concert with the provided EMS, offers greater capabilities. Indeed, in a recent industry survey, only 55% of respondents noted satisfaction with their current software stack and indicated that their primary concerns had shifted from immediate safety worries to operational issues. These are the sort of everyday concerns typical of a maturing technology – one that requires the deeper integration of a robust analytics platform.

One of the main benefits of analytics compared to the provided EMS is that it is a tool for the entire life of an ESS. Utilities can start using an analytics platform even before a battery storage system is in operation. Analytics software that offers modeling features lets utilities simulate how a BESS will perform based on their planned usage, which offers several benefits to utilities. Modeling helps determine how much storage utilities will need, so they can avoid spending more than necessary on an oversized installation. Modeling also helps utilities determine which system is best for their needs, as it can simulate battery degradation in different scenarios to account for services like demand response and peak shaving. Most analytics providers equip their software with a complete database of all major battery manufacturers, so the platform will be ready to model whichever ESS the utility is considering.

After construction, utilities can then employ analytics during the important step of commissioning a BESS. Commissioning is key to ensuring safe operation but can easily become a drawn-out process that delays deployment. Digital commissioning using analytics can complement on-site efforts by uncovering issues that may go unnoticed during on-site commissioning, offering deeper insight into the performance and condition of the storage system. Resolving BESS issues earlier in commissioning ensures utilities can deploy the system to the grid faster.

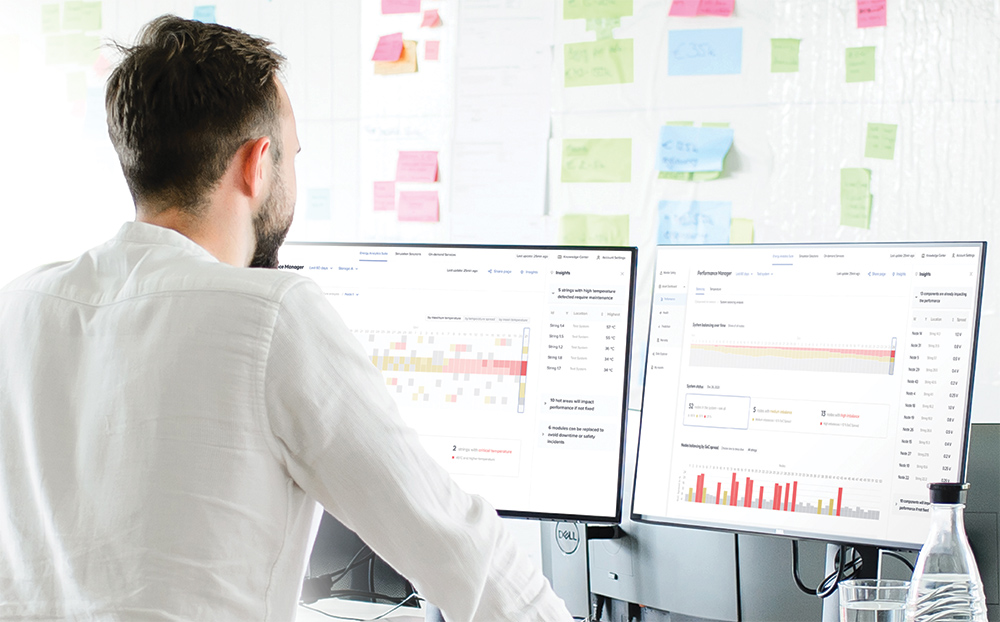

Once a BESS is operational, analytics continue to offer everyday support for utility operators. The software monitors battery data to immediately alert users to areas of concern, using complex algorithms to recommend the best path forward. Analytics identify issues that a standard EMS would otherwise miss, ensuring greater uptime for a BESS that will not be knocked out of commission by a defect that spirals into a larger issue. For utilities with a diverse portfolio of storage assets, analytics is also ideal as it brings together various installations into a single asset management platform with straightforward visuals.

During regular operations, the monitoring and data crunching of analytics also help utilities determine if they should alter their BESS strategy. If a utility decides to enroll its BESS in ancillary services after deployment, for example, analytics will recommend how to best adjust its operation to meet those needs. Considering the need for flexible assets in the face of a changing grid of intermittent renewables and increased demand, it’s key that battery software can adjust to any changes in how a utility operates its BESS.

Another operational benefit to analytics is how it works with the various warranties from BESS suppliers. Navigating warranty restrictions can be daunting for operators and can lead to utilities running their battery storage far below capacity to avoid unplanned warranty deratings. Some analytics suites offer detailed warranty trackers that alert operators if a BESS is in danger of voiding its warranty, and the detailed information within analytics also simplifies warranty claims. The warranty features of analytics also make it possible for utilities to run BESS closer to limits operators would typically avoid out of an abundance of caution, maximizing performance.

Through the end-of-life for a BESS, analytics continues to serve a purpose. Analytics can even help postpone when EoL will occur, or at least tell operators when to expect it. With access to a wealth of data, analytics will adjust when it expects a BESS to approach EoL based on current and planned usage. The platform provides recommendations on how to adjust BESS operations to extend the system’s lifecycle. A battery equipped with analytics is also well-placed for second-life potential; a BESS with a lifetime of detailed health reports and monitoring recorded by analytics is easier to repurpose – like maintaining detailed service records for a vehicle.

Calming safety worries

Analytics software is an ideal tool for BESS operators who are growing more concerned with operational issues, but it also enhances safety monitoring. Having better insights into safety issues is still critical for utilities, even as battery systems mature. Though the risk of battery fires is small, the danger posed by thermal runaway in lithium cells continues to make safety an overriding concern for storage operators. This is especially true for utilities, many of which have to balance community concerns of BESS safety with the need for greater storage capacity.

By providing access to advanced data collection and processing capabilities, analytics helps utilities avoid the sort of high-profile conflagrations that can swiftly put an end to BESS deployment aspirations. Algorithms within analytics software identify issues early on that could eventually lead to fires, such as manufacturing defects at an individual cell level. The safety alerts sent by analytics platforms are also granular and will direct operators to exactly where they need to focus their efforts, whether it be the cooling system or an electrochemical issue.

Just as analytics is helpful at every operational phase of a battery, the platform also assists with safety at each stage. During commissioning, analytics will alert operators to manufacturing defects before the system energizes which could lead to a fire. The software will also raise red flags around the utility’s planned strategy if it threatens to push the BESS to dangerous limits. Analytics can even assist after a fire. In one instance, a storage integrator approached an analytics firm to identify the root cause of a BESS fire. The analytics company’s software, in processing data provided by the integrator, was able to source the fire to a flawed cell during the manufacturing process.

Expanding BESS revenue potential

Energy storage can be a large capital expense, especially at the utility scale required for grid applications. The good news is there are many options for generating revenue from a BESS. In North America, the various ISOs/RSOs offer several energy markets for battery storage participation, but the options can be bewildering. Utilities must navigate arbitrage, frequency regulation, demand reduction, and peak shaving, as well as wholesale markets for resource adequacy and reserve capacity.

Analytics software helps utilities navigate all the above use cases and provides operational guidelines to ensure battery degradation does not impact long-term profitability. The different wholesale markets will each place unique stressors on BESS assets, which analytics software considers when predicting how batteries will age. Utilities can also use the single analytics dashboard to manage different market enrollments for each battery.

Beyond market enrollments, analytics will also help optimize BESS revenue during everyday operations, and even prior to deployment. Modeling provides utilities with a way to test different BESS strategies before commissioning systems, helping determine which will provide the most revenue over time. Utilities can employ analytics this way very early in the planning process, receiving guidance from the software on which BESS to purchase for maximal return on investment.

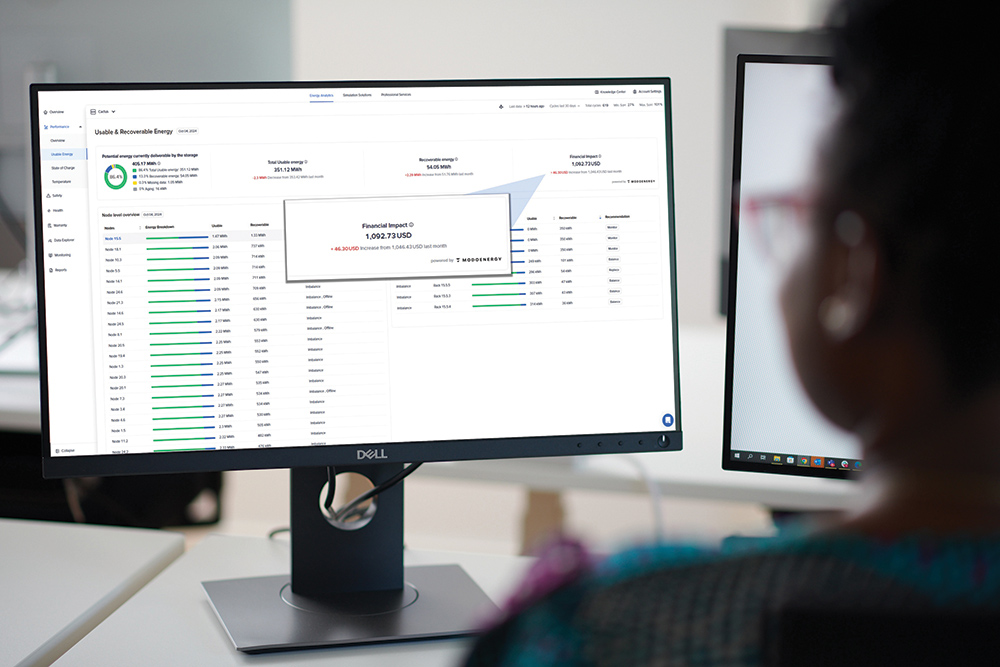

During regular operations, analytics are critical for determining the accurate state of charge (SoC) so utilities can be certain of a battery’s capacity. An EMS alone cannot calculate true SoC, instead relying on temperature, voltage, and current to estimate it – an issue in any of these measurements results in an inaccurate SoC from the EMS. The accurate SoC enabled by analytics’ enhanced computing power is critical to BESS profitability. For example, inaccurate SoC could mean that an asset is unable to deliver the forecasted energy or Àprovide contracted ancillary service – thereby leading to underperformance penalties.

Battery analytics also contribute to revenue generation by detecting potential issues early on, enabling operators to proactively address issues and avoid costly downtime caused by unexpected failures. The software will help operators isolate an issue without having to shut down large portions of the BESS to locate it, avoiding lost revenue for a utility, along with stopping the issue from snowballing into something that seriously damages a BESS. Even approaching EoL, analytics continues to optimize for revenue, monitoring degradation and capacity loss to determine how these factors impact a battery’s market potential towards the end of its lifecycle.

Taking full advantage of BESS data with battery analytics

Battery storage systems are complex technologies with a wealth of available data, and utilities are doing themselves a disservice by not using this data to its full potential. While the standard energy management software provided by BESS suppliers is adequate to avoid serious safety issues, it is not designed for a maturing technology with everyday operational concerns.

In deploying advanced battery analytics software, utilities can make the most of their energy storage investments, from planning to end-of-life, and enhance existing safety monitoring while opening new doors for revenue. Battery storage will be a critical piece of the grid in the years to come. Analytics is just as important a piece of this puzzle for utilities.

Lennart Hinrichs is executive vice president & general manager Americas at TWAICE, where he oversees TWAICE’s business across the Americas from the company’s Chicago office. He previously served as vice president of Marketing & Strategic Partnerships and commercial director. Before joining TWAICE, Hinrichs worked in strategy consulting and other start-ups driving the business model development and go-to-market strategy in industries ranging from consumer goods to telecommunications and automotive.