Joe DeCrow and Jim Thomson, Capgemini

Getting a read on the utility industry is no simple undertaking. No two utilities are alike in how they structure their business model, their sources of power or the enabling technologies they employ torun their operations.

So when Capgemini and Platts came together in early 2006 to discuss how they would survey the industry, they struck upon a seemingly novel idea: Let’s let the industry tell us what it thinks, from the beginning. No preconceived notions. No loaded questions. Let’s hear it straight, directly from the executives who are making the big-time decisions about the future of America’s electric utilities.

Thus was created the Platts/Capgemini Utilities Executive Study, a two-phased study that generated some of the most authentic insights into the current – and future – condition of the North American utility industry.Some 33 senior executives at U.S. and Canadian utility companies were first asked to identify the top issues facing their companies. Once the top issues were identified, the survey team developed a web-based questionnaire that more fully explored the issues and some 90 executives were invited to provide their views. The questions and the responses were randomly rotated for each survey participant, to guard against front-loading.

As could be expected, the responses were intriguing and our read on the results are that utility executives are very concerned – in a positive way – about the future of their industry. They’re concern is not fraught with worry or fear. Once moving past their day- to-day operating worries, the top-of-mind concerns of those executives responding are big picture, forward-looking and proactive. We explain our assessment of their concerns in this essay.

High-Level Findings

Not surprisingly, the Platts/Capgemini Utilities Executive Study found that executives are very concerned with the day-to-day issues dramatically affecting them: regulation, infrastructure investments and the risks associated with volatile natural gas prices. They think that retail competition will move forward, but they anticipate major changes along the way. Utility companies will also make significant investments in their information technology, workforce training, new grid technologies and risk management systems over the next two years. And over the next five to ten years utility companies will also invest in workforce automation and renewable energy sources.Within the area of information management, cyber security is the area rated as most important.

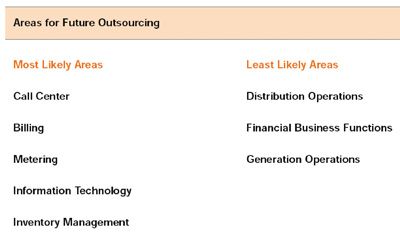

Interestingly, given their expected investments in information management and workforce automation, the executives did not rate business process outsourcing as a pressing concern. Our take on that is utility executives tend to rank their pain points – risk management, regulation, volatile fuel costs – as more pressing issues and BPO is not among them. In fact, our take is verified considering that they expect business process outsourcing to increase across the industry over the next five years in several crucial areas (see Figure 1).

Figure 1

Figure 1

Beyond Today

The utility industry sometimes gets a bad rap as being staid and stagnant because of its need to conform to regulatory strictures. And regulators aren’t known for innovation and foresight.

But executives at North American companies are carefully focused on the future, seeing an increased reliance on information and other technology for deploying smart meters, securing the cybersphere, and implementing a smart grid. They are extremely concerned about their aging workforces and the challenge which retirements will place upon the ability of a younger, less experienced workforce to operate, maintain and restore their transmission and distribution systems back into service following outages caused by storms and other unplanned events.Coinciding with their expected workforce depletions, the utilities foresee an increase in workforce enablement systems including scheduling, mobile-activity focused knowledge transfer and the extension of back office processes and systems to the field. And of course renewable energy will figure large in all their planning, as the industry is pushed – and pulled – away from fossil fuels and toward wind, solar, geothermal, nuclear, fuel cell, bio and other yet undefined sources.

Some other interesting extracts from the study include who will be investing in the technologies of tomorrow. Fifty-one percent of executives from companies with less than 100,000 customers report that their future resource allocations for new technology (meters, smart grid, etc.) will increase in the next 1-2 years. The mid-tier utilities are the most gung-ho, with 94 percent of the executives from companies with 100,000 and 700,000 customers saying they will increase purchases of new meter and grid technologies. And 78 percent of executives from large companies – those with more than 700,000 customers – will maintain steady investment levels. Our take is that large infrastructure investments can sometimes be difficult for smaller utilities to make – and the possibility for acquisition and merger into a larger utility operating company may make large investment imprudent. By contrast, mid-size utilities possibly see the benefit of larger investments in their technology and infrastructure, possibly to achieve higher premiums in the event of acquisition. This has yet to play out, but the mid-tier’s near unanimity is impressive.

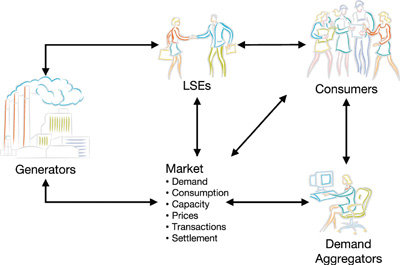

The executives’ opinions on retail competition are not so positive. The executives resoundingly feel that retail competition in the electric industry has yet to prove successful. Regardless, one-third believe retail competition will continue to grow in the next five to 10 years, while one-fourth think it will diminish and 40 percent say it will stay the same. In the view of some, competition will grow as lessons are learned and markets mature.We believe that in order to achieve the market maturity levels necessary to provide consumers with real choice, transparency is required.Transparency will be achieved when all market participants – generators, system operators and consumers – are linked in near real time, congestion is eliminated,marginal prices are no longer linked to gas prices and effective demand response systems are in place.Not only that but markets will demand retail competition and it’s too late to put the cat back in the bag. The executives see hope that regulators and utilities will continue to work together toward a solution – consumers want choice!

The more pessimistic executives think that retail competition will diminish because legislators and regulators are “too deep in the pockets” of industry participants. And, they say, regulators cannot distinguish between reliability requirements and generation competition, while consumers are indifferent to retail competition because the results have been so lackluster, with no proven benefits. Finally, a major force in the industry – merger and acquisition activity – will limit the ability of retail competition to be successful on a large scale because of rate concessions demanded by regulators as a condition for deal approval.

Metering

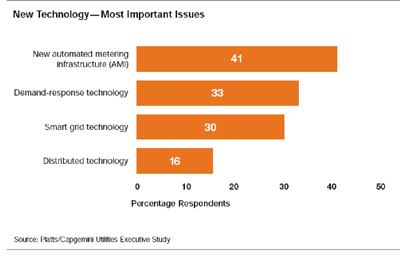

Some of the most interesting results of the survey came from executives’ seeming widespread acceptance of the need to move quickly toward a working, efficient Advanced Metering Infrastructure. Indeed, AMI ranked first as their top “new technology” interest; demand response and smart grid technology followed in second and third place, respectively.

Indeed, the display of interest in AMI indicates where the industry’s mindset is today. Give the recent history of pilot projects for automated meter reading systems, most people will now tell you that utilities are backtracking a bit, requesting proposals for new approaches for implementing the latest technology advances.Not only has there been great progress in the technology itself but also the range of possibilities for those advances has snowballed. The number ofbusiness cases for implementing AMI grow daily. Indeed, some of North America’s largest utilities have embarked on AMI initiatives, providing evidence that investments in technology advances make sense when the regulatory environment is right. Utility executives must be seeing that AMI will improve customer service, enable demand response, improve reliability and serve as a critical first step toward addressing the limitations of today’s grid design.

In our view though, AMI should be considered in the context of a smart grid transformation.There are several key AMI elements that enable benefits far beyond reading meters and calculating billing determinates.The communications infrastructure required to collect consumption data from meters can also be used to automate disconnect and reconnect activities and enable communication with grid monitoring and control devices.The meter data management system (MDM) that is typically part of an AMI enables grid operators to receive outage notifications from meters, query the status of meters, provide billing systems with the data they need to support complex rate plans and allow customers to view consumption and cost data they need to take action to impact their energy consumption and cost.

To satisfy a wide range of stakeholder expectations, utilities must be good at delivering their core product while also thinking creatively about the regulatory requirements – and the financing opportunities – that can make AMI andsmart gridsmart business decisions.

Billing

Our study also indicated that billing systems rank highly as an executive concern, second only to fears about cyber security. In the past, customer information systems embedded the billing function, so that it was costly and time-consuming to update them when tariff changes came along. Today, billing applications need separation from the CIS system. Modular billing systems are more flexible, user-friendly and capable of handling the ever-more complex billing algorithms and orchestration parameters.

Flexibility is a key attribute of tomorrow’s systems as they must meet the requirements of traditional, fully regulated distribution companies with end-to-end customer service responsibilities. New companies responsible for distribution, metering and retail functions will also have billing functions associated with the same set of consumers, premises and meters.

The focus on billing systems is even more understandable when combining market structure options with the new types of rate plans that are coming out. Market-based or time-of-use rates, that can be coupled with conservation credits or buy/sell plans for customers with local generation capabilities all will pose their own challenges. Executives’ interest in billing systems offers insight into the possibilities for new forms of billing structures. They’ll need to be easily configurable, allowing utilities to respond quickly to changing market demands.

Customer Care

Successful AMI installation relies on robust communications platforms. Farsighted companies know that platform should also provide new value-added products and services to customers. But the challenge will be determining the right combination of offerings and pricing for individual market segments – the exact reason that utility executives ranked Customer Relationship Management systems as a sixth topic of concern in the information management section. The ideal customer service system of tomorrow must do more than schedule service calls, restore service or enable a solid revenue management process. It must satisfy customers’ more demanding expectations of more transparency into the utility.This transparence will be achieved byproviding more information to customers, like the company’s environmental track record,their own electricity consumption and costs, flexible rate and demand management plans that provide them the ability to make choices and take action to conserve and reduce their electricity costs.Customers must have interactive access to information to review and act upon.Several options exist for providing this access including via the internet or using dedicated devices mounted in the home.

Despite the skepticism shown by utility executives concerning the future of retail competition, wholesale electricity markets are well established and here to stay.These markets will continue to mature over time.Improvements in these markets will be driven by addressing the most important technology issues identified by executives in the Platts/Capgemini Utility Executive Study:

- AMI

- Demand Response

- Smart Grid

- Distribution Technology

Once addressed, these issues will allow critical market data to be shared between all market participants in near real time.Giving generators, consumers, load serving entities and other energy service providers access to capacity, demand and price information improves transparency and efficiency in the market. Improved market efficiency will go a long way toward enabling consumers to make decisions that exert some real control over the cost and sources ofelectrical energy they consume.

Information is King

It does not matter which of the critical issues you focus on – Information Technology, AMI, Grid Technology, Customer Billing or Workforce Management – they all depend upon data.Large quantities of data that must be gathered, validated, stored, incorporated, provided control or decision support algorithms and presented in a useful form to asset managers, grid operators, field workers, customer service representatives or customers for their consideration and action.We believe there are three primary key issues that must be addressed across the utility enterprise in order to effectively manage information. First is a robust two-way communications infrastructure that touches every element on of the grid and all the people that design, build, operate and maintain and interact with customers who consume electricity from it. Second is a data management system that validates, stores and distributes data in many dimensions and at varying time intervals to a large number of sophisticated control and decision support systems throughout the utility enterprise.Third is that set of next generation forecasting, billing, control and decision support systems.

There are a number of funding options available to utilities when it comes to building the assets necessary to address these information management issues.Creatively evaluating and acting upon these funding alternatives will separate the winners and losers.

Concerned with the Future

The first Platts/Capgemini Utilities Executive Study affirmed that its participants are very forward looking. The industry focuses heavily on what’s coming around the bend. The daily grind of regulation, fuel cost volatility and shareholder/stakeholder demands takes its toll, but tomorrow’s utility company is being formulated today. This transformation, brought about by better technology and the data it generates, will become reality, sooner than we think. n

About the Authors

Jim Thomson – As a leader in Capgemini’s utility industry practice, Mr. Thomson drives the company’s Advanced Metering Infrastructure (AMI) solution development in North America, spearheading Capgemini’s go-to-market efforts in this area. Jim joined Capgemini in early 2006 after a distinguished 14-year career at IBM and PricewaterhouseCoopers.He has over 22 years of systems development, systems integration and project management experience in serving the utility industry after starting his career at the National Security Agency.He has a bachelor’s degree from Purdue University and a masters degree from Johns Hopkins University and is based out of Capgemini’s Dallas office.

Joe DeCrow – Joe is part of Capgemini’s utility industry practice and drives Asset and Work Management solution development in the United States and Canada. Joe joined Capgemini in 2006 after a combined 35 years of utility industry experience in project management, engineering and design, construction, maintenance and field operations with General Electric, PricewaterhouseCoopers and IBM.He has a bachelor’s degree from Youngstown State University and a masters degree from the College of William and Mary in Virginia and is based out of Capgemini’s Dallas office.