Most experts agree that upgrading and expanding our nation’s transmission infrastructure is a critical part of any investment plan for America’s future. The American Society of Civil Engineers gives a D+ grade to the upkeep of our electricity system, noting that, “without greater attention to aging equipment, capacity bottlenecks and increased demand, as well as increasing storm and climate impacts, Americans will likely experience longer and more frequent power interruptions.”

But determining the appropriate amount of transmission to build, and where to build it, is a complex process, made even more challenging by the many stakeholders involved at the federal, state and local levels. Most U.S. transmission projects take five to 10 years to build, and the delays and uncertainty can often create insurmountable hurdles for many badly needed projects.

One of the keys to addressing our infrastructure backlog is planning by Regional Transmission Organizations (RTOs). Once a specific need is identified in an RTO plan, the chances that the transmission line will get financed and built go up dramatically. This is why we highlighted in our recent research report that RTOs are largely failing to plan for a large portion of future renewable energy demand: the demand from large corporate buyers. This is a very fixable problem – it is time for RTOs to address corporate demand so that we have the 21st-Century infrastructure that Americans need and deserve.

In the past several years, U.S.-based corporations have been making major commitments to buy renewables and acting on those commitments. A coalition of more than 100 U.S.-based corporate entities called the Renewable Energy Buyers Alliance (REBA) has set a goal of purchasing 60 gigawatts (GWs) of renewable energy by the year 2025, equivalent to the amount of energy produced by 110 conventional power plants and enough electricity to power nearly 50 million homes. These corporations have already procured 9 GWs of renewable power, and as costs continue to decline for wind and solar, they are likely to accelerate this procurement.

Large companies are choosing long-term renewable energy contracts to power their operations both because their customers want clean energy and because of the cost saving and hedging benefits of renewables. New utility-scale wind and solar projects are now frequently the lowest-cost option for power – even before accounting for tax incentives – and companies are moving to lock in those low prices now to control their future energy costs.

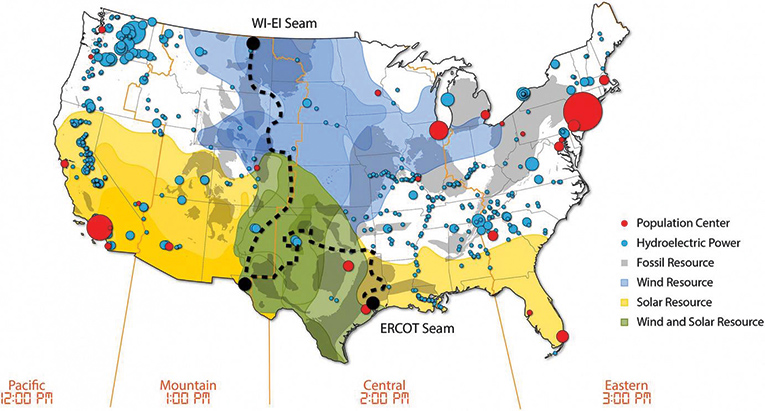

Figure 1: NREL Interconnection Seams

To meet their goals, the REBA companies aim to procure an additional 51 GWs of renewables in just the next seven years. But they face a major challenge: there is a gap between where the country can produce the most cost-effective wind and solar resources and where electricity demand is projected to grow. The 15 states between the Rockies and the Mississippi River account for 88 percent of the country’s wind technical potential and 56 percent of the country’s utility-scale solar photovoltaic technical potential but are home to only 30 percent of projected 2050 electricity demand. Ensuring a reliable electricity system by connecting energy supply with demand is a core responsibility of transmission planners (see Table 1).

Our report shows that even if REBA companies attempt to procure only half the amount of renewables they have pledged to procure, they will likely face serious obstacles given the absence of attention to their renewable energy demand at the RTOs.

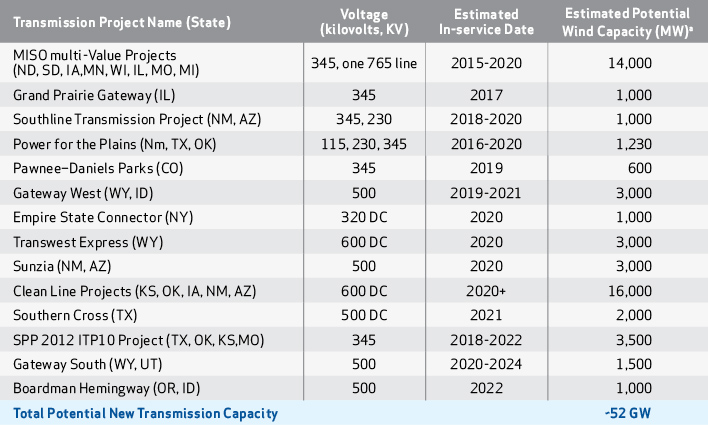

According to our research, only 52 GWs of capacity is available in the planned transmission lines that will access our nation’s best renewable resources, even assuming all the planned projects are completed. Transmission capacity is needed, not just for the 51 GWs of REBA’s voluntary corporate demand through 2025, but also to meet the mandatory demand from utilities implementing state-specific renewable portfolio standards as well as voluntary demand from utilities and other large institutional buyers such as universities and the military (see Figure 1).

Further analysis of ISO and RTO interconnection queues — which show the capacity of power generators seeking transmission interconnection — demonstrates that significant amounts of wind and solar are seeking access. In 2016, 150 GWs of wind and solar power capacity (equivalent to approximately 274 conventional power plants) entered interconnection queues compared to 40 GW of natural gas (equivalent to approximately 73 conventional power plants). Wind and solar comprised 78.9 percent of the total resources seeking access to transmission.

MISO and SPP experienced especially sizable additions in 2016. At the end of 2016, 142 GW of wind power capacity was seeking transmission interconnection in these RTOs — higher than all other generating sources.

In light of this demand, will the pipeline of planned transmission projects enable large corporate buyers to fully meet their goals? Our report finds that this result is very unlikely.

Table 1: Transmission Line Activity Serving Renewable Energy Projects

Our report compared a high and low scenario for trans-mission construction with a high and low scenario for corporate renewable energy procurement, with RPS demand remaining the same across both scenarios. We found that only in a scenario with low corporate procurement (20 GWs or less) and an aggressive trans-mission build (90 percent or more of the planned projects completed by 2025), would there be potentially enough new capacity to meet corporate demand. Although we did not study the impact of retirements of existing plants, environmental regulations or others changes that might free up capacity in existing lines, we also did not account for voluntary procurement from utilities and other institutional buyers that are not members of REBA. Voluntary procurement by utilities is a particu-larly noteworthy trend, as new renewable projects are consistently bidding into utilities’ requests for proposals as the lowest-cost option. Voluntary procurement by utilities and other non-REBA institutions could more than offset the freed-up capacity resulting from coal plant retirements and other changes to the generation mix.

Given these findings, two key actions are needed: (1) RTOs and other regional planners must begin accounting for corporate demand, and (2) corporate buyers must begin communicating their plans to transmission planners and advocating for their inclusion in models of future demand.

One way to implement the first recommendation is through strengthening the interregional planning processes and adding corporate procurement to the discussion. By improving these planning processes, FERC could help ensure that planned transmission development – both inter- and intraregional – is sufficient to meet corporate demand.

Also, while load forecasting is already an important part of regional planning, incorporating corporate energy demand for renewables into forecasts would be beneficial. One trend is particularly deserving of attention by modelers: big tech companies are choosing to site new data centers in areas with nearby renewable resources. These new facilities increase the load in that region, as was the case with the recently completed Facebook center in Fort Worth, Texas and Apple data center in Des Moines, Iowa.

In other cases, corporates are increasingly using virtual power purchase agreements (VPPAs) to procure renewables. A recent study of corporate wind PPAs by the American Wind Energy Association (AWEA) found that corporate customers were signing virtual PPAs rather than physical PPAs by a ratio of nearly 4:1. Although wind energy historically has been the preferred technology for corporate buyers, many companies recently have begun entering into solar PPAs as well, such as Apple, which has contracted 130 MW of solar through a PPA with First Solar.

And while VPPAs are purely financial transactions that do not require physical energy delivery or result in regional load changes, these deals are only possible if the transmission is already in place to facilitate their renewable purchase. In one recent example, featured as a case study in our report, the Hitchland-Woodward transmission line in the Oklahoma Panhandle allowed RES Americas to complete their Bluestem wind farm, the output of which was purchased by Google.

Perhaps more importantly, corporate customers prefer to invest in renewable energy projects that are located reasonably close to at least some of their energy demand, a practice known as co-location. Approximately 80 percent of the wind capacity bought by corporate customers through virtual PPAs is associated with wind projects located in the same electricity market where the corporate customer has at least some energy demand, according to AWEA.

This commitment to “buy local” is reflected in a statement from the 71 REBA companies that signed the “Corporate Renewable Energy Buyers’ Principles,” affirming that “where possible, we would like to procure renewable energy from projects near our operations and/or on the regional energy grids that supply our facilities, so our efforts benefit local economies and communities as well as enhance the resilience and security of the local grid.”

Corporate buyers would play an important role in facilitating the growth of renewables by clarifying their locational goals in transmission planning processes. By communicating their energy goals to regional planners, corporate buyers can help ensure that renewable energy projects have the transmission capacity they need to become viable.

General Motors (GM) is an example of a REBA member that is becoming increasingly interested in transmission planning. A major wind power purchaser, GM sees the connection between adequate transmission and meeting their renewable goals. It recognizes that expanding and upgrading transmission will remain a key to unlocking the lowest-cost resources with the greatest carbon reduction potential well into the future.

“GM’s ability to access renewable energy is key to our decisions about where to expand new facilities,” said Rob Threlkeld, Global Manager of Renewable Energy, General Motors. “It’s es¬sential that transmission planners take the growing corporate demand for renewables into account in the planning process. Expanding and upgrading transmission is critical in helping GM access low-cost renewable energy and meet our commitments.”

We see a unique opportunity for GM, and other companies like it, to have an enormously beneficial impact in our nation’s future by helping ensure that the nation has the infrastructure it needs to transition to a clean energy economy. Likewise, the RTOs and other transmission planners can make a positive difference by acknowledging that the exciting trend of corporate procurement of renewables is here to stay.

John Kostyack is the executive director of the Wind Energy Foundation (WEF), where he leads WEF’s work across the United States to educate decision makers, the media and the public about the economic, environmental, and national security benefits of renewable energy and the forward-looking energy and infrastructure policies needed to secure those benefits. Kostyack is an attorney with more than 30 years of leadership experience in government, the private sector and nonprofit organizations.

John Kostyack is the executive director of the Wind Energy Foundation (WEF), where he leads WEF’s work across the United States to educate decision makers, the media and the public about the economic, environmental, and national security benefits of renewable energy and the forward-looking energy and infrastructure policies needed to secure those benefits. Kostyack is an attorney with more than 30 years of leadership experience in government, the private sector and nonprofit organizations.

David Gardiner is the founder and president of David Gardiner Associates (DGA), a Washington DC-based sustainability consultancy that helps companies, foundations, and advocacy groups develop climate and energy programs and products that will lead to real change. Prior to founding DGA, Gardiner served as the executive director of the White House Climate Change Task Force during the Clinton Administration, the EPA’s Assistant Administrator for Policy and the Legislative Director for the Sierra Club.

David Gardiner is the founder and president of David Gardiner Associates (DGA), a Washington DC-based sustainability consultancy that helps companies, foundations, and advocacy groups develop climate and energy programs and products that will lead to real change. Prior to founding DGA, Gardiner served as the executive director of the White House Climate Change Task Force during the Clinton Administration, the EPA’s Assistant Administrator for Policy and the Legislative Director for the Sierra Club.