IN THE PAST, the distribution aspects of electric utilities were part of vertically integrated monopolies responsible for generation, transmission, distribution, and customer service. Prior to the 1970s, load was doubling more than once per decade and equipment was mostly new. Since rates were declining and earnings were growing, utilities could spend liberally on their distribution systems to achieve high levels of reliability while minimizing most aspects of risk. These days are a distant memory.

Today, the industry is vertically unbundling so that generation, transmission, distribution, and customer service can be operated as separate businesses. Many utilities are now “DISCOs,” where the vast majority of spending relates to physical distribution system infrastructure. With slow load growth, aging equipment, depleting rate bases, rate freezes, and regulatory uncertainty, DISCOs are looking for ways to increase earnings, credit ratings, and stock price. At the same time, regulators are expecting distribution reliability to improve, and nobody seems sure of how to properly manage risk. Is asset management a silver bullet? No, but a proper understanding of asset management basics can help DISCOs deal with these issues in a systematic and appropriate manner.

Asset management is a term derived from the financial industry, where its concepts are applied to investment portfolios containing stocks, bonds, cash, options, and other financial instruments. Fundamental to financial asset management is the tradeoff between risk and return. Investors identify acceptable risk. Asset management techniques are used to achieve this level of risk for the highest possible return.

Many techniques of financial asset management are applicable to distribution asset management. Of particular importance is the treatment of reliability and the risk of not meeting reliability targets. However, distribution assets are more complicated to manage than financial assets for a variety of reasons. They have non-financial aspects of performance and risk, they require maintenance and replacement, they are part of a highly complex interconnected system, and there is not a liquid market.

This article discusses asset management for distribution companies, or autonomous divisions of integrated utilities responsible for distribution system investments and operations. It first presents the goals and objectives of asset management, a corporate framework, and the competencies required to make it all work. The remainder focuses on pressing issues facing distribution companies today, and the ability of asset management to help address these issues in an effective manner.

Goals

In its most general sense, asset management is a business approach designed to align the management of asset-related spending to corporate goals. The objective is to make all infrastructure-related decisions according to a single set of stakeholder-driven criteria. The payoff is a set of spending decisions capable of delivering the greatest stakeholder value from the investment dollars available.

Typically, utilities adopt an asset management approach to either reduce spending, more effectively manage risks, or drive corporate objectives throughout an organization. These are good things, but should be considered a result of asset management rather than its objective. For example, asset management is not:

Asset Management is NOT:

Asset management is a corporate strategy that seeks to balance performance, cost, and risk. Since reliability is the primary driver of discretionary cost, the goal of distribution asset management is to balance reliability, cost, and risk. Achieving this balance requires the alignment of corporate goals, management decisions, and technical decisions. It also requires the corporate culture, business processes, and information systems capable of making rigorous and consistent spending decisions based on asset-level data. The result is a multi-year investment plan that maximizes shareholder value.

Goals of Distribution Asset Management:

Asset management is ambitious in scope, and requires supporting metrics, organizational design, processes, information systems, and corporate culture. Successful implementation can be quite disruptive, and requires the involvement and support of top management, sufficient resources, and effective change management skills. Generic approaches are likely to fail, but thoughtful approaches can help utilities reach the next level in business success.

Framework

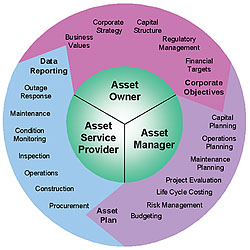

In its classical form, asset management separates itself from asset ownership and asset operations. The asset owner is responsible for setting financial, technical, and risk criteria. The asset manager is responsible for translating these criteria into a asset plan. The asset service provider is responsible for executing these decisions and providing feedback on actual cost and historical reliability.

This decoupled structure allows each asset function to have focus: owners on corporate strategy, managers on planning and budgeting, and service providers on operational excellence (see Figure 1). The asset owner sets the business values, corporate strategy, and corporate objectives in terms of cost, reliability, and risk. The asset manager identifies the best way to achieve these objectives and articulates this in a multi-year asset plan. The service provider executes the plan in an efficient manner, and feeds back asset and reliability data into the asset management process.

Asset management is also about process. Instead of a hierarchical organization where decisions and budgets follow the chain of command into functional silos, asset management is a single process that links asset owners, asset managers, and asset service providers in a manner that allows all spending decisions to be aligned with corporate objectives supported by asset data.

Competencies

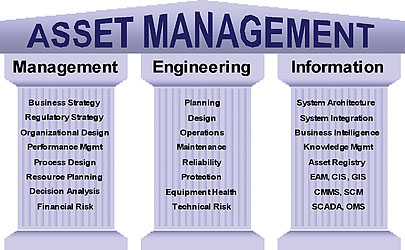

A robust asset management structure is supported by three pillars of competency including management, engineering, and information (see Figure 2). Building these competencies is daunting when viewed in isolation. Far more difficult is developing cross-functional expertise so that management, engineering, and information skills can be addressed in a mutually-supporting manner. At a minimum, this requires knowledge of the concerns, jargon, and methodologies associated with each pillar.

There are not many people in the traditional DISCO business who have strong skills relating to all three pillars. As such, many projects and initiatives will be led by project managers who need support when considering the full range of issues related to asset management. Without this support, projects will often achieve tactical goals, but will be incongruent with an overall corporate asset management strategy.

Aging Infrastructure

Most DISCOs in the U.S. have average equipment ages exceeding thirty years. It often seems wasteful to replace old equipment before it fails, but the possibility of drastic increases in equipment failures is unacceptable from all aspects of asset management including cost, reliability, and risk. Typically, the rate of DISCO asset replacement is on the order of 0.5%. In order to be a sustainable strategy, assets must last an average of 200 years! This level of asset replacement is clearly not in the interest of any thoughtful stakeholder, but traditional DISCO thinking seems incapable of proactively addressing this ubiquitous and looming problem.

More than any other issue, aging infrastructure illustrates the potential of asset management to address critical DISCO problems. First, it forces executive management to articulate clear goals in terms of budgets, reliability, and acceptable risk. It also requires an asset registry that tracks, at a minimum, the age of each piece of equipment in the field. Engineers can then perform detailed technical analyses comparing tactics such as inspect, repair, extend life, replace, and make system modifications. This analysis must necessarily take a multi-year approach, since aging infrastructure cannot be addressed in a single budget cycle. If reliability and risk targets cannot be met within budget constraints, asset owners must decide which to relax. When done properly, asset management will produce an aging infrastructure plan that justifies increased capital spending through a rigorous, data-driven, and auditable process.

Reliability

More than thirty five state utility commissions require reliability reporting, and many have set reliability targets that utilities are expected to achieve. The clear trend is towards DISCOs being required to meet reliability targets. This also implies that DISCOs must manage the risk of not meeting these reliability targets. Reliability is also a major cost driver, and should be the major focus of asset management initiatives within distribution companies.

Although reliability is best achieved through proactive planning and design, most reliability initiatives are reactive and not fully aligned with corporate objectives. By taking an asset management approach, reliability is treated explicitly, rigorously, and cross-functionally. All reliability decisions are based on solid historical information relating to equipment performance, system performance, operational performance, and cost. Decisions related to expansion, replacement, reconfiguration, operations, inspection, and maintenance are all considered together. Gains can be profound, and it is not uncommon for an asset management approach to achieve all the reliability benefits of existing programs for less than half of existing levels of spending.

Risk Management

Risk management is perhaps the most misunderstood aspect of asset management. Chief risk officers tend to view this topic in terms of financial risk management, where statistical methods are well established. The tradeoff between financial risk and reward is quantifiable, and risk mitigation can be pursued through diversification, indemnification, options, futures, swaps, and a myriad of other financial instruments.

Reliability risk management is a different animal, and concerns itself with undesirable events such as equipment failure, poor reliability indices, worst performing feeder, and “headline events” related to a reliability incident. Many DISCOs approach risk by looking at the probability and severity of bad things happening if a project is not approved. Although this is a good start, it falls short of true asset management since it is based on projects rather than reliability, and is not rigorous in its approach.

Risk is best thought of as the risk of not meeting reliability targets such as SAIDI, worst-customer reliability, storm response, and major substation outages. Viewed in this way, it is insufficient to just set performance targets such as “achieve a SAIDI of two hours or less.” Each target must be accompanied by a risk tolerance such as “achieve a SAIDI of two hours with 90% confidence.” If this target is not achieved, the asset management group can confidently state that this was a one-in-ten year occurrence, and that the distribution system is performing as designed.

Proper treatment of risk requires the knowledge of equipment condition, the impact of maintenance and operations on equipment condition, and the impact of equipment condition on the probability of failure. It also requires supporting information systems and business processes that allow risk mitigation in the form of inspection, maintenance, operations, replacement, and system modifications. A complete technical risk management program will be integrated into an overall corporate risk management program, and should be familiar with hedging, real options, scenario analysis, the cost of capital, regulatory affairs, legal affairs, and public relations. Risk management is an explicit goal of asset management, and must become a DISCO core competency.

Budgeting and Project Selection

Ultimately, asset management is responsible for spending decisions. The purpose of a budgeting and project selection process is to ensure that these decisions are made consistently, in the best manner possible, and in full alignment with corporate objectives. Typical utility budgeting processes are insufficient, and it is often helpful to ask the following questions. Are reliability, cost, and risk being truly balanced, or being deal with in another manner? Is reliability being measured in a ways that represent the interests of all stakeholders? Is budgeting based on multiple years and total life cycle costs? Is the risk of meeting budget and reliability targets treated in a rigorous manner?

When implementing an asset management strategy, many utilities begin by focusing on project ranking. By forcing all projects to be assigned a benefit and a cost, projects across departments and functions can be directly compared. By ranking all projects based on the ratio of reliability to cost, projects can be selected in order until reliability targets are reached or budgets are exhausted.

Compelling as project ranking may seem, it is problematic if there is not a single measure of reliability. Within narrow programs such as distribution automation, it may be possible to have a good single measure of benefit (e.g., reduction in customer interruption minutes). Within a greater asset management context, many different reliability issues must be considered, and a single measure becomes meaningless. It is always possible to create a generic index of benefit based on the weighted sum of a wide range of disparate benefits, but the resulting list of ranked projects can often cause more problems than it solves.

To avoid this problem, reliability should be based on an set of measures that address all stakeholder concerns. Once these and budget constraints are identified, optimization techniques can identify a multi-year spending plan that satisfies all reliability, risk, and budget constraints in a way that minimizes total life cycle cost and maximizes shareholder value.

Final Thoughts

Distribution asset management is the art of balancing reliability, cost, and risk. Achieving this balance requires support from three pillars of competency: management, engineering, and information. Initiatives can stem from each of these pillars, but must always consider and coordinate with the other two.

Distribution asset management is capable of addressing the most pressing issues facing the distribution businesses including aging infrastructure, reliability, project selection, and risk management. Each issue is daunting when considering in isolation. More daunting is the thought that true asset management will optimize decisions across all of these issues simultaneously. Asset management can be truly revolutionary, but only when it is based on three functions, a single process, supporting systems, and a robust skill set of management, engineering, and information.

About the Author

Dr. Richard E. Brown is a principal consultant with KEMA, and specializes in helping utilities improve business performance through management and technical consulting. He has published more than 60 technical papers related to reliability and asset management, and is author of the book Electric Power Distribution Reliability. He is a senior member of IEEE, chair of the Working Group on Distribution Planning and Implementation, and recipient of the Walter Fee Outstanding Young Engineer award (2003). Dr. Brown has a BSEE, MSEE, and PhD from the University of Washington, an MBA from the University of North Carolina, and is a registered professional engineer. He can be reached at rebrown@kema.com.

Today, the industry is vertically unbundling so that generation, transmission, distribution, and customer service can be operated as separate businesses. Many utilities are now “DISCOs,” where the vast majority of spending relates to physical distribution system infrastructure. With slow load growth, aging equipment, depleting rate bases, rate freezes, and regulatory uncertainty, DISCOs are looking for ways to increase earnings, credit ratings, and stock price. At the same time, regulators are expecting distribution reliability to improve, and nobody seems sure of how to properly manage risk. Is asset management a silver bullet? No, but a proper understanding of asset management basics can help DISCOs deal with these issues in a systematic and appropriate manner.

Asset management is a term derived from the financial industry, where its concepts are applied to investment portfolios containing stocks, bonds, cash, options, and other financial instruments. Fundamental to financial asset management is the tradeoff between risk and return. Investors identify acceptable risk. Asset management techniques are used to achieve this level of risk for the highest possible return.

Many techniques of financial asset management are applicable to distribution asset management. Of particular importance is the treatment of reliability and the risk of not meeting reliability targets. However, distribution assets are more complicated to manage than financial assets for a variety of reasons. They have non-financial aspects of performance and risk, they require maintenance and replacement, they are part of a highly complex interconnected system, and there is not a liquid market.

This article discusses asset management for distribution companies, or autonomous divisions of integrated utilities responsible for distribution system investments and operations. It first presents the goals and objectives of asset management, a corporate framework, and the competencies required to make it all work. The remainder focuses on pressing issues facing distribution companies today, and the ability of asset management to help address these issues in an effective manner.

Goals

In its most general sense, asset management is a business approach designed to align the management of asset-related spending to corporate goals. The objective is to make all infrastructure-related decisions according to a single set of stakeholder-driven criteria. The payoff is a set of spending decisions capable of delivering the greatest stakeholder value from the investment dollars available.

Typically, utilities adopt an asset management approach to either reduce spending, more effectively manage risks, or drive corporate objectives throughout an organization. These are good things, but should be considered a result of asset management rather than its objective. For example, asset management is not:

Asset Management is NOT:

- Reliability-centered maintenance

- Equipment condition monitoring

- Loading equipment to higher levels

- Risk reviews for cancelled projects

- A “black box” that tracks assets and prioritizes spending requests

Asset management is a corporate strategy that seeks to balance performance, cost, and risk. Since reliability is the primary driver of discretionary cost, the goal of distribution asset management is to balance reliability, cost, and risk. Achieving this balance requires the alignment of corporate goals, management decisions, and technical decisions. It also requires the corporate culture, business processes, and information systems capable of making rigorous and consistent spending decisions based on asset-level data. The result is a multi-year investment plan that maximizes shareholder value.

Goals of Distribution Asset Management:

- Balance cost, reliability, and risk

- Align corporate objectives with spending decisions

- Create an multi-year asset plan based on a rigorous and data-driven processes

Asset management is ambitious in scope, and requires supporting metrics, organizational design, processes, information systems, and corporate culture. Successful implementation can be quite disruptive, and requires the involvement and support of top management, sufficient resources, and effective change management skills. Generic approaches are likely to fail, but thoughtful approaches can help utilities reach the next level in business success.

Framework

In its classical form, asset management separates itself from asset ownership and asset operations. The asset owner is responsible for setting financial, technical, and risk criteria. The asset manager is responsible for translating these criteria into a asset plan. The asset service provider is responsible for executing these decisions and providing feedback on actual cost and historical reliability.

This decoupled structure allows each asset function to have focus: owners on corporate strategy, managers on planning and budgeting, and service providers on operational excellence (see Figure 1). The asset owner sets the business values, corporate strategy, and corporate objectives in terms of cost, reliability, and risk. The asset manager identifies the best way to achieve these objectives and articulates this in a multi-year asset plan. The service provider executes the plan in an efficient manner, and feeds back asset and reliability data into the asset management process.

Asset management is also about process. Instead of a hierarchical organization where decisions and budgets follow the chain of command into functional silos, asset management is a single process that links asset owners, asset managers, and asset service providers in a manner that allows all spending decisions to be aligned with corporate objectives supported by asset data.

Figure 1. Asset management is based on three functions (asset owner, asset manager, asset service provider), a single process, and many decisions.

Competencies

A robust asset management structure is supported by three pillars of competency including management, engineering, and information (see Figure 2). Building these competencies is daunting when viewed in isolation. Far more difficult is developing cross-functional expertise so that management, engineering, and information skills can be addressed in a mutually-supporting manner. At a minimum, this requires knowledge of the concerns, jargon, and methodologies associated with each pillar.

There are not many people in the traditional DISCO business who have strong skills relating to all three pillars. As such, many projects and initiatives will be led by project managers who need support when considering the full range of issues related to asset management. Without this support, projects will often achieve tactical goals, but will be incongruent with an overall corporate asset management strategy.

Aging Infrastructure

Most DISCOs in the U.S. have average equipment ages exceeding thirty years. It often seems wasteful to replace old equipment before it fails, but the possibility of drastic increases in equipment failures is unacceptable from all aspects of asset management including cost, reliability, and risk. Typically, the rate of DISCO asset replacement is on the order of 0.5%. In order to be a sustainable strategy, assets must last an average of 200 years! This level of asset replacement is clearly not in the interest of any thoughtful stakeholder, but traditional DISCO thinking seems incapable of proactively addressing this ubiquitous and looming problem.

More than any other issue, aging infrastructure illustrates the potential of asset management to address critical DISCO problems. First, it forces executive management to articulate clear goals in terms of budgets, reliability, and acceptable risk. It also requires an asset registry that tracks, at a minimum, the age of each piece of equipment in the field. Engineers can then perform detailed technical analyses comparing tactics such as inspect, repair, extend life, replace, and make system modifications. This analysis must necessarily take a multi-year approach, since aging infrastructure cannot be addressed in a single budget cycle. If reliability and risk targets cannot be met within budget constraints, asset owners must decide which to relax. When done properly, asset management will produce an aging infrastructure plan that justifies increased capital spending through a rigorous, data-driven, and auditable process.

Figure 2. Asset management must be supported by three pillars of competency: management, engineering, and information.

Reliability

More than thirty five state utility commissions require reliability reporting, and many have set reliability targets that utilities are expected to achieve. The clear trend is towards DISCOs being required to meet reliability targets. This also implies that DISCOs must manage the risk of not meeting these reliability targets. Reliability is also a major cost driver, and should be the major focus of asset management initiatives within distribution companies.

Although reliability is best achieved through proactive planning and design, most reliability initiatives are reactive and not fully aligned with corporate objectives. By taking an asset management approach, reliability is treated explicitly, rigorously, and cross-functionally. All reliability decisions are based on solid historical information relating to equipment performance, system performance, operational performance, and cost. Decisions related to expansion, replacement, reconfiguration, operations, inspection, and maintenance are all considered together. Gains can be profound, and it is not uncommon for an asset management approach to achieve all the reliability benefits of existing programs for less than half of existing levels of spending.

Risk Management

Risk management is perhaps the most misunderstood aspect of asset management. Chief risk officers tend to view this topic in terms of financial risk management, where statistical methods are well established. The tradeoff between financial risk and reward is quantifiable, and risk mitigation can be pursued through diversification, indemnification, options, futures, swaps, and a myriad of other financial instruments.

Reliability risk management is a different animal, and concerns itself with undesirable events such as equipment failure, poor reliability indices, worst performing feeder, and “headline events” related to a reliability incident. Many DISCOs approach risk by looking at the probability and severity of bad things happening if a project is not approved. Although this is a good start, it falls short of true asset management since it is based on projects rather than reliability, and is not rigorous in its approach.

Risk is best thought of as the risk of not meeting reliability targets such as SAIDI, worst-customer reliability, storm response, and major substation outages. Viewed in this way, it is insufficient to just set performance targets such as “achieve a SAIDI of two hours or less.” Each target must be accompanied by a risk tolerance such as “achieve a SAIDI of two hours with 90% confidence.” If this target is not achieved, the asset management group can confidently state that this was a one-in-ten year occurrence, and that the distribution system is performing as designed.

Proper treatment of risk requires the knowledge of equipment condition, the impact of maintenance and operations on equipment condition, and the impact of equipment condition on the probability of failure. It also requires supporting information systems and business processes that allow risk mitigation in the form of inspection, maintenance, operations, replacement, and system modifications. A complete technical risk management program will be integrated into an overall corporate risk management program, and should be familiar with hedging, real options, scenario analysis, the cost of capital, regulatory affairs, legal affairs, and public relations. Risk management is an explicit goal of asset management, and must become a DISCO core competency.

Budgeting and Project Selection

Ultimately, asset management is responsible for spending decisions. The purpose of a budgeting and project selection process is to ensure that these decisions are made consistently, in the best manner possible, and in full alignment with corporate objectives. Typical utility budgeting processes are insufficient, and it is often helpful to ask the following questions. Are reliability, cost, and risk being truly balanced, or being deal with in another manner? Is reliability being measured in a ways that represent the interests of all stakeholders? Is budgeting based on multiple years and total life cycle costs? Is the risk of meeting budget and reliability targets treated in a rigorous manner?

When implementing an asset management strategy, many utilities begin by focusing on project ranking. By forcing all projects to be assigned a benefit and a cost, projects across departments and functions can be directly compared. By ranking all projects based on the ratio of reliability to cost, projects can be selected in order until reliability targets are reached or budgets are exhausted.

Compelling as project ranking may seem, it is problematic if there is not a single measure of reliability. Within narrow programs such as distribution automation, it may be possible to have a good single measure of benefit (e.g., reduction in customer interruption minutes). Within a greater asset management context, many different reliability issues must be considered, and a single measure becomes meaningless. It is always possible to create a generic index of benefit based on the weighted sum of a wide range of disparate benefits, but the resulting list of ranked projects can often cause more problems than it solves.

To avoid this problem, reliability should be based on an set of measures that address all stakeholder concerns. Once these and budget constraints are identified, optimization techniques can identify a multi-year spending plan that satisfies all reliability, risk, and budget constraints in a way that minimizes total life cycle cost and maximizes shareholder value.

Final Thoughts

Distribution asset management is the art of balancing reliability, cost, and risk. Achieving this balance requires support from three pillars of competency: management, engineering, and information. Initiatives can stem from each of these pillars, but must always consider and coordinate with the other two.

Distribution asset management is capable of addressing the most pressing issues facing the distribution businesses including aging infrastructure, reliability, project selection, and risk management. Each issue is daunting when considering in isolation. More daunting is the thought that true asset management will optimize decisions across all of these issues simultaneously. Asset management can be truly revolutionary, but only when it is based on three functions, a single process, supporting systems, and a robust skill set of management, engineering, and information.

About the Author

Dr. Richard E. Brown is a principal consultant with KEMA, and specializes in helping utilities improve business performance through management and technical consulting. He has published more than 60 technical papers related to reliability and asset management, and is author of the book Electric Power Distribution Reliability. He is a senior member of IEEE, chair of the Working Group on Distribution Planning and Implementation, and recipient of the Walter Fee Outstanding Young Engineer award (2003). Dr. Brown has a BSEE, MSEE, and PhD from the University of Washington, an MBA from the University of North Carolina, and is a registered professional engineer. He can be reached at rebrown@kema.com.