People are challenged with the day-to-day race to keep up with their lives. However, in a world so focused on immediacy, there remain moments where people pause and take note. These moments present a golden opportunity for organizations to interact most effectively with consumers to enhance their engagement and overall experience, whether in person, online or through other communications.

Transactional communications are a perfect example. It might seem counterintuitive to think people still spend significant time poring over statements and bills. However, transactional documents, such as monthly bills, are still important and widely read, both in digital and paper formats.

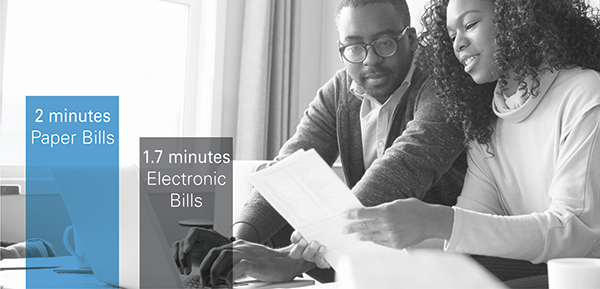

The estimated median amount of time consumers spend examining their paper utility bills is two minutes, according to recent research. The same survey showed an estimated average time of 1.7 additional minutes that consumers spend reading those same bills in electronic form (Figure 1). This adds up to more than 20 minutes a year that consumers take to read either paper or electronic bills. People are engaged with their utilities; they just want to engage on their terms.

Figure 1. Estimated Median Time Consumers Spend Reading Their Utility Bills

Source: Expectations & Experiences: Household Finances, Fiserv, 2017

Listen to What Customers Want, and They’ll Listen

Transactional communications can be far more than compliance necessities; they provide a crucial platform for utilities to actively interact with their customers. New competition brings with it pressure to find new ways to share information and advice in order to build engagement. Utilities can use the billing and statement experience as an opportunity to connect with customers and strengthen relationships.

The research also found that 37 percent of consumers remember seeing personalized messages in their statements or bills. The message has to resonate, and personalizing the content allows customers to know their utility is speaking directly to them. That could mean, for example, calling out a specific energy-efficient product or offering a relevant service. It might include capturing customer interest by using color and clear branding, or partitioning the content and drawing attention to specific promotional or educational information. Utilities can add QR codes to the documents linking to websites or special offers, creating a more seamless link between different channels.

Monthly correspondence can highlight new services such as notification and alert options to let people know about maintenance activity in their neighborhoods or account access changes. Those communications enhance relationships with consumers by empowering them and deepening their trust in the utility. And that, in turn, strengthens the relevance of the transactional document communications, no matter how they are delivered.

Consumers Use All Channels and Will Continue to Do So

Utilities looking through the lens of consumers know people gravitate towards all of the channels and are inclined to use the one that best meets their needs at any given point in time. Mobile platforms are obviously growing and increasingly important, but that immediacy does not necessarily come at the expense of other communication channels. Paper remains a relevant avenue through which consumers receive and pay bills, despite the growth in digital channel use and acceptance of digital transactional communications.

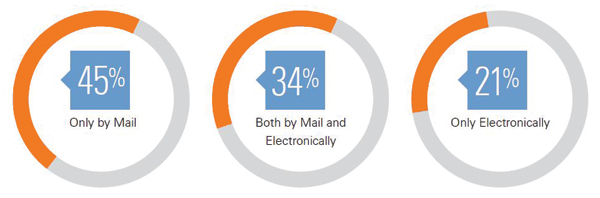

The recent research showed 45 percent of consumers receive their utility bills by mail, 34 percent receive both paper and electronic versions, and 21 percent receive electronic only (Figure 2). Furthermore, while people are comfortable with various ways of receiving bills, 52 percent still consider traditional postal mail as the most secure.

If current paper suppression rates continue, utilities can expect only half of all consumers to have discontinued paper transactional documents by 2022. Utilities will, therefore, need to support multiple modalities for the foreseeable future.

Figure 2. Consumer Preferences in Receiving Utility Bills

Source: Expectations & Experiences: Household Finances, Fiserv, 2017

The Key to Deeper Engagement

The more people engage in personalized interactions that anticipate their billing and payment needs, the higher the bar is set for consumers’ engagement in other channels, such as IVR, or in person. No matter the channel through which bills are delivered, transactional document communications give utilities an opportunity to enhance the overall consumer experience through well-placed communications. When that monthly correspondence is on target, the benefits are abundant.

Utilities can amplify their brand voices with consistent communications, increase engagement and loyalty by directing specific information to consumers, reduce unnecessary call center calls, and enhance the customer experience with clear messages about when bills need to be paid.

Ultimately, customers want providers to connect with them wherever and whenever they choose. Utilities have the opportunity to meet people at that point of convenience – when they are actively engaged and ready to listen – and position themselves strongly to drive meaningful engagement and loyalty.

Chris Chronis is director of product marketing and research at Fiserv. Chronis joined Fiserv in 2009, and his focus is product marketing, market and competitive intelligence and strategic planning for Output Solutions. Prior to joining Fiserv, Chronis spent more than 20 years in the financial services industry and 18 years in the customer communications management segment, where he focused on competitive intelligence, strategic planning and market and product requirements development. He has been quoted in many industry publications including Bank Technology News, Insurance and Technology, Securities Industry News, Mutual Fund Market News and has provided many briefings to leading analyst firms including Gartner, Forrester, Mercator and IDC.

Chris Chronis is director of product marketing and research at Fiserv. Chronis joined Fiserv in 2009, and his focus is product marketing, market and competitive intelligence and strategic planning for Output Solutions. Prior to joining Fiserv, Chronis spent more than 20 years in the financial services industry and 18 years in the customer communications management segment, where he focused on competitive intelligence, strategic planning and market and product requirements development. He has been quoted in many industry publications including Bank Technology News, Insurance and Technology, Securities Industry News, Mutual Fund Market News and has provided many briefings to leading analyst firms including Gartner, Forrester, Mercator and IDC.