Energy traders keep a close eye on California during the summer. As the wildfires rage on, energy traders play a huge factor in the energy markets and how they affect energy producers, service providers, and consumers alike. Tuning in to the news to check the weather forecast may be a way to predict how your day is going to pan out, but for energy traders, this simple routine is crucial for strategic planning and allows them to make calculated investment decisions. Weather and weather prediction play a volatile role in energy trading.

Energy trading consists of market trades involving development and consumption of energy and commodities like coal, oil, natural gas and energy itself, generated in many ways, or even stored in battery storage. In these systems, commodity and energy prices often fluctuate based on domestic or international weather patterns, energy usage, resource extraction and refinement, production activity and more.

Energy traders are required to research and collect data regularly, to make accurate predictions based on market trends for buyers and sellers of energy commodities in order to properly advise them on investments. The profession demands consistent communication, optimization and problem-solving and strong negotiation and interpersonal skills are imperative. In addition to calculating investments, they use weather prediction tools to best calculate the demand for energy during a given period in order to bid correctly for a positive return on investment.

There are many different ways energy traders buy and make sales. Depending on how traders are making these decisions, they are grouped into different categories, producers, buyers and speculators. Producers of energy commodities estimate how much energy they need to produce by securing guaranteed sales, creating a fixed price for the buyer. Buyers of energy come from industrial, commercial, residential and even those with an electric power industry background. For speculators, trades take place with futures contracts, which means the trader has agreed to buy or sell products or commodities at a predetermined price in the future. Another trade option is cash market transactions which are immediate transactions between a buyer and a seller.

Energy trading is a sensitive market, directly affecting the energy industry as a whole, service providers and households, and with weather constantly changing, so do prices. Since energy produced needs to equate energy used, production and use of energy is a strategic balance, and solely relying on industrial battery storage to balance the grid is not sufficient. There are many questions energy traders need immediate answers to so they can make calculated investments, and without proper weather projection tools, they are unable to make those trades without great risk.

Weather prediction and energy trading

Weather impacts energy trading based on many factors, including seasonal changes, geographical location, long and short-term weather patterns, temperature, wind, rainfall, snowfall, unforeseen extreme weather changes and more.

Seasonal and geographical changes can affect energy trading, for example, if a location with a warm climate is predicted to have a particularly hot day, more energy will need to be produced due to projected air conditioning usage and vice versa for colder climate locations using heating units.

Changes in weather over time also affect traders. Seeing changes from day-to-day, week-to-week or even month to month can affect the outcome of a positive return on investment, so seeing accurate information for weather patterns for short and long periods is crucial to making calculated investments.

Over longer periods, climate change can play a bigger role. In terms of research and data, one year’s climate change record may not be enough to accurately predict new weather phenomena or drastic changes from year to year.

Extreme weather plays a huge role in energy prices fluctuating. For example, in the event of a natural disaster, like wildfires affecting California, smoke clouds can affect neighboring states like Arizona, making the weather cooler in a time where the climate is usually hotter, affecting the amount of energy used in Arizona. These natural disasters can affect the weather in a completely different part of the country, and without accurate weather prediction tools, it would be hard to account for this in trading.

If energy traders solely relied on data from a previous year, they would be left with blind spots to these weather changes. For example, solar energy farms could base their production quantity on how much sun they received the previous year, but due to unforeseen events, such as the wildfires, or even hurricanes, they risk not reaching their quota. This is also true for windmills producing energy. Without proper data collection, these are factors that are hard to account for.

The challenges of energy trading and weather forecasts

Relying on minute-by-minute weather forecasts is essential and could be the difference between considerable profits or loss in a short amount of time. Weather software and technology can prove great assets to companies in the energy markets as they can most accurately predict weather movements specifically affecting the market. Often energy traders turn to meteorologists for accurate weather predictions, but that acquisition could be costly and as human traits come, inaccurate. As an alternative, energy traders have been seeking technology weather prediction tools and adding overall long-term value.

Without weather prediction tools energy traders have to trade semi-blindly making uncalculated decisions, affecting energy companies and consumers themselves. Lacking the proper tools would be detrimental to energy markets and it is hard to grasp how the energy trading world would look if these instruments did not exist. For the average person, weather might be a determining factor in how they might dress or how they decide to get to work that day, but for energy traders and the energy market, weather prediction is paramount.

Hedge funds that are in the business of commodities, supply and demand, are heavily reliant on weather, as mentioned. Weather impacts both the supply and the demand. Nowadays, weather is accessible to all via NOAA and HRRR – the governmental tools for weather prediction in the U.S. Other countries have similar tools. The problem arises when the governmental data isn’t accurate enough, doesn’t drill down to the resolution needed for energy trading or doesn’t detail a specific weather parameter needed for energy trading, such as air quality.

Hence, energy traders use public governmental data, and weather vendors. But most energy traders use the same data and the same vendors. The problem is that in order to succeed in the field of energy trading, you need a competitive edge. Weather technology is a game-changer for some traders and grants them a competitive advantage. A small change in the accuracy of a forecast can result in millions of dollars.

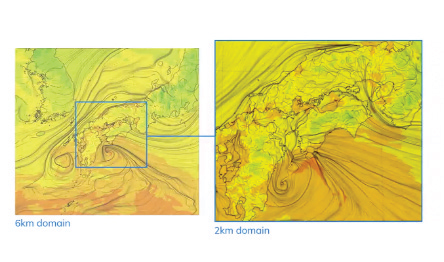

One of the main and most important aspects is location: resolution is key in order to understand the accurate weather in a specific location. HRRR’s resolution is 10- 12km, while certain weather technology companies can reach a resolution of 100 meters. This can be crucial in understanding wind patterns at a wind farm, as an example.

Another aspect of weather technology is that it can be tailored to the needs of the energy trader, based on the commodity they are trading. Not only that, an energy trader who is following hundreds of wind farms and thousands of solar farms can also be pinpointed to the most impactful weather sites they want to trade on.

The next generation for energy traders is now

When we think of weather and energy trading, the combination of predictive impact is key. But actually, historical weather data is a crucial factor as well, in order to learn how weather phenomenon behaved in a specific area and what was the outcome for the commodity.

As we think about the technologies and capabilities needed now across the energy trading market, a few core areas of need are apparent:

Improved Accuracy: Specifically looking only at public and government weather data will only give traders a small piece of the puzzle. Systems that were built for large scale emergency and defense alerts, public data doesn’t provide the level of granularity of refresh rates in real-time that are needed to make decisions confidently.

Hyperlocal Targeting Capabilities: Consider wind blowing across a city. The wind speed, direction and intensity or length could be and usually is, quite different on one side of the city versus the other. You need to be able to understand weather impact at a hyperlocal level, down to the street to be able to truly tell how things like crosswinds or other weather parameters will have an impact.

Time-based Insights: Being able to seamlessly plug into historical, real-time, and forecasted data is needed for traders to have a full understanding of weather impact over time. Being able to quickly understand in hyperlocal areas the impact of the weather in years past quickly gives confidence and meaning to real-time and forecasted data.

AI-powered Historical Modeling: With historical weather being of crucial importance, the only way to ensure traders have access to the most cutting-edge technology is to use artificial intelligence to help train past, present, and future models. An AI-powered modeling approach will be able to comprehend and analyze the more important and impactful data points by an order of magnitude.

Customized Data Based on Specific Needs: While having access to the best weather data and technology is great, it needs to be flexible. The goal or approach of one trader or firm might be different from another. For example, some projects are happening in real-time while others are more long-term, and the level of detail for projects varies. Thus, being able to customize all of your weather data, sync it to impact, and tailor the final solution for your needs is essential for success. Examples of custom parameters needed on a global basis, including trading regions such as CAISO, MISO, ISO-NE, NYISO, ERCOT, SPP, PIM, etc., might include:

- Location

- Coverage

- Parameters

- Global coverage

- Temporal resolution

- Spatial resolution to 2 KM

- Millions of virtual sensors

The most successful traders in the coming months and years will be the ones with full access to a high-resolution forecast impact model, combined with automated decisioning software and API integrations. The needs include historical, real-time, and forecasted data, in addition to global coverage. Having access to this type of weather intelligence means having the best technology, and the benefits to traders are significant.

Evan McNamara is the director of energy trading and account management at ClimaCell, the weather intelligence platform.

Evan McNamara is the director of energy trading and account management at ClimaCell, the weather intelligence platform.