Regulations, corporate drivers, leadership and market influences have combined to produce a patchwork of uneven progress on critical utility industry initiatives such as distributed generation, customer choice, asset optimization and the industrial Internet of Things. These initiatives rely on analytics to gain the most return on investment.

To better understand organizational readiness for analytics and key areas of analytic priority in this diverse business landscape, SAS conducted an industry survey. The survey explored the issues and trends that are shaping how utilities are deploying data and analytics to achieve their business goals.

The survey tallied responses from 136 utilities from 24 countries. More than half of the responses were from the US, with Australia, Canada, New Zealand and Denmark rounding out the top five. The survey responses show that the industry has come a long way in a relatively short period of time.

It was not too long ago that utility leaders were on a steep learning curve as their smart grids were fully implemented leaving new masses of data on their collective doorstep. Today, the use cases are becoming solidified and the lessons learned applied.

This is as true in the “soft” issues (people and process) as it is for the “hard” issues (technology and data). For example, today more than half of utilities with one million or more customers now have some form of an analytics center of excellence (CoE). This is an important step in being able to align and apply data and analytics skills sets across the enterprise.

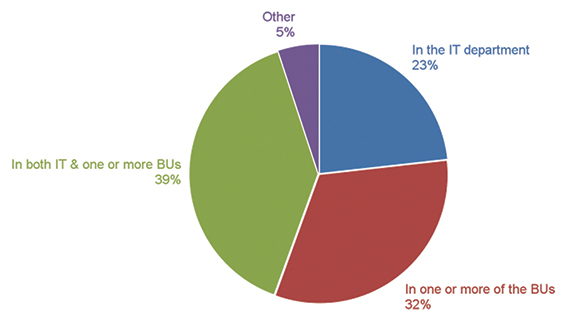

Where the CoE resides, however, is still a work-in-progress as noted in Figure 1. While the natural choice might be to plunk down the CoE in the IT department, every organization should look at how to best leverage those valuable analytics resources.

Figure 1. Where does the Analytics Center of Excellence reside?

We are also seeing changes in how utilities will deploy analytics solutions and manage masses of data in today’s data-rich environments. One area getting a lot of attention in utilities is the use of cloud technologies and solutions. While utilities are arguably behind the adoption curve in this space (and for good reason), we do see “SaaS” (Software as a Service) getting traction in the utility industry. Half of all utility responses indicate the use of SaaS to solve their analytics challenges as being very likely or somewhat likely. As recently as a few years ago this was virtually unheard of in the utility industry.

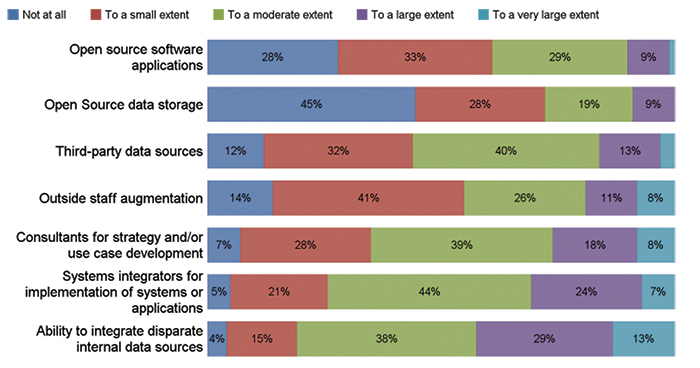

And what about some of the other newer approaches to making analytics work in utilities? Figure 2 shows where utility analytics leaders are jumping in with both feet to drive analytics value in their organizations. Note that issues around data and systems integration continue to rank high; these are as critical today as they were a generation ago. Also note that the use of open source tools might still be relatively low, but this will surely rise as a new crop of analysts and data scientists enter the industry, many of whom spent much of their college careers working in the open source environment. For instance, in a separate question in the survey nearly two-thirds of responses indicate that “R” is currently in use or will be by the end of 2017.

Figure 2. To what extent does your utility depend on the following for analytics initiatives?

(click to enlarge)

One observation about how the utility industry has adopted analytics over the last five years is that the rate of adoption can vary widely within one utility from department to department. Some of this is driven by need; other times it is driven by organizational sub-cultures (some are simply more likely to be early adopters of what’s new). While these variations of analytics adoption has traditionally varied greatly over the last five years, we will see this evolve to more consistent analytics adoption within the utility enterprise as the concept of enterprise analytics platforms takes hold.

The development and appointment of new positions will help with the movement towards an enterprise-wide approach. The survey indicated that only 15 percent of utilities have a Chief Data/ Analytics Officer. As this and similar positions (recently observed examples include “VP, Analytics” and “Chief Data Strategist”) become more the norm, the ability to take an enterprise approach will grow.

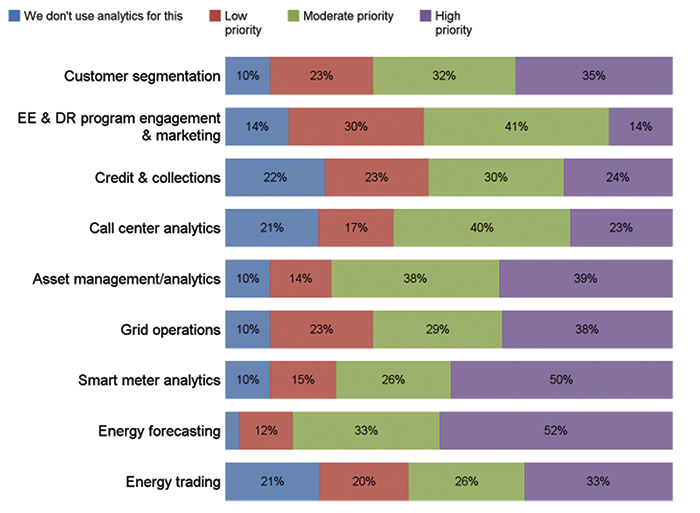

Either with or without an enterprise platform, the needs of the business will ultimately dictate the priorities of which areas of the business will move forward with analytics initiatives. Figure 3 looks at the relative priority of different analytics application areas.

Figure 3. Relative priority of different analytics application areas in utilities

(click to enlarge)

Note that energy forecasting has the highest priority as measured by “high priority” responses, as well as by adding the “high priority” with the “moderate priority” responses. As utilities continue to face flat-to-declining revenues, executives will be looking for areas where efficiencies can be realized and costs can be cut. The days of “business as usual” are over and this is perhaps most pronounced in the energy forecasting space where “good enough” is no longer the standard.

Not to be lost in this analysis is the proliferation of customer analytics applications in the mix. Utility customer care groups have a long history of working with data, often with a decades-old legacy CIS. These groups will continue to drill deeper into customer service and cost improvements as the data gets richer and as the ability to sharpen their focuses with data and advanced analytics tools becomes more of a business imperative in today’s challenging business climate.

Today’s utility business environment has turned many of the old assumptions on their head. Never before have we seen the convergence of increasing cost to serve with decreasing costs of energy – not an easy recipe to master. Proactive utility leaders will be continuing along their analytics journeys with the resulting digital transformations to remain viable for customers for the long term.

About the Author

Mike Smith is a principal industry consultant with SAS. He has more than 27 years of experience in the utility IT, automation, smart grid, and analytics markets. Smith has led numerous industry research initiatives and has founded and co-founded numerous industryleading research, media, and event initiatives and organizations, providing insights and forums for thought leaders and market participants. Smith has a B.A. in economics from San Jose State University and is a veteran of the US Army (Captain, Infantry).

Mike Smith is a principal industry consultant with SAS. He has more than 27 years of experience in the utility IT, automation, smart grid, and analytics markets. Smith has led numerous industry research initiatives and has founded and co-founded numerous industryleading research, media, and event initiatives and organizations, providing insights and forums for thought leaders and market participants. Smith has a B.A. in economics from San Jose State University and is a veteran of the US Army (Captain, Infantry).