Hurricane Sandy made it obvious that electric distribution utilities were ill-prepared to prevent large-scale power outages or quickly restore power to businesses and households. After Sandy, many states and industry groups created special commissions and studies that offered prescriptions to harden the energy infrastructure. However, this past winter’s storms, and the lengthy outages that resulted, underscore the fact that these prescriptions could take years to implement and still may be insufficient. The consequences have been severe for utility customers. Not surprisingly, the reputation of the utilities has been damaged, and their customers increasingly are looking for alternatives. If the electrical utility sector does not address its problems, it will lose customers, as well as investors. Utility companies may find themselves short of capital at a time when they need to invest the most. Fortunately, there are some immediate actions these firms can take.

October 2012

Hurricane Sandy, the so-called Superstorm, made landfall near Atlantic City, New Jersey, on Oct. 29, 2012. The storm affected 24 states. The U.S. Department of Commerce estimated that Sandy caused some $50 billion in damage and 100 direct storm-related deaths.

On Oct. 31, two days after Sandy hit, more than 6 million people were without power, including over half the population of New Jersey and a fifth of New York State residents. The duration of the tail – the time during which customers are left without power – would go on and on.

According to a February 2013 New York State Bipartisan Task Force,1 report on the storm; ‘Power for 2.19 million households was out for days, weeks and even months.’ The report continued: ‘Most local officials expressed dissatisfaction with their local utility company’ largely due to a ‘lack of communication, disorganization, poor customer service and slow response time.’ This disappointment was widely shared and magnified by traditional, digital and social media.

In Sandy’s wake, many states convened committees and issued special reports. The consensus was that electric utilities must be better prepared for extreme weather events. The reports stressed the need to:

- Build resilience by selectively burying power lines, improving tree trimming and creating redundant distribution capabilities

- Invest in enhancing and modernizing infrastructure by deploying smart meters and other technologically advanced distribution systems

- Improve resource-sharing agreements among utilities and governing authorities across states, where one state agrees to send its workers to another state in greater need

- Insist that regulators hold utilities accountable for storm response targets and assess heavy fines and fees in cases of noncompliance

Winter 2013-2014

On Feb. 5, 2014, the Philadelphia region was hit by a major snow and ice storm (PA Snowstorm), causing Philadelphia Electric’s (PECO) second-largest outage ever and leaving approximately 623,000 of its customers without power. Altogether, greater Philadelphia area utilities left more than 712,000 customers in the dark. Two days later, PECO still had not restored service to 290,000 customers. Some customers were without power for more than a week.

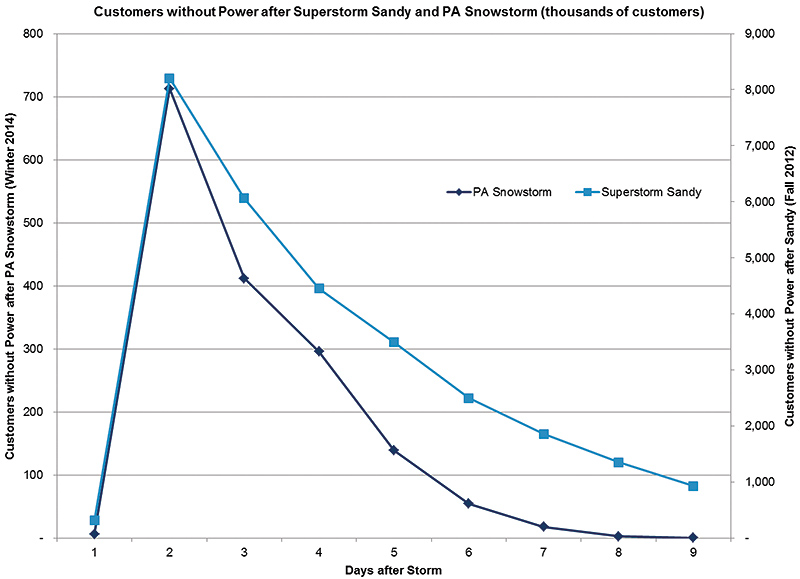

Despite the well-intentioned and worthwhile suggestions and directives that emerged from post-Sandy task forces and commissions, actual improvement in extreme weather utility response is hard to document. Today, the nation’s electric system seems scarcely more resilient than it was two years ago. After significant storms, the peaks (the number of households and businesses that lose power) are just as high; the tail is just as long (see Figure 1).

Figure 1: Sources: Atlantic City Electric (ACE), Delmarva Power, Maryland Public Service Commission, PECO, PPL Electric Utilities Corporation (PPL) and Public Service Enterprise Group Incorporated (PSE&G) websites.

The human cost is obvious. However, the PA snowstorm also drained between $80 million and $120 million from PECO’s coffers. Thus, with a combination of heavy financial impact and strong customer dissatisfaction – the inevitable consequences of outages, especially long ones – a perfect storm, so to speak, is brewing for electric utilities.

It is not surprising that more customers are deciding to provide for their own energy needs. As more customers self-provide – whether through micro grids, on-site generators, solar technologies or other means – the number of people paying for the existing electrical infrastructure will decline, reducing revenues for utilities. Those reductions will drive up the utilities’ cost per customer, decreasing margins and the capital available for investment in infrastructure modernization and other activities that might lower the peak and shorten the tail of extreme weather events. Those investments could include burying power lines, replacing old poles or implementing aggressive tree-trimming programs.

In short, electric utility companies are caught in a bind. Enduring underperformance creates a huge threat to their revenue bases and business models. By many metrics, the financial health of investor-owned utilities has suffered. According to the Edison Electric Institute (EEI), energy sales declined between 2002 and 2012, while costs and debt increased during that same 10-year period.

Missing the Big Picture

Post-Sandy reports looked to the future but offered few suggestions for fixing the present. And the present has its problems.

Where have all the workers gone?

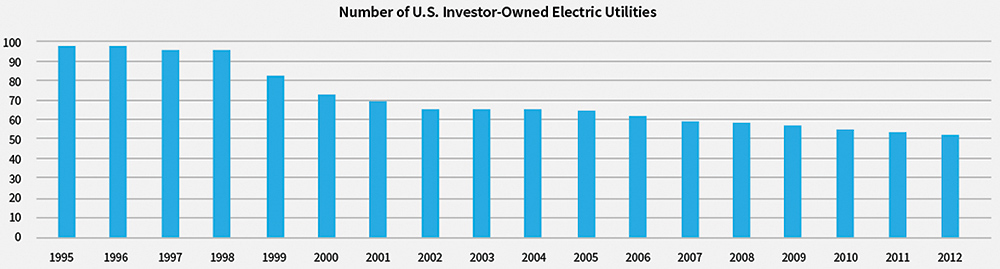

Over the past 15 years, utility companies have consolidated through mergers and acquisitions (M&A) to establish economies of scale that keep rates low. Between 1995 and 2012, the number of investor-owned utilities shrank by nearly 50 percent (see Figure 2).

Figure 2

Source: Public Utilities Fortnightly

The consolidation of the utility landscape has unintended consequences; M&A’s result in a serious shortage of skilled labor needed to respond effectively to outages and turn the lights back on.

In this highly regulated sector, agency approval is necessary for any M&A, and that approval consistently has been contingent upon the merging companies meeting cost-reduction targets. For example, when National Grid acquired Niagara Mohawk in 2000, New York State mandated nearly $200 million in cost reductions. In part, the merger achieved those savings through workforce reduction, including buy-outs and attrition.2

The Massachusetts Department of Public Utilities, in its approval of the 2012 Northeast Utilities/NSTAR merger, which is projected to save $784 million over 10 years, explained the rationale of workforce reduction to achieve those savings: ‘The nature of merger savings, primarily staff reductions, are well within management’s ability to estimate now and control later, so it is reasonable to conclude that these savings, at least, can be achieved.’3

But restoring power to customers as fast as possible depends almost entirely upon electric line workers going out in a truck, riding a bucket up to the top of poles, and fixing the poles and wires knocked down by wind, snow, ice, and falling branches. A 2011 survey conducted by the Center for Energy Workforce Development found a potential 32 percent reduction via retirement and attrition of electrical line workers from 2010 to 2015. As the total number of line workers has fallen, the average age has risen. A 2006 U.S. Department of Energy report found that in some organizations, half the line workers would be eligible to retire within the next five to 10 years.

Filling those positions won’t be easy. The Bureau of Labor Statistics estimates that job growth for line workers – employment the agency describes as physically demanding with irregular hours – will be slower than average through 2022. Becoming a qualified electrical line worker requires between four and seven years of training.

A smaller, older workforce laboring in a hazardous, demanding occupation is likely to be less productive, exacerbating the problem of restoring power expeditiously. Yet post-Sandy studies largely have ignored the growing shortage of skilled, trained, able line workers and supervisors. Regulators are loath to authorize utilities to spend money to staff up and train; the primary concern is to keep rates as low as possible.

The difficulties surrounding mutual aid

Almost all post-Sandy reports stress the need for improvements to the mutual aid process – agreements to send utility company workers across municipalities and state lines when needed to address a crisis. Indeed, representatives from 36 utilities have worked diligently to create the National Response Event framework. But the resulting plan has yet to demonstrate its effectiveness. However admirable the concept of mutual aid may be, its workability is limited by several practical, real-world factors.

In order to expedite restoration, utilities must use contractors and other utility mutual aid crews as soon as the companies are ‘free from significant threat.’4 In the case of a hurricane, utilities can turn to these mutual aid and outside contractor resources up to a week or more in advance. Since mutual aid resources often cannot be made available early, these resources cannot be relied upon at the beginning of a restoration when needed most. Consequently, it can take up to three or four days to determine whether a utility can afford to release its employees, by which time reasonable recovery targets already will have been missed.

Although utilities face a financial risk if they call upon these resources early (if they turn out not to be needed), the risk is outweighed by the even greater costs, reputational damage and customer losses of not having crews at the ready.

In addition, utilities operating in multiple states ordinarily cannot (again by rule) send workers across state lines – even to its own locations - without the approval of state officials and often only after all the home state customers have been restored. The EEI National Response Event framework provides a leadership structure to manage a ‘more efficient resource allocation.’5 However, the revised mutual aid process – while enhanced – remains voluntary and likely will be too slow or late in providing assistance in the early hours of an event when needed most. The reports following Sandy almost unanimously missed these impediments to mutual aid.

Getting Real about the Practical Solutions in the Next Storm

To change public perception of electric utilities and restore investor confidence, companies must work to lower the peak and shorten the tail of outages caused by severe weather over the short term. Key elements include identifying which organizations are doing well at restoring power and developing better, consistent metrics across the industry.

Right now, states are increasingly proactive. In January 2014, New York State, for example, announced a competition to pilot 10 microgrids (independent community-based electrical distribution systems) for areas with approximately 40,000 residents. New York is proposing to spend more than $1.3 billion to fund electric grid resiliency. But attacking storm-caused power outages by introducing new systems or improving the infrastructure is expensive and will take years to implement.

It’s the trees… and everyone knows it!

A faster, more diligent tree-trimming program to remove branches that bring down power lines is a practical near-term solution. A 2012 Connecticut State Vegetation Management Task Force report said that falling branches caused nine out of 10 power outages in the Connecticut Light & Power (CL&P) service area. In 2012, CL&P (a Northeast Utilities company) announced plans, after working with local arborists and receiving homeowner consent, to extend its annual trimming program from 3,200 to 4,800 miles. Connecticut has set up a special task force that calls for more state-supported funding at the local level to manage the state’s roadside forests. Connecticut also encouraged municipalities to develop easily understood and centralized tree-pruning guidelines in order to cut through the red tape associated with trees on public roads that dictates (and frustrates) utility tree-trimming activities.

All states should work to smooth the path for utilities, allowing them to trim trees without having to get approval from every individual municipality and every town arborist before touching any tree in any given jurisdiction

Staffing levels and the use of contractors

The workforce battle is the one that electric utilities must fight now. Without skilled, ready workers to deploy, customers will be left in the dark for an unacceptably long time. Utilities must collaborate with regulators and governing authorities to free up the money necessary to rebuild workforces and training programs. At the same time, electric companies must be proactive in replacing retiring line workers.

To ensure that utilities have properly equipped, trained people who can be sent to the right places in a timely fashion, these companies should conduct diligent surveys of their service areas to make sure the appropriate resources are available in the most vulnerable areas. Electric companies also should develop strong, integrated, contractual relationships with accredited, reliable third-party contractors that can support remediation efforts once the lights have gone out.

A Matter of Survival

The social cost of power outages is sizable in terms of human suffering. The economic cost in lost productivity – the value of lost load (VOLL) – for utility customers also is significant. VOLL directly relates to a customer’s willingness to pay for reliable electric service. But VOLL – which depends on the type of customer affected, regional economic conditions, demographics and the duration of an outage – is difficult to measure. However, a 2013 Congressional Research Service study estimated the annual inflation-adjusted cost of weather-related outages to be between $25 billion and $70 billion. That toll will only increase as our economy becomes ever more reliant on the provision of uninterrupted, high-quality energy.

Public anger at utilities cannot be wished away or addressed by public relations campaigns. Negative sentiment inevitably will encourage the development of alternative energy distribution systems such as microgrids that lower demand for utility services and result in lost revenues to the companies. In a vicious cycle, these lost revenues will further hamper the utilities’ ability to refresh and harden the infrastructure; to invest in new, cost-reducing technologies; and to rebuild a critical workforce.

Conducting ‘business as usual’ or planning for the future without dealing with the challenges of the present is a real threat to U.S. utilities. The likelihood of that threat is increasing and requires both short-term and long-term action.

About the Authors

Ellen Smith is a Senior Managing Director in the Economic Consulting Practice Group at FTI Consulting. Ellen’s areas of expertise include matters involved in power reliability related damages, utility regulatory strategy, emergency response and strategic communications. Prior to joining FTI Consulting, Ms. Smith was the Chief Operations Officer and Executive Vice-President at National Grid USA, in Waltham, Massachusetts.

Ellen Smith is a Senior Managing Director in the Economic Consulting Practice Group at FTI Consulting. Ellen’s areas of expertise include matters involved in power reliability related damages, utility regulatory strategy, emergency response and strategic communications. Prior to joining FTI Consulting, Ms. Smith was the Chief Operations Officer and Executive Vice-President at National Grid USA, in Waltham, Massachusetts.

Conor Branch, Director at FTI Consulting, has several years of experience supporting energy sector expert witnesses. He has performed modeling and analytics used in expert witness testimony and litigation support in various natural gas and power-sector proceedings before FERC, state regulatory entities, federal court, and international arbitration panels. He has additionally provided research and analytic support for several Independent system operators. Mr. Branch has also provided financial analysis and valuation services to a variety of generation assets across the U.S.

Conor Branch, Director at FTI Consulting, has several years of experience supporting energy sector expert witnesses. He has performed modeling and analytics used in expert witness testimony and litigation support in various natural gas and power-sector proceedings before FERC, state regulatory entities, federal court, and international arbitration panels. He has additionally provided research and analytic support for several Independent system operators. Mr. Branch has also provided financial analysis and valuation services to a variety of generation assets across the U.S.

RJ Arsenault is a senior director in the Energy Consulting Services within FTI Consulting. Mr. Arsenault has spent a combined 10 years in the energy and financial sectors. His expertise in the electricity industry covers each facet of the investment cycle from target identification and evaluation to commercial optimization asset portfolios.

RJ Arsenault is a senior director in the Energy Consulting Services within FTI Consulting. Mr. Arsenault has spent a combined 10 years in the energy and financial sectors. His expertise in the electricity industry covers each facet of the investment cycle from target identification and evaluation to commercial optimization asset portfolios.

References

1 Bipartisan Task Force on Hurricane Sandy Recovery.

2 State of New York Public Service Commission, Opinion No.1-6, Case 1-M-0075, Opinion and Order Authorizing Merger and Adopting Rate Plan, p.21

3 Commonwealth of Massachusetts Office of the Attorney General, p.28

4, 5 http://www.cueainc.com/documents/Mutual%20Assistance.pptx