Over the course of the last decade, online electronic bill payment has found favor with many consumers, becoming a mainstream service in many segments, including the utilities industry. On the other hand, electronic bill presentment, in which an electronic version of a bill (e-bill) is delivered to a financial institution or biller website, has seen slower adoption. Even though e-bills have been available for nearly as long as electronic bill payment, there still remains a widespread lack of consumer awareness about the availability of e-bills, how they work and the benefits e-bills provide to recipients.

The benefits of encouraging e-bill adoption are becoming too great to ignore. Consumers are becoming increasingly demanding of flexibility. Most visit their biller site for billing and payment related activities, and nearly a quarter of consumers report changing the way they pay bills month to month. The 2012 Fiserv Billing Household Survey showed that 40 percent of consumers who receive e-bills through their bank’s website also report visiting the biller’s website directly one or more times per month. This gives billers, including utilities companies, an opportunity to directly engage with customers.

A study conducted by AccuData on behalf of Fiserv and Con Ed found that customers who receive e-bills via a financial institution or the company’s website are more likely to make on-time payments and utilize online self-service rather than costly customer service calls. Online billing and payment is an important and strategic part of the customer experience and ultimately improves the overall relationship.

With consumer interest in e-bills growing, now is an ideal time for billers to begin promoting the service. In order to convert growing interest in e-bills to e-bill activation, consumers must first be aware that e-bill is an option and then understand the advantages of the service.

Traditional Marketing and E-bills

In order to plan a successful consumer marketing campaign it’s important to think about the process through which consumers adopt technological innovations. According to Everett Rogers’ classic book, Diffusion of Innovations, there are five stages in the technology adoption process – knowledge, persuasion, decision, implementation, and confirmation.

When it comes to marketing e-bills, most billers have relied on traditional marketing strategies that focus on the first three stages of this process – knowledge, persuasion and decision. The first step involves providing knowledge about what an e-bill is and what value it holds for the consumer. The second involves persuading the consumer to try e-bills by providing an incentive such as a free offer, charitable donation or credit. The third step is to provide a call to action asking the consumer to adopt the e-bill.

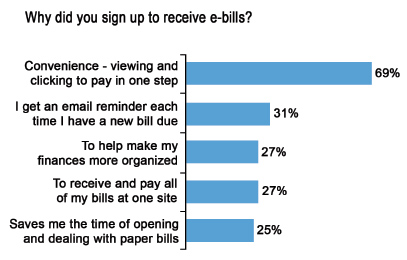

Overall, these tactics have played a major role in producing positive incremental growth in e-bill implementation, and these efforts should be continued, utilizing strategic messaging on the reported benefits of e-bills (see figure), such as the ability to view and pay bills in one step and the ability to manage finances more efficiently and effectively, to market the service to prospective users.

Source: Consumer Trends Survey, Fiserv Inc., August 2011

However, for e-bill to become a mainstream consumer service, billers should also give consumers a chance to experience and confirm the usefulness of e-bills. This involves receiving e-bills and associated alerts and becoming accustomed to the entire process while still receiving paper bills. Firsthand experience will give consumers the confidence to confirm the decision to leave paper bills behind and close the loop on adoption of e-bill technology.

A Hands-on Approach to E-bill Adoption

Tryvertising, a relatively new marketing trend borrowed from the broader world of retail marketing, enables consumers to become familiar with new products by trying or previewing them before a purchase is made. It’s similar to iTunes® allowing customers to listen to a 30-second clip of a song before purchasing or SiriusXM™ radio equipping new vehicles with an automatic °trial of its service. The concept has gained wide appeal among consumers.

When applied to billing, tryvertising encompasses the use of e-bills side-by-side with paper bills for a specific duration so that consumers gain firsthand experience of the benefits of receiving e-bills. This is significant because, according to the Fiserv Billing Household Survey, the biggest single motivator for online consumers to try e-bills is the ability to try e-bills while they are still receiving paper bills.

By experiencing electronic bill presentment and associated capabilities such as due-date alerts while still receiving paper bills, consumers are able to establish a comfort level with the electronic process. An introductory period also assures consumers that e-bills, along with due-date alerts, provide the reminders necessary to help make certain bills are paid on time. This eliminates one of the primary impediments to paper bill turn-off – the reliance on paper bills as a reminder to pay.

Putting the Theory into Practice

By allowing consumers to try e-bills before turning off their paper bills, billers can build consumer knowledge and comfort with the service, motivating more consumers to adopt e-bills and encouraging existing e-bill recipients to sign up for more e-bills.

A series of pilots of the e-bill tryvertising program was conducted with a leading Telco, four top 10 banks and one top 10 credit union. The pilots were structured so that customers began receiving e-bills alongside their paper bills for a 90-day period. Once the pilot was complete, the customers were then given the option to opt-in to e-bills or they would revert to receiving only paper bills.

Over 395,000 active online bill payment customers at the various institutions were included in the pilot. On average, the participating financial institutions and biller realized the following results:

- Activation Rate: the number of e-bill activations was three times higher for customers enrolled in the pilot than for customers who were not enrolled

- First Time E-bill Users: 74 percent of those that activated an e-bill were first time e-bill users

- Draft Effect on E-bills: nearly 70 percent of pilot participants who activated an e-bill activated at least one additional e-bill from another biller; on the average, two additional e-bills were activated.

- Draft Effect on Bill Payment: more than 60 percent who activated an e-bill added an additional bill for payment through their financial institution

These results show that an introductory period can have a significant impact on e-bill adoption, particularly among first time users. In other words, tryvertising really does work to help consumers implement and confirm that e-bills are the right choice for bill presentment.

E-bill: A Critical Piece of a Bigger Picture

As consumer interest in e-bills increases and adoption is forecast to grow, now is the time for the utility industry to revisit their e-bill strategy. While consumers appreciate the convenience, financial organization and control e-bills provide, many still don’t know if their gas or electric company offers e-bills at the biller site or through their financial organization, how e-bills work and how they can benefit from electronic bill presentment. Utilities organizations have the opportunity to help educate consumers and drive e-bill adoption by promoting e-bills through traditional marketing, offering e-bills through channels such as online banking as well as new approaches such as tryvertising.

By offering and encouraging the use of digital channel technology such as e-bills, the utilities industry can deliver a more complete personal financial management experience that will enhance the overall customer relationship while containing costs.

www.fiserv.com/resources/con-edison-ebill-study.htm

About the Author

Eric Leiserson is a senior research analyst at Fiserv, where he is responsible for the development of consumer-related electronic billing and payment research, adoption strategies, and marketing programs. He has conducted numerous primary research projects and Webinars in the areas of green marketing, consumer segmentation, longitudinal surveys, Web usability, and focus groups. Prior to joining Fiserv, Leiserson held marketing and sales positions at Unisys Corporation and Intuit.

Eric Leiserson is a senior research analyst at Fiserv, where he is responsible for the development of consumer-related electronic billing and payment research, adoption strategies, and marketing programs. He has conducted numerous primary research projects and Webinars in the areas of green marketing, consumer segmentation, longitudinal surveys, Web usability, and focus groups. Prior to joining Fiserv, Leiserson held marketing and sales positions at Unisys Corporation and Intuit.