Last month the Canadian Electricity Association (CEA) released the State of the Canadian Electricity Industry 2020 at Globe Series, which convenes leaders from business, government and civil society to share knowledge to accelerate the transition to a cleaner energy future. Emphasizing the pace and scope of transformation in the electricity sector, the recommendations within the report will guide CEA's thought leadership and advocacy in the year ahead. For the Q2 issue of EET&D, we spoke with President and Chief Executive Officer of the Canadian Electricity Association CEA Francis Bradley to discuss the report, its findings, and how CEA intends to address the recommended next steps.

EET&D – How has the Canadian electricity sector transformed over the last number of years?

FB – For more than 100 years, Canadian electricity companies had a simple mandate: provide reliable, safe power to all. Keep the lights on. And they did just that.

For many decades, the business model was remarkably stable. An electricity utility or other company in 1980 interacted with its regulators and business partners, managed its operations and served its customers in fundamentally much the same way it did in 1970 or even in 1960.

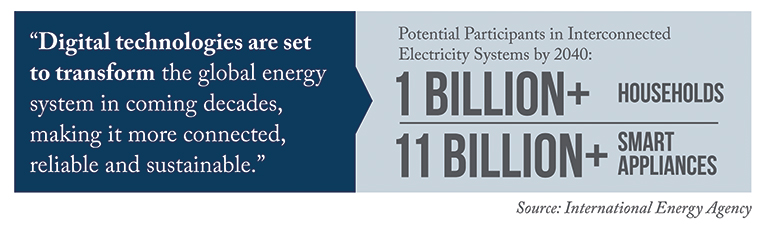

Today, these same companies are expected to also provide a broad range of energy services. New technology, renewable sources of energy and customer convenience and personalization are the drivers of grid innovation. Proactive communication capabilities are endless. System outage updates can be communicated via text linking to an outage map while pending weather challenges are communicated via Twitter. These advancements are now basic customer expectations.

Similarly, sensors, smart home energy management assistants and resulting data provide the opportunity in achieving nearly net-zero consumption. Smart lighting in homes and businesses can be connected and controlled. Utilities are now evolving from the traditional one-directional pipeline delivery system to a platform-based relationship with customers.

The Canadian electricity industry is undergoing a period of unprecedented change through decarbonization. This is the backdrop against which our State of the Canadian Electricity Industry 2020 was presented.

EET&D – What does electrification mean to CEA and its members?

FB – Actually, our focus is on decarbonization. Many people think electrification is just the growth of electric vehicles. But it is more than that.

Our members are focused on the process of expanding the use of low-carbon electricity for Canada’s energy needs. By 2050, electricity will play a substantially greater role in Canada’s overall energy use.

This shift is largely driven by consumer and political demand to reduce greenhouse gas (GHG) emissions in a sector already 80 percent GHG free. And only about 20 percent of the sector’s energy use is electric.

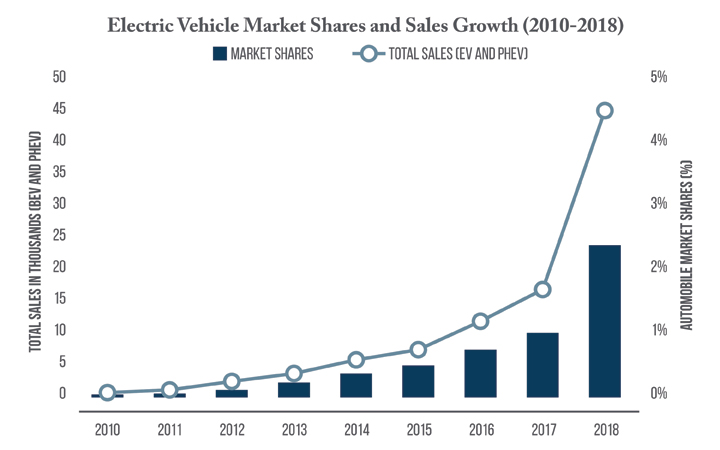

While the transportation sector including passenger vehicles, mass transit and heavy-duty trucking is positioned to lead this move towards electrification, buildings and industrial applications will be just as impactful.

The Electric Power Research Institute noted that electrification could increase the U.S. demand by 24 percent to 52 percent by 2050. These numbers provide a baseline for prospective Canadian demand. This challenge will stretch current infrastructure to its maximum capacity. As the industry continues to migrate from carbon-based generation, the limitations of renewable energy will become obvious. Energy storage, distributed energy resources and grid modernization will be critical in bringing a new generation to the customer.

EET&D – If Canada is going to reach net-zero carbon by 2050, what is the key driver in getting there?

FB – Innovation. Innovation is key to the change needed in the electricity industry.

The electricity sector has a culture of innovation. In 2018, CEA hosted Canada’s first electricity Centre of Excellence. The Centre of Excellence (CoE) is dedicated to recognizing and celebrating electricity innovation from coast-to-coast. The CoE showcases cutting-edge development in the way that electricity is produced, delivered and consumed, and highlights transformational progress in how electricity yields economic, social and environmental benefits for Canadians.

The industry will continue to evolve as the expectations of the customer continue to grow. Whether the project is tailored to EV owners, allowing utilities to charge cars overnight during off-peak hours, or the development of the largest ever off-grid, solar and storage microgrid project in Canada – all Centre of Excellence projects are positively impacting the lives of Canadians and transforming our ever-changing industry.

As we look ahead, one of the challenges Canada will have to address is the framework for energy regulation and innovation. Federal, provincial, and territorial governments must work collaboratively to ensure energy regulators are given the mandate to accommodate infrastructure investments and innovation into the rate-making processes. The industry appreciates the need for utilities to control costs, but strategic innovation can result in significant benefits and produce cost-savings over-investment as usual.

EET&D – In this era of transformation, how will the industry meet the needs of customers and communities?

FB - Perhaps the most fundamental of many current transformations relate to the emergence of a more diverse, distributed and technology-enabled electricity system.

One of the challenges we have in today’s electricity system is that it is built to meet peak demand. And sometimes that peak is only reached for a very short time each year, with summer and/or winter peaks depending upon the system.

In some jurisdictions, we see the complexity and market impacts of surplus baseload, which can result in spilling water, or even negative pricing in some regional wholesale markets.

The challenges of juggling system resources with variable demand is now becoming even more complex, with the addition of variable generation resources, both at grid scale and on the customer side of the meter. The future will see even greater variability of both demand and supply.

Storage is a solution to some of these issues, potentially enabling more efficient plant and system operation, allowing for peak-shaving and valley-filling. Much of the discussion about storage is about batteries, pumped storage, compressed air and other such technologies.

In this era of technology and personalization, companies will be challenged to meet increasing customer expectations and to maintain relationships through new touchpoints such as electric vehicle charging, smart homes and consumption dashboards.

Innovation will depend on first understanding what drives customer behaviour, as well as what changes are likely to emerge and how fast.

The introduction of distributed energy systems will also fundamentally alter customers’ relationship with power. They will have the ability to sell and trade energy to one another enabled by two-way communication between utilities and customers. This will make the current electricity grid more efficient and will potentially save customers money while benefiting the environment.

The franchise of a utility company will change as utilities become essentially distribution system operators. And the rising demand for clean energy to transform transportation, heating, ventilation, air conditioning and industrial processes means we will need every single kilowatt that we can find.

The impact of distributed systems and increased consumption is something that every electricity company is thinking about. They are developing their plans on how they will fit into this future model. Based on conversations I’ve had with energy experts on my podcast, the Flux Capacitor, CEOs, CEA member companies, regulators, thought-leaders and customers are focused on what the future might bring and what it means for them.

But when I ask integrated utility companies if promoting distributed energy resources will cannibalize their generation business, the response is “no.” That’s because the sentiment is that the pie will be so big and the demand so large that we won’t have a choice but to integrate a more distributed energy system as we also expand generation. We need to make sure we are building as much grid as we can.

EET&D – Is the electricity sector affected by regulatory burdens?

FB – At the federal level alone, the electricity industry is affected by more than 90 different regulations that are either in force or pending. These stretch across 31 different statutes, covering issues as diverse as greenhouse gas (GHG) emissions, species at risk, migratory birds, navigation protection and more.

The electricity industry recognizes the vital role of regulation. However, legislative and regulatory requirements should be outcomes-driven, predictable and, to the greatest extent possible, non-duplicative. In the absence of that, the cumulative impact of a myriad of regulations has the effect of inhibiting new investments and increasing costs to electricity end-users, including residential, industrial, commercial and institutional customers. An effective investment and regulatory environment will be critical as Canada moves to a more resilient, low-carbon economy.

In 2012, the Conference Board of Canada (CoB) estimated that the electricity industry would need to invest at least $350 billion by 2030 to meet demand growth and modernize its aging infrastructure. Considering the growth in regulatory requirements, particularly related to GHG reductions, this estimate for the industry has now been updated to $1.7 trillion by 2050.

Meeting this investment requirement requires an efficient and effective investment and regulatory system in Canada. These investments are crucial for growing Canada’s economy and reducing our carbon footprint. They create good jobs, promote clean economic growth and ensure that businesses and households can continue to benefit from access to safe, sustainable and reliable energy. Addressing issues related to competitiveness, investment climate, and cumulative regulatory burden will pay dividends into the future.

EET&D – What are CEA’s key recommendations for the remainder of 2020?

FB – In order to reach Canada’s climate targets, we need to develop innovative solutions across all sectors. The creation of a national strategy to guide decarbonization and electrification remains a key CEA policy objective and is at the forefront of our recommendations.

Business as usual is not an option. Advances in technology are shifting what the future will look like. Electrification of the economy, including electric cars and beyond, will increase demand. Smart grids, renewables and distributed generation options will shift how electricity is generated.

Governments, Indigenous Peoples, communities and the energy sector must work collaboratively to build the social license for new projects and create the regulatory structure to have them approved. That will mean identifying areas where regulatory requirements are duplicative or have a burden greater than their public benefit. It will mean focusing on what we want to achieve: access to reliable, clean and competitively priced power. Federal and provincial governments will need to work together and ensure new innovative projects are approved.

We live in exciting times. Electricity is transforming at an unprecedented rate that will have major implications for how we live and the Canadian economy. We can build a clean energy future together, but we must start now.

Francis Bradley is the president and CEO of the Canadian Electricity Association (CEA). Beginning as a junior in communications, Bradley has worked at CEA for 33 years in a variety of roles, most recently as Chief Operating Officer since 2014 and interim Chief Executive Officer beginning December 2018. A frequent speaker on security, technology, industry transformation and the future of the electricity industry, he was a co-author for five years of the annual North American Electric Industry Outlook published jointly by the Washington International Energy Group and CEA.

Francis Bradley is the president and CEO of the Canadian Electricity Association (CEA). Beginning as a junior in communications, Bradley has worked at CEA for 33 years in a variety of roles, most recently as Chief Operating Officer since 2014 and interim Chief Executive Officer beginning December 2018. A frequent speaker on security, technology, industry transformation and the future of the electricity industry, he was a co-author for five years of the annual North American Electric Industry Outlook published jointly by the Washington International Energy Group and CEA.