The traditional notion of integrated resource planning (IRP) is rapidly changing within those utility contexts where distributed resources are playing a more prominent role. Traditionally, the transmission and distribution planners were not an integral part of the IRP process. As the industry transitions away from a pure vertically integrated business model and distributed renewable generation, smart grid technologies, electric vehicles and demand side services continue to expand, the location specific capabilities of power systems increasingly play a key role in the planning process.

In the context of integrated resource planning, forecasts typically look at energy and power requirements from 5 to 20 years into the future. A demand forecast is basic to analyzing how much new generation capacity may be needed, how transmission and distribution systems should be expanded, and in which customer groups or geographic areas these requirements will be concentrated. A good transmission and distribution planner must know how much power must be delivered, where and when it will be needed. He or she must be able to identify loading situations that require action, in advance of the lead time required for those actions, and be able to identify and evaluate alternatives in order to maximize the benefit(s) desired from its execution, such as:

- How long will this circuit configuration be an effective solution to the problem?

- Will we need another substation between this and the service area boundary, or is this new one it, forever?

- Do we need to allow for a second transformer in the new substation we will build in four years?

- Could demand side management (DSM) be an effective solution to the problem?

As the industry continues to transition toward distributed renewable resources and smart infrastructure, these questions will be increasingly difficult to answer with traditional ‘top down’ methods, and point to the need for a more granular circuit level analysis and a more central role for the transmission and distribution planners.

Today’s resources must be positioned in the right locations in order to handle fluctuations in electric demand. For capital budgeting, an error in forecasting the amount, timing or location of future demand leads to a misallocation of the vital resources.

Furthermore, the economic recession has made it much more difficult to accurately predict distribution level load conditions, especially where mild weather has accompanied slower economic growth.

Over the past five years, several forward-thinking Investor and Publicly-Owned Utilities in North America are working to improve their IRP methodologies. Duke Energy, Pacific Gas & Electric, Fortis BC, Avista, and Nashville Electric Service and have partnered with Cincinnati based software company Integral Analytics (IA) to build the next generation of IRP software tools. What does this mean for T&D planning engineers?

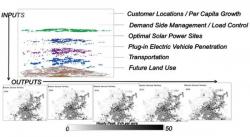

The new software tools are part of IA’s web-based forecasting system, LoadSEER. At its core, Spatial Electric Expansion & Risk, is a spatial load forecasting system designed specifically for T&D planners who face increasingly complex grid decisions caused by emerging micro-grid technologies, extreme weather events and new economic activity. The objective of the system is to statistically represent the geographic, economic and weather diversity across a Utility’s service territory, and use that information to forecast circuit and bank level peak loads over the planning horizon. Planners are able to decompose system impacts using map layers superimposed on the spatial representation of the T&D infrastructure. As seen in Figure 1, load growth forecasts, distributed renewable generation, demand response, distributed intelligent systems and other demand or supply factors are spatially located relative to the existing capital infrastructure.

The powerful GIS mapping and load forecasting functionality uniquely blends short term econometric forecasting with long term geographic forecasting. This enables distribution planners to more accurately predict risks on their circuits due to local load growth and/or distributed generation (DG) changes, including electric vehicle adoption, increasing solar penetration, switching transfers, demand response and other factors. The core algorithm automatically models geographic and economic drivers, along with weather, to provide engineers with the most representative circuit by circuit forecast models. In some cases, one circuit might respond to Retail Sales, while another might be sensitive to Employment, Personal Income, Housing Starts, or various combinations. This process allows planners to analyze specific future scenarios such as transportation network expansion, suburban sprawl, urban redevelopment, new manufacturing and additional employment centers. The final forecast results can be leveraged to enhance an existing suite of planning tools, including direct exports to power flow analysis tools. Short and long term consistency is managed through a top down and bottoms up reconciliation process shown in Figure 2.

Figure 2: Top Down and Bottoms up Reconciliation

A major aspect is to insure both short and long term consistency with system level financial planning, by streamlining regulatory data requirements, creating more defensible long term substation forecasting methods, and streamlining various aspects of the decision and approval process. Moreover, the software enables a much more accurate methodology for calculating avoided marginal costs of grid asset deferrals for use in more intelligently targeting DG, Smart Grid programs, demand response and energy efficiency. The use of these tools is illustrated in the following example.

Case Study: Planning for Duke Energy’s Virtual Power Plant

Integral analytics continues to work with forward looking utilities to develop smart, distributed resources. For example, the company worked with Duke Energy on its McAlpine Creek project, a ‘virtual power plant’ made up of grid electricity, solar power, large-scale energy storage, all linked together by a smart grid architecture that keeps power flowing and balanced. The initial phases of the project included solar arrays installed at the McAlpine substation in south Charlotte. Then households in the service territory received smart meters from the utility, with several participating in auto- DR residential energy management systems. The idea is to hook up air conditioners, heat pumps, water heaters, dryers and other appliances via wireless networks so they can be powered down or turned off to save energy and help the utility curb peak power demands.

Integral Analytics is tasked with getting all those things to work together. It makes software that can choreograph appliance demand across all these customers. By doing that, the system can reduce the total peak demand that the utility sees without actually curtailing demand. That is, it can get a lot of appliances and air conditioners and the like to respond to commands to turn their power use up or down slightly without a noticeable effect on the part of the homeowner.

Fine-tuning like this is made possible with the in-home devices feeding data to the utility, as well as sensors at the substation level. Working from those ends, Integral can do things like figure out which distribution feeder lines and transformers are under the most strain and turn down power demand from homes fed from them. At the same time, it can also take into account homeowner preferences for how they’d like their energy managed. For example, it can determine which customers said they’re OK with having their air conditioners turned off versus those who want to keep them on.

That’s a complicated task even when one is only dealing with relatively stable grid power. Adding solar panels that can see power output sag and soar depending on cloud cover overhead only adds to the challenge. It’s a similar challenge facing utilities across the country as they seek to incorporate growing amounts of intermittent renewable power into their transmission and distribution grids.

The impact on the transmission and distribution system is modeled using a spatial resource planning model using the following eight step process:

- Run the growth plan through LoadSEER

- Identify asset/planning area capacity surplus and deficiencies

- Enter planned deficiencies mitigation projects

- Identify candidate T&D project deferral opportunities

- Determine the needed DSM savings to defer the T&D capital project

- Design an appropriate DSM project

- Calculate the avoided capacity and energy cost

- Evaluate cost effectiveness

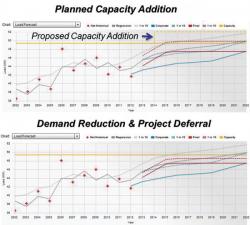

The new projects are then added to the system. In our case a virtual power plant and its demand reducing capabilities are added to the spatial model. The impacts on the capital budgeting decision are shown in the following Figure 5. The capacity expansion is no longer needed. The value of the project can be measured using the avoided capacity cost that would have otherwise been spent on the capacity addition. In our case the benefit is equivalent to a $219/ kW capacity investment, as shown in Figure 6.

Figure 5: The Proposed Project Can Defer Capital Investment

Figure 6: The Avoided Cost Value of Deferring Capital Investment

The issue is whether targeted investments in energy efficiency or DG could offset investments in T&D equipment or even help delay the need for new generation. For example, say your system average T&D avoided cost is $40/ kW-year. With that, your ability to implement cost effective energy efficiency will reach a specific limit. However, if the T&D avoided cost is $300/kw year for certain locations that are faster growing and or over-utilized, you might find that a lot more can be done in those targeted areas cost-effectively that might exceed what you would do just using a system level average. Furthermore, if you have an energy efficiency regulatory recovery mechanism that has a shared savings component, or some form of incentive that the utility can obtain for implementing energy efficiency, a better understanding of the sub-regional avoided costs (as opposed to the system average) could provide a boost to the utility incentives.

In summary, spatial transmission and distribution planning tools are increasingly needed to solve the complex short and long term planning tasks. The transmission and distribution engineers play a central role in the planning process as the locational needs of the distribution system increasingly become the focus of the capital allocation process. The strategic benefits of spatial resource planning (SRP) are listed below.

Strategic Benefits

- Ability to forecast up to 100 economic influences, by circuit, in addition to weather. We are finding that economic risk often trumps weather risk.

- Automated regression model fitting, with recommended forecast results, so planning engineers can minimize time spent developing forecasts.

- A GIS spatial forecast, based on 20 years of NASA satellite histories, modeling geographic influences unique to your regional customer base and the landscape.

- Ability to target DSM or DG to target circuits, without jeopardizing reliability.

- Comprehensive quality checking, process review, and log history for use in data requests and defensibility, as well as oversight and management during the forecast period.

- Ability to directly integrate solar forecasts, EV forecasts or other micro grid impacts, down to the customer level.

- Quick export to your power flow analysis tool.

About the author

Scott Smith is Director, GIS at Integral Analytics, Inc. He serves as Lead Developer of proprietary geo-spatial risk-based electric distribution planning application, LoadSEER. Specializing in remote sensing techniques, land change modeling, risk-based spatial electric load forecast simulations, and electric vehicle impacts on electric distribution systems, Scott helps meet the planning and forecasting needs of T&D and demand side management planners by giving them the ability to model changes in electric demand over space and time. Projects include software support to forecasting groups at Duke Energy, Pacific Gas & Electric, Avista Utilities, PacifiCorp, Kansas City Power & Light, Northern Virginia Electric Cooperative, and Nashville Electric Service.

Scott Smith is Director, GIS at Integral Analytics, Inc. He serves as Lead Developer of proprietary geo-spatial risk-based electric distribution planning application, LoadSEER. Specializing in remote sensing techniques, land change modeling, risk-based spatial electric load forecast simulations, and electric vehicle impacts on electric distribution systems, Scott helps meet the planning and forecasting needs of T&D and demand side management planners by giving them the ability to model changes in electric demand over space and time. Projects include software support to forecasting groups at Duke Energy, Pacific Gas & Electric, Avista Utilities, PacifiCorp, Kansas City Power & Light, Northern Virginia Electric Cooperative, and Nashville Electric Service.