The development and growth of the plug-in hybrid electric vehicle (PHEV) and electric vehicle (EV) market is completely dependent on the parallel development of the recharging infrastructure. Although there has been significant effort lately in identifying and resolving the issues associated with public charging stations, the simple reality (and one of the key customer value propositions) is that most charging in this nascent industry will occur at the customer’s premise. Unfortunately, there has been relatively little industry discussion and identification of the key technical and operational issues that may face customers and utilities with respect to PHEV/EV home charging. This article begins to identify some of the more immediate and practical issues.

David Mulder

Director

Green Grid Initiatives

Capgemini America

Base Scenario for Discussion Purposes

To facilitate discussion of the key issues below, I have assumed that the market segment purchasing PHEVs or EVs over the next five years will exhibit the following general traits:

• Affluent – PHEVs/EVs are more expensive than conventional vehicles, even with the tax credit

• Urban –Most individuals purchasing EVs live where they will not have the need to drive more than 70-100 miles a day

• “Impatient” - Given a choice, customers would prefer shorter charge times, whether at home or at a public charging station

• Higher than Average Electric Consumption – Affluent families live in homes that are larger than average, and have more appliances in them

Issues Differentiation: The “Home” Grid versus the Utility Distribution Grid

The issues identified below can be separated into two general areas: The Home Grid and the Utility Distribution Grid. The Home Grid is essentially the electrical infrastructure within the home that is owned and maintained by the customer. The distribution grid is the utility infrastructure spanning from the customer’s home to the utility substation. Table 1 provides an initial list of components and issues that may need to be resolved early in the PHEV/EV adoption cycle.

Table 1: The Home Grid versus the Smart Grid – Components to Address

The Home Grid – Summary of Issues

The Meter

To the extent that there are discussions about the effect of PHEV/EVs on the utility grid, the solution is always to charge the vehicle “off peak”, and introduce TOU rates and demand response programs. The fact is, unless the customer has a smart meter, neither the customer nor the utility has the knowledge required to successfully manage load.

A smart meter will provide internal data (as granular as every 15 minutes) that will allow the utility to deploy – and the customer to react to – TOU rates. However, even with a smart meter, the utility only sees usage for the entire home, not for individual appliances or circuits. For reasons outlined below, it may be necessary to meter the PHEV/EV load separately. Some utilities have discussed the pros and cons of installing a separate meter with a remote disconnect, so they could remotely shut off a charger in the case of emergency.

The Service Entrance/Panel

The first and - potentially the most costly – issue to address immediately is whether the customer has a large enough electric service to accommodate a new PHEV/EV load. Most states require all new and remodeled residences to have their electric service upgraded to 200amps. However, there are still a significant number of residences with 100 amp, even 60 amp services. Although the probability is small that that initial market segment will be living in a home with less than a 200 amp service, it is an issue to address up front. Upgrading the electric service can cost anywhere from $2,000-3,000.

The PHEV Charger

The customer will need to decide which charger he/she wants to have installed at their home. Table 2 summarizes the two major choices; if the “Impatient” assumption above holds true, most customers will opt for a Level 2 charger. Nissan specifically recommends this over the alternative of “trickle charging” using a 120 volt outlet. The major issues to explore with the Level 2 Charger are 1) cost of installation; 2) whether your electric service can support a 7+ kW load; and 3) the local permitting process, as a permit may be required to install a Level 2 Charger and dedicated circuit breaker.

Table 2: Home Charger Characteristics

Source: Coulomb Technologies Website (www.coulombtech.com) –

Note: specifications above are for their commercial products;

home charging systems will be similar, if not slightly lower.

Other Appliances Connected to the Home Grid

Things may become interesting for the customer if they have an “electric intensive” home (i.e. electric water heater, central air, multiple refrigerators and freezers, etc). The higher the loads, the closer the customer is to overloading his/her electrical system and the more disruptive the additional PHEV/EV will be on the customer’s daily activities.

Home Energy Management System (HEMS)

Utilities are exploring the feasibility of offering HEMS to customers as a way for customers (and utilities with permission) to remotely manage their appliances to curtail electric load when the electric grid is constrained.

HEMS will play an increasingly important role in allowing customers to manage their electric demand to accommodate the addition of a PHEV, and not solely for the benefit of the utility.

Customer Energy Portal

Some customers will not opt to install a HEMS. However, they will still need to have means of monitoring their energy usage and PHEV charging status. Some utilities have begun offering this to their customers as a value-added service. The challenge in the near term will be to have the capability to integrate PHEV data as well.

A coincident peak loosely defined is the point in time during the day where the demand for electricity is highest. For the utility – this is the daily system peak – the hour where the sum total demand for all of its customers yields the highest generation capacity requirement. This phenomenon also occurs for each individual customer, and it may vary significantly based on demographics, usage characteristics, etc. Why is this important now? Simply put – adding a PHEV/EV charger to the household may change when these peak occurs for the customer. The customer coincident peak is what the electric service panel is designed to meet as a maximum load. Here’s another law of unintended consequences: the coincident peak of an all-electric home typically occurs when the electric heat (another high load) is running, which occurs during the evening. So, what happens when the electric heat is on, the electric water heater is running, and the customer is charging a vehicle on a Level 2 charger? In short, between the new loads and new rates, the customer may need to become very proactive in managing his/her loads.

The Utility Grid – Summary of Issues

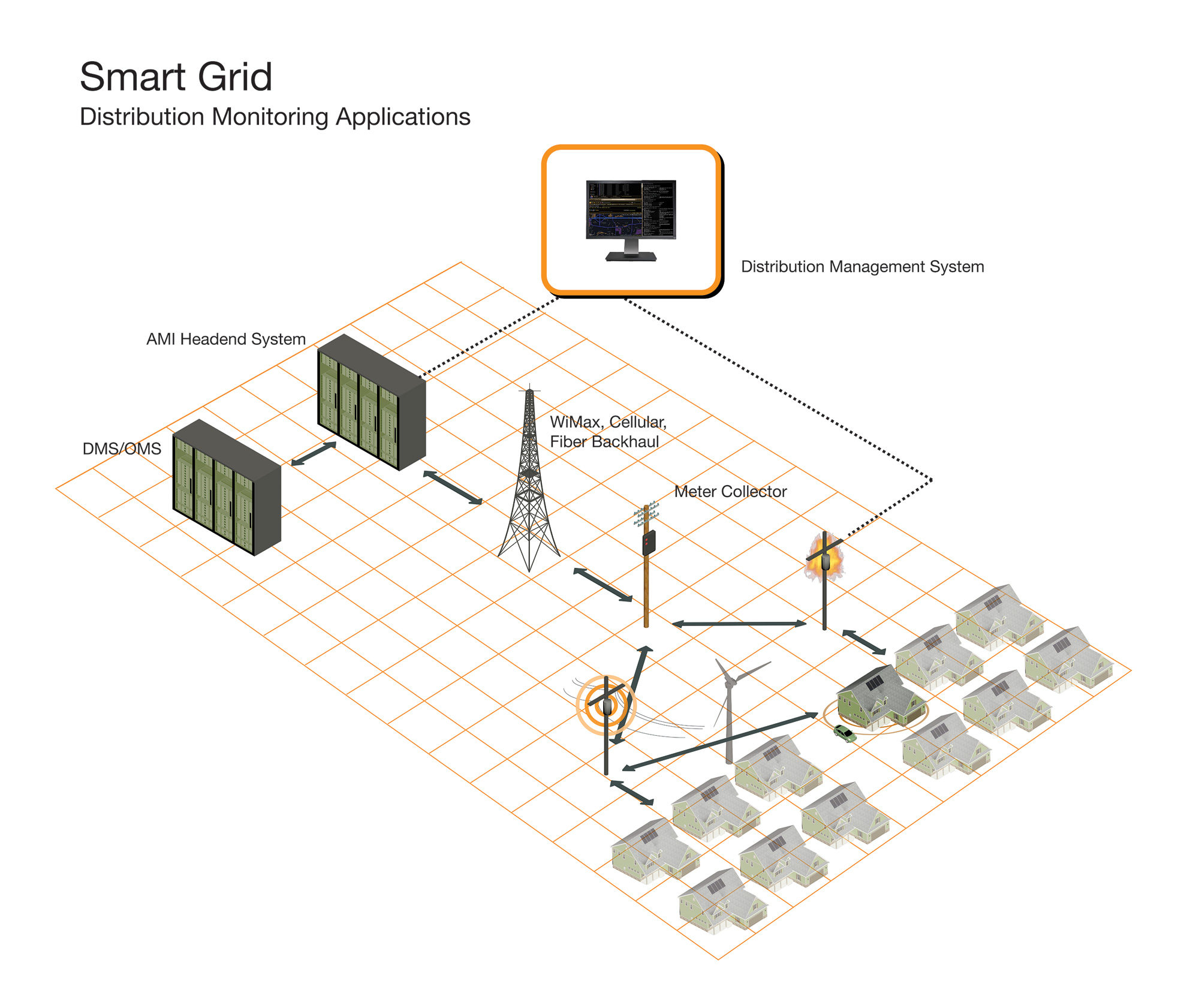

The utility will need to be able to proactively monitor many elements of its distribution grid if it plans to accommodate new loads (like PHEVs and renewable generation) and programs (such as HEMS, TOU rates, and advanced demand response programs). In short, the utility will need to deploy a variety of components of a “smart grid”. Below are several components that specifically affect the ability to manage PHEV/EV loads:

The Meter

Many utilities are installing or contemplating installing smart meters. Smart meters provide utilities visibility into the energy use patterns of individual customers. Without them, they will have no idea (unless they set up an individual meter for the PHEV Charger) when the customer is charging their vehicle.

The Transformer

Utilities typically oversize transformers to accommodate the gradual growth in customer electric loads. Unfortunately, most utilities have little insight into the loading of their transformers. Therefore, some of the transformers currently in operation (especially those over 20 years old) may be approaching their capacity loading with the existing growth. PHEVs/EVs represent a major addition in load on the transformer.

Although transformers are relatively inexpensive and straightforward to replace compared to other distribution equipment, excessive loading can lead to a failure, outages and decreased reliability. Exacerbating this issue is the reality that “urban” transformers tend to serve more customers than their suburban and rural counterparts, and may be more heavily loaded.

Transformer Monitoring

Utilities who are installing smart grid infrastructure will have the foundation in place to implement real time transformer monitoring. This can be accomplished two different ways, depending on the extent of the smart grid infrastructure: 1) by aggregating the meter data of customers being served via the transformer; or 2) by measuring the voltage and current at the transformer and calculating the transformer loading. In both cases, data is collected at regular intervals and a transformer load profile is created. This profile can be compared against the rating of the transformer and alerts could be sent to the utility distribution operations team if a transformer is approaching an overload situation. This application exists today.

Feeders/Conductors

Transformers aren’t the only devices than can be overloaded; the lines that transport electricity to consumers are also at risk. Similar to transformers, with proper planning these can also be replaced. However, re-conductoring a feeder is obviously more complicated process for underground systems than overhead ones.

Utility Coincident System Peaks and “Grid” Peaks

The primary focus of utilities – whose product historically has not been able to be stored – was to plan for its system peaks. These peaks typically occurred less than 200 hours a year, yet failure to match capacity with demand creates significant problems. Since PHEV/EVs represent a significant potential new form of customer demand, the immediate concern was how to manage the charging of vehicles to minimize the creation of new peaks. As a result, utilities are considering the creation of new rates and demand response programs to manage this issue; these are discussed below.

However, the other and potentially more immediate issue is identifying and managing the peak demand usage that may occur on different points of the grid where PHEVs will be located.

The “grid peaks” in these cases may or may not correlate with the utility system peak. In short, utilities will need to proactively monitor all points of their distribution grid for potential “peak” times.

Time-of-Use (TOU) Rates

TOU rates have been repeatedly touted as the “silver bullet” to convince customers to charge their PHEVs off-peak. However, there has been limited experience with TOU rates through the U.S., where the majority of utilities still use fixed rate tariffs. Since it easily takes six months or more to file a rate case for a new tariff, utilities who believe they will see an increase of PHEVS should be investigating now the ramifications of a new rate.

Furthermore, unless the PHEV is metered separately, implementation of a TOU rate would affect the total customer electric load. As an unintended result, the customer may have to alter his/her lifestyle and move additional load off peak to avoid electric bill increases from the adoption of a TOU rate required for the PHEV.

Demand Response Programs

The value of demand response programs increases with the addition of PHEV loads, and in different ways. Obviously, the original intent of demand response programs remains intact: to reduce customer loads in times of tight capacity. These programs can help utilities manage loads at their system peak. However, they will also help them manage issues that may arise on the distribution grid that may be caused by excessive load build up on lines, at transformers, even with potential phase overloading.

Conclusions and Recommendations

The Automotive Industry is clearly focused on developing vehicle and batteries that meet the customer’s value propositions. The Recharging Industry is focused on the installation of public infrastructure. These are both critical components to a successful industry. Unfortunately, there has not been enough attention paid to one of the most basic – yet critical assumptions: the customers will charge their vehicles at home the majority of the time. It is in the best interest of the utilities to begin to lay the groundwork with their customers regarding the operation and “fueling” of PHEVs and EVs. Moreover, utilities are in a unique position to provide significant value to the industry and its customers through innovative marketing and energy management programs that will help customers optimize the use of their PHEV. It just needs to start now, while there is time to establish policies and programs.

Below are several recommendations a utility may consider if they are faced with the reality of PHEV/EV growth in its service territory:

Develop a PHEV Evaluation Service

Most utilities have developed energy audits programs that were offered to customers as a way of helping them learn about and manage their energy usage. This program could be expanded to include PHEV advisory services, and could cover 1) an electrical inspection to determine if their service entrance could accommodate the addition of a PHEV; 2) a “PHEV Energy Audit” that would give the customer an idea of the electricity costs associated with owning and operating a PHEV/EV; 3) an expanded home energy audit that would take into account the new PHEV, with an analysis of the customer’s potential coincident peak, and recommendations for managing electric loads more efficiently; and if applicable 4) a TOU rate comparison and recommendation, which would simulate customer electric costs under different rate scenarios.

Determine a strategy for proactively influencing the customer’s PHEV charging habits

The full spectrum of options have been anecdotally discussed recently from the implementation of TOU rates to the implementation of a HEMS to the installation of separate meter with a remote disconnect switch. Each option requires a unique (and sometime overlapping) set of activities to complete. Furthermore, they may intersect with activities underway today. The more proactive the utility, the better it will be able manage customer – and industry expectations. Finally, managing PHEV/EV charging habits will need to occur at the public charging stations as well as the home chargers; since these are already being installed today, utilities in certain areas may need to accelerate its strategy development.

Investigate – and then Implement – a Smart Grid

Most utilities have some sort of smart grid planning activity underway. Unfortunately, it takes a long time – years – to complete the business planning, technology research and testing, and regulatory filings to implement one. Fortunately, it will take several years for the PHEV/EV industry to get established in the United States. The hypothesis remains that PHEVs will have a more disruptive affect on the utility’s distribution grid, than it will its generation capacity. In order to effectively manage the disruptions, the utility will need the ability to dynamically monitor the grid.

About the Author

David Mulder is the Director of Green Grid Initiatives at Capgemini. He focuses on the integration and operation of renewable resources and demand response programs on the utility’s smart grid.