The idea of a regulated utility providing energy-as-a-service (EaaS) may seem redundant. Utilities have been in the business of delivering electricity since the late 19th century, after all. How might this particular wrinkle on XaaS (everything-as-a-service) be different than that pertaining to any other service business just doing what it already does: the transportation-as-a-service of the airline, the dining-as-a-service of a restaurant, or the snipping-as-a-service of a barber, say?

The answer, as those in the business of providing electricity well know, is that a combination of market and regulatory pressures, environmental concerns, geopolitical disruptions, consumer preferences and technological advances is fast changing how and where electricity is generated, used and stored. That, in turn, is altering the historically straightforward relationship between utilities and their customers.

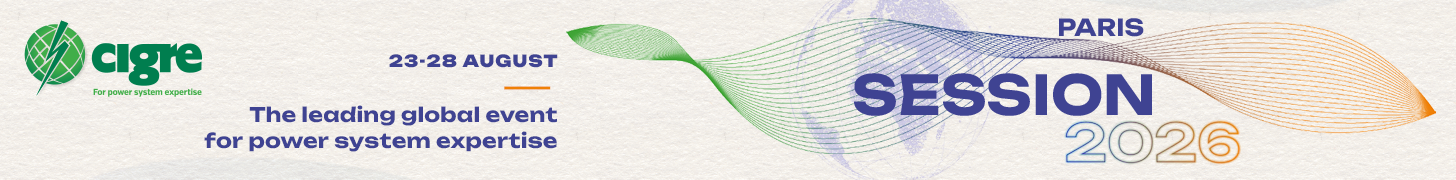

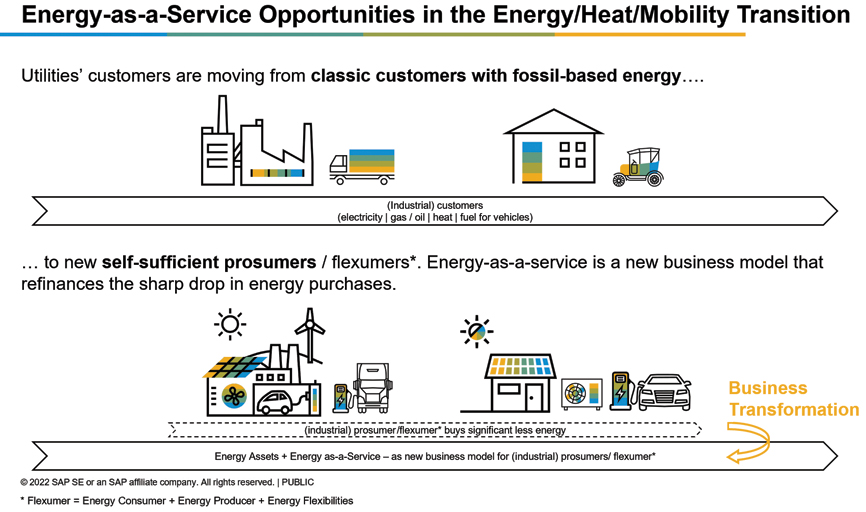

The global push toward distributed renewable-energy generation (as in rooftop solar panels) and, to a lesser extent, storage (such as wall-mounted battery packs) is the primary driver of this evolving relationship. Electricity consumers have forever paid simple bills for power generated centrally and delivered through traditional, one-way transmission and distribution infrastructure. Those consumers are morphing into “prosumers” who use as well as produce electricity — and even into “flexumers,” who not only consume and produce, but also lend flexibility to the grid.

Energy-as-a-service represents a profound change in the way utilities do business. With that change come challenges — and also big opportunities.

(click to enlarge)

The implications for utilities are hard to miss. If you make your money by delivering electrons, and prosumers and flexumers are using fewer of your electrons because they’re producing and storing electrons of their own, you’re going to make less money.

The key question for utilities is this: How do you grow earnings despite selling fewer kilowatt-hours amid a rapidly evolving power-generation and consumption paradigm involving the mass uptake of products such as solar panels, heat pumps, battery packs, demand-side management add-ons to cycle air conditioners on and off and energy-efficiency-enhancing hardware such as smart thermostats, to name a few. EaaS for electric utilities is about the servitization of these sorts of products — combined with traditional electricity delivery as well as new service offerings — as a central element of a more sustainable, renewable, efficient and holistic energy production and delivery ecosystem with the utility at its nexus.

A new business model

The International Renewable Energy Agency has categorized public-utility EaaS opportunities into three general areas. Energy advice harnesses a utility’s expertise to help customers identify opportunities to optimize energy consumption and minimize cost. This drives sales for other services and, potentially, can generate fee-based revenue. Next is the sale and installation of energy assets and end-to-end services related to renewable energy generation and storage systems. Finally, energy management involves the monitoring, control and optimization of a customer’s power production and usage over time, again with an emphasis on efficiency and cost savings.

One might ask whether a utility shouldn’t simply farm out these sorts of services via energy-services companies (ESCOs, which profit from their clients’ energy savings), information and communications technology companies (ICTs, whose technologies provide insights and fine-grained energy management capabilities) and others. It will take a village of players to realize EaaS, after all. But utilities should ask themselves the degree to which they should cede this new terrain to others — as opposed to exploiting both their historic status as natural monopolies and their hard-earned brand equity as energy providers and trusted partners.

The vision should be of a one-stop shop for all things energy-related, and such “shops” are desperately needed. Consumers and businesses are increasingly faced with complex questions related to their energy use and production: How many and what sorts of solar panels may be appropriate? What’s the right heat pump or whole-house fan or wall-mounted battery box? How can different elements of a prospective prosumer’s portfolio most optimally combine? What energy-efficiency measures offer the most favorable payback? What financing options and rebates are available? What smart-home options are out there? How might an electric vehicle (EV) alter a household’s energy calculus?

A utility pursuing EaaS must be able to do more than just answer these sorts of questions. It must be able to profit from those answers through an ability to assemble bundles of products and services that help the utility make money while benefitting its customers and the planet.

Doing so lets the utility retain and expand upon its natural role at the hub of all things electric — a role that will only grow with the global drive toward the electrification of transportation and space heating. Consider also that the utility’s scale and, in a given geography, total market penetration, position it to harvest efficiencies others simply can’t.

It alone has comprehensive insights into who’s producing and consuming how much energy, when and where. The utility knows the local high school is sipping electricity at midnight even as the factory a few miles down the road is ramping up its third shift. It knows who has wireless demand-side management switches hooked to their air conditioners and how the weather — which can influence not only cooling demand but also the variable production of wind and solar — is likely to influence how many of those switches will need to cycle AC units off to shave summer demand peaks. Machine learning and artificial intelligence (AI) will increasingly be coming into play, and with both, scale is indispensable to accuracy. Consider the potential of AI in managing and fine-tuning the charging of electric-vehicle fleets based on predictive models of individual drivers’ behavior, among other potential applications of these technologies.

For all these reasons, EaaS appears to be the logical way forward for electric utilities — and, perhaps, the only way forward with a growth path. So how to embark on the EaaS journey?

Utilities must adapt to grow revenues despite customers buying less centrally produced energy because they're generating their own.

(click to enlarge)

Two key building blocks

Delivering on the promise of EaaS requires building for a future rife with uncertainties: ever-evolving market pressures and consumer tastes, technological advances in energy production and storage and shifting regulatory environments among them. The good news is, you can address a lot of that uncertainty by focusing on just two aspects of IT infrastructure: the billing system and the customer service portal.

The focus on billing and customer-service systems is not to discount the importance of systems dedicated to logistics, fulfillment, maintenance, supplier- and subcontractor-relationship management, field-technician solutions, purchasing-related systems and other indispensable aspects of a utility’s IT portfolio. It’s that the changes EaaS bring will manifest primarily in higher transaction volumes for those systems — the functionality, in other words, tends to be there already.

Not so with the billing system, whose upgrading represents an indispensable EaaS investment. Legacy utility billing systems perhaps can handle a few pricing tiers based on seasonality or usage. But they are rarely up to the task of mixing and matching various hardware and service solutions into products designed for different customer segments — or, ideally, targeting individual customers. And if you can’t bill for EaaS bundles, you can’t bundle.

Customer-service portals demand similar enhancement in pursuit of EaaS. Today’s customer-service portals tend to be visually pleasing but light on functionality, perhaps able to deliver service — and outage-related information, possibly capable of generic price comparisons. Next-generation customer-service portals will have the ability to formulate and display EaaS product-and-service bundles based on a customer’s location, usage patterns and other factors.

For example, why not incorporate GIS technologies to identify homes with greater solar-energy production potential and offer them discounts? Why not register that a particular customer was shopping for seven-kilowatt solar-panel packages last time she visited and remind her that customers who shopped for seven-kilowatt packages also looked at 10-kilowatt packages? Why not remind her that, given her tendency to charge her EV during peak hours and high time-of-use rates, a wall-mounted battery would both pay for itself over time and contribute to the stability of the grid, helping her neighbors as well as herself.

A new relationship

This represents a major departure from utility customers’ historic relationship with their energy providers, which generally consisted of touching base on those rare occasions when there was a billing issue, a service outage, or a shutoff and restart of power having to do with relocation. A reacquaintance, on mutually beneficial terms, is long overdue.

EaaS-capable billing systems and customer-service portals are, of course, two sides of the same coin, both indispensable in enabling the flexibility to offer customers what they want (or they don’t yet know they want). That flexibility will be increasingly important as the consumer-to-prosumer/flexumer transition expands out from highly motivated early adopters — who have made the nontrivial effort to familiarize themselves with the details of energy terminology — to mainstream customers lacking the time or interest in steeping themselves in the vagaries of demand-side management, time-of-use pricing and so forth.

One imagines future scenarios in which AI-augmented solutions tease out usage patterns; dynamically assemble portfolios of hardware, service and software solutions based on individual customers’ energy-related expenditures; present bundles of varying ambition and cost to those customers, and then price and bill, based on subscription- or even outcome-based models.

But simpler models supported by upgraded billing solutions and customer-service portals can pay dividends in the near term. Utilities harnessing data available today plus good-old-fashioned human intelligence can manually develop a hierarchy of bundles that nudge reluctant customers — due to financial limitations, unfamiliarity with nontraditional energy technologies, or pure inertia — to dip their toes into renewables. One might start them on a wind-energy package, for example. Then, over time, one can upsell them to community solar, leased rooftop solar, storage systems, smart thermostats, heat pumps, appliances and lighting. As with XaaS in other spheres, the endgame is that the customer doesn’t actually own anything. Rather, it’s all available on a month-to-month, subscription basis.

This is already happening, of course. For more than a decade now, Sunrun and others have been offering residential customers rooftop solar as a service with zero or minimal up-front cost and manageable monthly lease payments over 20 years. The German utility EWE is working with Bosch, Vaillant, Viessmann and others to avail EWE customers of heat pumps and other climate-control systems to EWE customers at a fixed monthly rate. On the business-to-business side, Australia’s AGL offers commercial customers bundles of solar and battery power, energy-efficient lighting, power-factor correction and demand response systems to lower costs and improve overall system reliability. Elsewhere, energy performance contracts (EPCs) and managed energy service agreements (MESAs) are becoming more and more common.

The prospect of rolling out energy-as-a-service can be daunting, but doing so is imperative for future corporate growth and climate stability. Utilities are well positioned in the marketplace and in the public imagination to take advantage of the opportunities that EaaS presents. They can take critical steps in doing so by investing in their customer-service portals and their billing systems — the two key building blocks of the flexibility needed to enable EaaS and thereby position themselves for a future of sustained profitability despite delivering fewer electrons in the name of a sustainable future.

Raik Kulinna is global lead for Energy-as-a-Service at SAP, where he focuses on innovative technologies and new business models within the energy transition, heat transition and circular economy.

Raik Kulinna is global lead for Energy-as-a-Service at SAP, where he focuses on innovative technologies and new business models within the energy transition, heat transition and circular economy.